⚡ TL;DR

- Helium 10 Cerebro is powerful but expensive, requiring the $79/mo Platinum plan for meaningful daily usage (the Starter plan caps at 2 lookups/day).

- Budget-friendly options exist: AsinSeed offers unlimited lookups for $19.90/mo, and Sonar by Perpetua provides free basic reverse ASIN checks.

- Enterprise solutions vary: Data Dive ($149/mo) excels at AI-driven analysis, while Jungle Scout ($49/mo) offers strong multi-ASIN comparison for existing users.

- Workflow is the missing link: Most tools only find keywords; Keywords.am integrates discovery with placement, using the TFSD Framework to optimize listings directly.

- Marketplace coverage matters: While Cerebro covers major markets, alternatives like Keywords.am support 21 marketplaces with intent-aware localization.

- Different tools for different sellers: Solo sellers save with AsinSeed, while agencies often combine Data Dive or Cerebro with workflow tools.

- Recommendation: Use the comparison tables below to match a tool to your specific budget and seller type (Solo, Growing Brand, or Agency).

📑 Table of Contents

- Why do Amazon sellers look for Cerebro alternatives?

- What should sellers look for in a reverse ASIN tool?

- How do the top Cerebro alternatives compare side by side?

- What makes each Cerebro alternative different?

- Which Cerebro alternative is best for your seller type?

- Frequently Asked Questions About Cerebro Alternatives

- Conclusion

Helium 10’s Cerebro processes millions of reverse ASIN lookups monthly, but sellers on the Starter plan are capped at just 2 searches per day with a 20-keyword limit per search, making full competitor analysis nearly impossible without upgrading to the $79/mo Platinum plan.

Many sellers find themselves paying for the entire Helium 10 suite, which ranges from $79 to $249 per month, when reverse ASIN lookup is the only feature they use regularly. Others need marketplace coverage or workflow integration that Cerebro does not provide. While Helium 10 offers over 30 distinct tools for PPC, inventory, and product research, paying for the full bundle often does not make financial sense for sellers focused purely on keyword optimization.

This guide compares 7 reverse ASIN tools, from a free option to workflow-integrated platforms, with real pricing, feature breakdowns, and a decision framework based on seller type. Unlike other articles that only review one or two options, this analysis provides a comprehensive look at the market landscape to help sellers find the right Cerebro alternative.

Why do Amazon sellers look for Cerebro alternatives?

Sellers seek a Cerebro alternative primarily because of Helium 10’s pricing structure, feature bloat from its 30-tool suite, and the gap between finding keywords and actually placing them in listings.

Cerebro is undoubtedly a capable tool. Its “Cerebro IQ Score,” deep filter set, and coverage of both Amazon and Walmart make it a gold standard for enterprise users who need granular data. However, the barrier to entry is significant. The Free and Starter plans ($39/mo) are functionally identical regarding Cerebro access, both capping users at 2 lookups per day. To get functional limits, a seller must subscribe to the Platinum plan at $79/mo (billed annually) or higher.

For many, this pricing model forces a difficult choice: pay for a suite of 30+ tools they may not need, or operate with severely restricted data. Sellers who already use dedicated software for PPC management or inventory often find the redundancy of Helium 10’s other features wasteful.

A significant workflow gap also exists in most reverse ASIN tools, including Cerebro. These tools excel at discovering keywords but stop short of implementation. The seller is left with a spreadsheet of thousands of keywords and the manual task of organizing, prioritizing, and placing them into the listing’s Title, Features, Search Terms, and Description. This disconnection between discovery and action drives many to seek a Cerebro alternative that offers better integration with the listing optimization process.

What should sellers look for in a reverse ASIN tool?

