📑 Table of Contents

- Why are Amazon tariffs 2026 the biggest cost crisis for FBA sellers?

- What are the current US import tariff rates for Amazon sellers?

- How do tariff rates compare across sourcing countries?

- What happened to the de minimis exemption and why does it matter?

- How do you calculate your true landed cost on Amazon FBA?

- What are 5 proven strategies to protect your margins from tariff increases?

- Frequently Asked Questions About Amazon Tariffs in 2026

- Conclusion

⚡ TL;DR

- Triple squeeze alert: Amazon sellers face converging pressure from tariffs, rising FBA fees, and inflation, compressing margins significantly.

- SCOTUS ruling: The Supreme Court struck down IEEPA tariffs on Feb 20, 2026, but Section 301 (7.5-100%) and Section 232 duties remain active.

- Mexico wins: USMCA offers the only zero-tariff shelter, while Vietnam and India have reverted to low MFN rates post-ruling.

- De minimis is dead: The $800 exemption was eliminated in August 2025, adding customs broker fees to every shipment regardless of value.

- Landed cost reality: True landed cost now includes MFN duty, Section 301 surcharges, freight, broker fees, and FBA fees (often 60% above product cost).

- Five strategies: Diversify sourcing, optimize HTS codes, adjust prices gradually, restructure supply chains, and sharpen listing optimization.

More than 70% of products sold by Amazon wholesalers and retailers are manufactured in China, and those products now face tariff rates of 25% or higher under Section 301 alone. Amazon tariffs 2026 have created a triple squeeze for sellers: tariffs, rising FBA fees (up $0.08/unit in January 2026), and general inflation. Margins that were comfortable 18 months ago are now razor-thin. On February 20, 2026, the Supreme Court struck down IEEPA-based tariffs in a 6-3 ruling, but Section 301 and Section 232 tariffs remain fully in effect. This guide covers every tariff layer, walks through landed cost math, explains how to find HTS codes, and provides five strategies to protect margins.

Why are Amazon tariffs 2026 the biggest cost crisis for FBA sellers?

Amazon sellers face a triple cost squeeze from stacked import tariffs, rising FBA fees, and inflation that has compressed margins to historically thin levels.

The “triple squeeze” creates a financial environment where profitability requires more than just high sales volume. Sellers must contend with import tariffs, an Amazon FBA fee increase of $0.08 per unit that took effect in January 2026, and persistent inflationary pressures on raw materials and labor. These three forces converge simultaneously, eroding the buffer that previously absorbed minor inefficiencies in supply chains or marketing spend.

Adding to the operational complexity, Amazon ended all US FBA prep and labeling services on January 1, 2026. This policy change forces sellers to either handle preparation in-house, contract with third-party logistics (3PL) providers, or rely on suppliers to prep goods perfectly before shipment. Each option adds a new layer of cost or management overhead to the FBA model.

The scope of this impact is massive because over 70% of Amazon wholesale and retail products are manufactured in China. For the majority of sellers, avoiding these costs is not as simple as switching suppliers, given the manufacturing infrastructure depth that China provides. However, the market has begun to adjust. Amazon reportedly stopped penalizing some top sellers for aggressive price increases, signaling a recognition that the current cost environment necessitates higher retail prices to sustain viable businesses.

Sellers who rely on paid advertising must also re-evaluate their unit economics. When landed costs rise, the break-even ROAS (Return on Ad Spend) increases, meaning campaigns that were once profitable may now lose money. A refined Amazon PPC keyword strategy becomes essential to ensure ad spend is directed only toward high-converting terms rather than broad, low-efficiency targets.

Understanding the scope of the problem requires knowing exactly which tariff layers apply to each product.

What are the current US import tariff rates for Amazon sellers?

Chinese imports face stacked tariffs including MFN base duties, Section 301 surcharges of 7.5-100%, and Section 232 duties on specific materials like steel and aluminum.

The Amazon tariffs 2026 landscape for Chinese goods is a complex stack of duties that varies significantly by product category. Sellers must identify every layer that applies to their specific Harmonized Tariff Schedule (HTS) code to calculate accurate costs. The table below details the current status of each major tariff layer as of February 2026.

Tariff Layer |

Legal Authority |

Rate |

Status (Feb 2026) |

|---|---|---|---|

Base MFN Duty |

Harmonized Tariff Schedule |

~3% average (varies by HTS code) |

Active |

Section 301 (Lists 1-2) |

Trade Act of 1974 |

25% |

Active (industrial goods, electronics) |

Section 301 (Lists 3-4A) |

Trade Act of 1974 |

7.5% |

Active (consumer goods, apparel) |

Section 301 (Strategic goods) |

Trade Act of 1974 |

25-100% |

Active (EVs 100%, solar 50%, batteries 25%) |

Section 232 (metals) |

Trade Expansion Act |

25-50% |

Active (steel, aluminum, copper) |

IEEPA Fentanyl Tariff |

IEEPA |

10% |

STRUCK DOWN by Supreme Court Feb 20 |

IEEPA Reciprocal Tariff |

IEEPA |

10% |

STRUCK DOWN by Supreme Court Feb 20 |

For typical consumer products falling under Section 301 Lists 3-4A, the effective tariff rate is approximately 10-15% post-ruling. This figure combines the base Most Favored Nation (MFN) duty with the 7.5% Section 301 surcharge. While this is a reduction from peak rates when IEEPA tariffs were active, it remains a significant tax on revenue compared to domestic goods or non-tariffed imports.