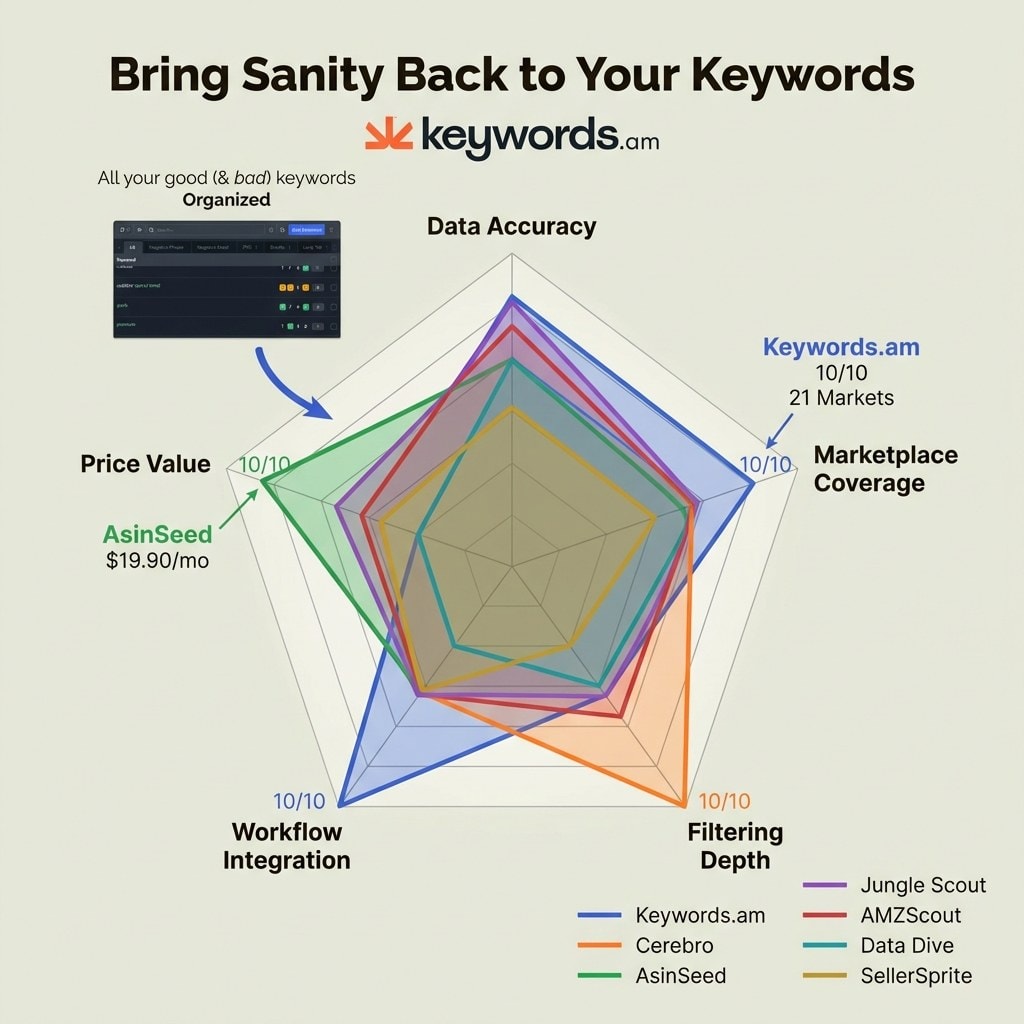

The five critical factors are data accuracy, marketplace coverage beyond US-only, keyword filtering depth, pricing relative to usage, and whether the tool includes a placement workflow.

Not all reverse ASIN tools are created equal, and understanding the nuances is key to selecting the right one.

- Data Accuracy: The source of keyword data significantly impacts reliability. Some tools, like AsinSeed, claim to source data directly from Amazon reports, while others rely on estimated search volumes. Discrepancies in search volume estimates can vary by up to 40% between tools for the same keyword, making the data source a crucial consideration.

- Marketplace Coverage: While Cerebro supports Amazon US, international markets, and Walmart, some alternatives are far more limited. For sellers operating globally, checking specific marketplace support is essential. Some tools only cover 6 major markets, while others, like Keywords.am, support up to 21.

- Filtering and Prioritization: A raw list of 5,000 keywords is unmanageable without powerful filters. Tools should offer the ability to sort by organic vs. sponsored rankings, word frequency, and competition metrics. This is an area where Cerebro’s IQ Score is genuinely useful, and alternatives must offer comparable sorting logic.

- Pricing Relative to Usage: A solo seller running 5 reverse ASIN lookups a week has vastly different needs than an agency running 50 a day. The “best” tool is often the one that aligns with specific volume requirements without forcing a subscription to unused features.

- Workflow Integration: Finding keywords is only step one. The ability to place them strategically across a listing is where revenue is generated. Sellers should evaluate whether a tool helps them bridge the gap between discovery and publication.

How do the top Cerebro alternatives compare side by side?

Seven tools span the range from free (Sonar) to $149/mo (Data Dive), with Keywords.am offering the only integrated workflow from keyword discovery through listing optimization at $30/mo.

The following table provides a direct comparison of the top alternatives. Note that for Helium 10 Cerebro, the $79/mo Platinum plan is the practical entry point for serious usage, as the Starter plan shares the highly restrictive limits of the Free tier.

|

Tool |

Starting Price |

Free Tier |

Marketplaces |

Unique Strength |

Best For |

|---|---|---|---|---|---|

|

Jungle Scout Keyword Scout |

$49/mo |

No |

Up to 19 |

Multi-ASIN comparison (10 at once) |

Beginners already in JS ecosystem |

|

AMZScout |

$49.99/mo ($1,599.99 lifetime) |

Trial |

12 |

Lifetime plan available |

Long-term budget buyers |

|

Data Dive |

$39/mo |

No |

8+ |

AI-driven competitor analysis, integrates multiple data sources |

AI-first research, power users |

|

SellerSprite |

$98/mo (free tier exists) |

10 queries/mo free |

10+ |

All features on every plan |

Value-seekers, Asian marketplace sellers |

|

AsinSeed |

$19.90/mo |

10 free/mo + 2/day |

9 |

800M keyword database, Amazon-report sourced |

Budget-first sellers |

|

Sonar by Perpetua |

Free |

Entire tool free |

6 |

Zero cost, real Amazon data |

Absolute beginners, zero budget |

|

Keywords.am |

$30/mo |

No |

21 |

TFSD Framework (keyword placement, not just discovery) |

Sellers who want research-to-publish workflow |

Budget-conscious sellers have clear options in AsinSeed and Sonar, while those seeking advanced data manipulation can look to Data Dive or Keywords.am. The wide range in pricing reflects the diversity of features, from simple data retrieval to comprehensive workflow automation.

What makes each Cerebro alternative different?

Each alternative has a distinct strength, from Jungle Scout’s multi-ASIN comparison to AsinSeed’s budget pricing at $19.90/mo to Keywords.am’s end-to-end listing optimization workflow.

Jungle Scout Keyword Scout, best for beginners in the Jungle Scout ecosystem

Keyword Scout is integrated into Jungle Scout’s full suite, which starts at $49/mo for the Standard plan and goes up to $79/mo for the Growth Accelerator annual plan. Its standout feature is the ability to perform simultaneous lookups on up to 10 ASINs, making it excellent for multi-ASIN comparison.

For enterprise users, the Cobalt plan extends coverage to up to 19 Amazon marketplaces. However, Jungle Scout does not offer a standalone reverse ASIN tool; users must subscribe to the full suite. This makes it a strong choice for beginners who will also utilize Jungle Scout’s product research tools, but potentially expensive for those seeking only keyword data.

AMZScout, best for sellers who want lifetime access

AMZScout offers a unique pricing model in the SaaS space: a lifetime plan for $1,599.99. For sellers committed to the long haul, this one-time payment breaks even at approximately 32 months compared to the monthly rate of $49.99.

The platform includes Reverse ASIN Lookup 2.0 as part of its Amazon Sellers Bundle. It supports 12 marketplaces, although functionality is most powerful for the US, UK, and Canadian markets. For sellers wary of recurring monthly subscriptions, AMZScout provides a rare alternative.