Industrial goods and electronics under Lists 1-2 face a steeper burden, with effective rates remaining around 28% (MFN + 25% Section 301). Furthermore, specific categories saw escalations in January 2026. Section 301 duties on lithium-ion batteries and natural graphite increased to 25%, medical gloves to 25%, and respirators to 50%, directly impacting sellers in the health, wellness, and electronics accessories niches.

But China is not the only sourcing country affected. Alternative sourcing countries have their own tariff landscape.

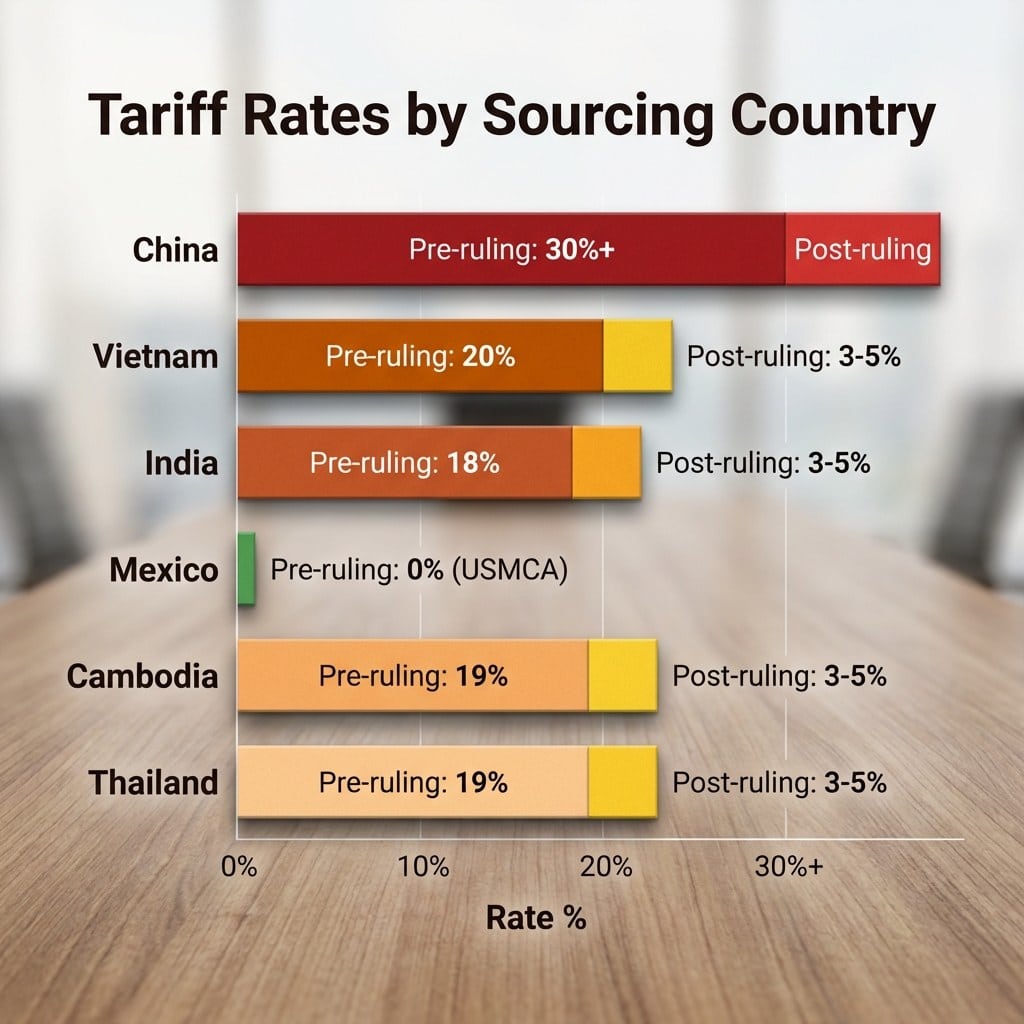

How do tariff rates compare across sourcing countries?

After the Supreme Court struck down IEEPA tariffs, Mexico under USMCA offers zero duties on qualifying goods, while Vietnam and India face only low MFN base rates.

The removal of IEEPA-based tariffs has reshuffled the Amazon tariffs 2026 landscape across sourcing destinations. While China retains high Section 301 duties, other manufacturing hubs have seen their tariff burdens drop significantly, restoring their appeal as alternative sources.