Data Dive, best for AI-first research and multi-source analysis

Data Dive has rapidly grown by positioning itself as an AI-first research platform. With plans starting at $39/mo and the Standard plan at $149/mo, it does not use a traditional “reverse ASIN” button. Instead, it employs AI-driven tools like DiveBox, ASIN Tray, and Niche Dive to construct Master Keyword Lists derived from competitor data.

It natively integrates data from multiple sources, including Jungle Scout, Keepa, Google Trends, and Seller Central. It is worth noting that Data Dive can integrate with Helium 10 Cerebro data, making it a powerful add-on for power users who want deeper analysis than what Cerebro provides on its own.

SellerSprite, best all-in-one value with keyword tracking

SellerSprite differentiates itself by offering all features across every plan, with the primary difference being tracking limits. The monthly plan is $98, but the Standard Annual plan brings the effective cost down to approximately $51/mo.

It offers a generous free tier with 10 queries per month and supports over 10 marketplaces, with particular strength in Asian markets like Japan and India. For sellers focused on these regions or those who appreciate a simple “all-features-included” pricing structure, SellerSprite is a solid contender.

AsinSeed, best budget option at $19.90/mo

For sellers strictly focused on budget, AsinSeed is the clear leader among paid options. At $19.90/mo for unlimited queries, it is significantly cheaper than most competitors. AsinSeed claims its database of 800 million keywords is sourced directly from Amazon reports rather than estimates, offering a different data quality profile.

The tool provides 2 years of historical organic keyword data, a rarity at this price point. A free tier allows for 10 searches per month plus 2 per day with partial results. Supporting 9 marketplaces, it is an ideal solution for solo sellers who need reliable data without a high monthly overhead.

Sonar by Perpetua, best free option for quick checks

Sonar by Perpetua is a completely free tool that requires no credit card. It draws from a database of over 180 million keywords generated by real Amazon shopper queries. It is an excellent resource for absolute beginners or for quick, ad-hoc checks.

However, it has limitations. It only supports 6 marketplaces (US, DE, UK, FR, ES, IT) and only displays keywords for ASINs ranking on page 1. Search volume is presented on a relative 1-5 scale rather than as specific numbers, and it lacks the advanced filters and export capabilities of paid tools. While not a full replacement for Cerebro, it is a valuable zero-cost utility.

Keywords.am, best for going from keyword discovery to optimized listing

Keywords.am takes a different approach by focusing on the workflow after keyword discovery. With plans ranging from $30/mo (Starter) to $120/mo (Scale), it integrates reverse ASIN lookup directly with the TFSD Framework (Title, Features, Search Terms, Description).

The platform addresses the common pain point of “keyword overload” by providing real-time coverage indicators that show exactly which keywords have been successfully placed in the listing. Its “Swiss Army Knife” feature automatically fills backend search terms with only the missing keywords, handling deduplication and byte-counting instantly.

With support for 21 Amazon marketplaces and intent-aware localization, it is designed for sellers who want to move from research to a published listing in one smooth process. The TFSD Framework guide details how this method ensures no high-value keyword is left behind. For a detailed head-to-head, see the Keywords.am vs Helium 10 comparison.

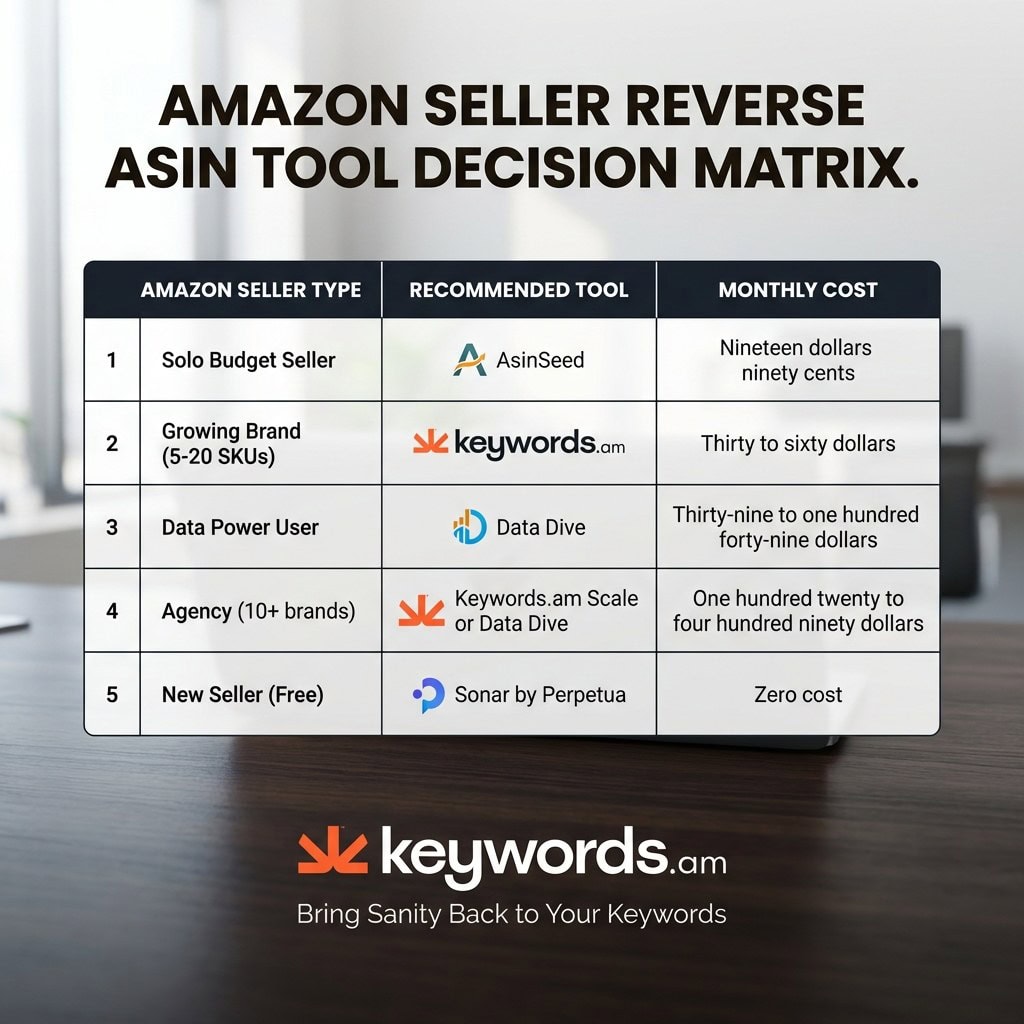

Which Cerebro alternative is best for your seller type?

Solo sellers should start with AsinSeed ($19.90/mo) or Sonar (free), mid-size brands benefit from Keywords.am’s workflow, and agencies need Data Dive or Jungle Scout enterprise tiers.

Choosing a tool is easier when matched to a specific business profile. The following framework simplifies the decision.

|

Seller Type |

Best Tool |

Why |

Monthly Cost |

|---|---|---|---|

|

Solo seller, tight budget |

AsinSeed |

Unlimited lookups at lowest price, Amazon-sourced data |

$19.90/mo |

|

New seller, zero budget |

Sonar by Perpetua |

Free, real Amazon data, good for learning |

Free |

|

Growing brand, 5-20 SKUs |

Keywords.am |

Research-to-publish workflow, TFSD coverage, 21 marketplaces |

$30-60/mo |

|

Data-focused power user |

Data Dive |

AI analysis, multi-source data integration |

$39-149/mo |

|

Already in Jungle Scout ecosystem |

Jungle Scout |

Built into existing suite, 10-ASIN comparison |

$49-79/mo |

|

Long-term budget planning |

AMZScout |

Lifetime plan at $1,599.99, breaks even in ~32 months |

$49.99/mo or lifetime |

|

Agency managing 10+ brands |

Keywords.am Scale or Data Dive |

White-label reports, multi-user, enterprise coverage |

$120-490/mo |

Successful sellers often combine tools to leverage their unique strengths. For instance, using Jungle Scout for broad product research, AsinSeed for quick keyword checks, and Keywords.am for the final optimization workflow is a common and effective stack. High-volume sellers with larger catalogs may need more tailored recommendations; the Helium 10 alternatives for high-volume sellers guide covers those scenarios in depth.

Frequently Asked Questions About Cerebro Alternatives

These six questions cover tool stacking, analysis frequency, category coverage, keyword placement workflow, Cerebro’s current value, and the cheapest alternatives available.

Q1: Can you use multiple reverse ASIN tools at the same time?

Yes, many professional sellers combine tools. Using one for keyword discovery and another for listing optimization workflow is common, since each tool has different data sources and strengths.

Running the same ASIN through two or three different tools often reveals keywords that a single platform might miss. This triangulation of data helps ensure a comprehensive keyword strategy. For more on this, see reverse ASIN lookup explained.

Q2: How often should sellers run competitor reverse ASIN analysis?

Monthly reverse ASIN checks for core competitors and quarterly deep dives for the broader category work well. Seasonal products may need weekly monitoring during peak periods.

Amazon’s A10 algorithm is dynamic, and competitor strategies evolve constantly. Consistent monitoring allows sellers to detect ranking changes early and adjust their own keyword targeting accordingly.

Q3: Does reverse ASIN lookup work for all Amazon product categories?

Reverse ASIN lookup works across all Amazon categories, but results vary in depth. Competitive categories like supplements and electronics return more keyword data than niche categories with fewer competing listings.

High-volume categories naturally generate more shopper data, which feeds into the databases of these tools. Niche products may see fewer results simply because there is less aggregate search behavior to track.

Q4: What happens to keywords found through reverse ASIN after discovery?

Discovered keywords need to be strategically placed across a listing’s title, bullet points, backend search terms, and description. The TFSD Framework automates this with real-time coverage tracking.

Most reverse ASIN tools deliver a list and consider the job done. However, the optimization workflow, which includes prioritizing high-impact terms, removing duplicates, and ensuring correct placement, is where the actual ranking improvement happens. Learn more in the Amazon backend keywords guide.

Q5: Is Helium 10 Cerebro still worth using in 2026?

Cerebro remains a strong reverse ASIN tool for sellers already committed to the Helium 10 ecosystem. However, the $79/mo minimum for meaningful usage makes standalone alternatives more cost-effective for keyword-focused sellers.

The Cerebro IQ Score and extensive filters are valuable for complex analysis. The decision ultimately rests on whether a seller utilizes enough of the other 30+ tools in the suite to justify the higher subscription cost. For many, a dedicated Cerebro alternative is a better fit.

Q6: What is the cheapest Cerebro alternative for reverse ASIN research on Amazon?

Sonar by Perpetua offers completely free reverse ASIN lookups with real Amazon data, while AsinSeed provides unlimited paid lookups at $19.90 per month. Both are significantly cheaper than Cerebro’s effective $79/mo minimum.

While free options like Sonar have limitations such as relative volume scores, they are accessible entry points. AsinSeed offers a balance of depth and affordability for those willing to spend a small amount for unlimited access.

Conclusion

Finding the right Cerebro alternative comes down to matching the tool to the specific needs of the business.

- Cerebro is powerful but expensive: It is locked behind a $79/mo paywall for serious usage, prompting many sellers to look for focused alternatives.

- Options exist at every price point: From the free Sonar tool to the $19.90/mo AsinSeed and enterprise-grade solutions like Data Dive, the market offers a wide range of choices.

- Workflow is key: Finding keywords is only half the battle. Sellers who want to transition from discovery to an optimized listing should consider workflow-integrated tools.

- Combine for best results: Professional sellers often use a stack of 2-3 specialized tools rather than relying on a single all-in-one suite.

For sellers who want to go from reverse ASIN data to an optimized, published listing without the chaos of spreadsheets, Keywords.am’s TFSD Framework turns keyword discovery into listing action, starting at $30/mo.