Country |

Pre-Ruling Rate |

Post-Ruling Rate (Feb 2026) |

Key Notes |

|---|---|---|---|

China |

30-47%+ |

10-28%+ (Section 301 intact) |

Still highest; product-dependent |

Vietnam |

20% |

~3-5% MFN only |

Was 46% initially, negotiated down |

India |

18% |

~3-5% MFN only |

Reduced from 25% on Feb 2, 2026 |

Mexico |

0% (USMCA) |

0% (USMCA) |

Best tariff shelter; separate legal framework |

Cambodia |

19% |

~3-5% MFN only |

Framework deal Oct 2025 |

Thailand |

19% |

~3-5% MFN only |

Framework deal Oct 2025 |

Mexico remains the strongest tariff shelter for US sellers. The United States-Mexico-Canada Agreement (USMCA) operates under a separate legal framework unaffected by the recent Supreme Court ruling. Goods that meet the rules of origin requirements can enter the US duty-free, providing a permanent structural margin advantage over competitors sourcing from Asia.

However, shifting supply chains is not an immediate fix. Supplier switching typically takes 6-12 months to execute properly, involving vetting, sampling, and quality control setup. Sellers considering this move should utilize Amazon listing tools for international expansion to verify demand and competition in potential new markets before committing capital. Additionally, an Amazon listing localization guide can help adapt product messaging for different manufacturing origins if product specs change slightly.

Sellers must also remain cautious. The administration has signaled it will pursue replacement tariffs using Section 301 and Section 232 investigations, meaning the current low rates for Vietnam and India could change if new trade cases are brought forward.

One major policy change has added costs even for low-value shipments: the elimination of the de minimis exemption.

What happened to the de minimis exemption and why does it matter?

The $800 de minimis duty-free threshold was eliminated for all countries by August 2025, requiring formal customs entry and broker fees for every import shipment.

The de minimis loophole, which allowed shipments valued under $800 to enter the US duty-free with minimal inspection, is effectively dead. The timeline for this closure began with China and Hong Kong on May 2, 2025 (introducing $100/$200 postal fees) and concluded with a blanket elimination for all countries on August 29, 2025.

This policy change has profound implications for logistics. Every shipment, regardless of size or value, now requires formal customs entry. This triggers customs broker fees that typically range from $125 to $300 per shipment. For sellers importing large containers, this cost is negligible per unit. However, for small parcel shipments, sample reviews, or just-in-time inventory restocking, these fixed fees dramatically increase the cost per unit.

For FBA sellers, this means all inventory shipments from China now face full tariff exposure. The strategy of breaking large orders into smaller shipments to bypass duties is no longer viable. This change impacts a massive volume of trade; previously, over 1 billion low-value packages entered the US tariff-free annually, a channel that has now been shut down.

It is important to note that the de minimis elimination was also enacted under IEEPA authority. Its legal status following the Supreme Court’s February 20 ruling is currently uncertain, and sellers should monitor legal updates closely as this situation evolves.

With all these Amazon tariffs 2026 cost layers, sellers need to know their exact landed cost before making any pricing or sourcing decisions.

How do you calculate your true landed cost on Amazon FBA?

True landed cost equals product cost plus tariff duties plus freight plus customs fees plus Amazon FBA fees, and most sellers underestimate it by 15-25%.

Accurately calculating landed cost under Amazon tariffs 2026 is the only way to ensure profitability. Many sellers overlook hidden layers like broker fees or specific Section 301 surcharges. Below is a step-by-step worked example for a standard $10 consumer product sourced from China, classified under Section 301 List 3-4A.

- Product cost: $10.00

- MFN duty (~3%): $0.30

- Section 301 (7.5%): $0.75

- Freight per unit: $1.50 (estimated ocean freight)

- Customs broker fee per unit: $0.25 (amortized across shipment)

- Amazon FBA fee: $3.50 (example standard-size)

- Total landed cost: ~$16.30

In this scenario, the total landed cost is $16.30, representing a 63% markup over the manufacturing cost before a single dollar of profit is made.

To perform this calculation for a specific product, sellers must find the correct Harmonized Tariff Schedule (HTS) code. This is the process:

- Navigate to the official USITC search tool.

- Enter a keyword describing the product (e.g., “wireless headphones”).

- Locate the appropriate 10-digit HTS code in the search results.

- Check the “General” column to find the base MFN duty rate.

- Consult Chapter 99 of the HTS to see if any additional Section 301 or 232 duties apply to that code.

- Cross-reference the “China Tariffs” annex to confirm the specific Section 301 list assignment.

For products that are difficult to classify, sellers can use the Customs Rulings Online Search System (CROSS) database to see how Customs and Border Protection has classified similar items in the past. Once the true cost is established, sellers can use an Amazon sales estimator to forecast revenue and determine if the current pricing model is sustainable.

Once sellers know their true costs, they can implement strategies to protect what remains of their margins.

What are 5 proven strategies to protect your margins from tariff increases?

The five most effective margin protection strategies are sourcing diversification, HTS code optimization, gradual pricing adjustments, supply chain restructuring, and listing optimization.

Sellers navigating Amazon tariffs 2026 can actively manage their exposure to rising costs through strategic planning. These five methods provide a framework for maintaining profitability in a high-tariff environment.

Strategy 1: Sourcing diversification

Building supplier relationships in at least two countries mitigates risk. As shown in the country comparison table, Mexico (USMCA) offers the strongest protection against future tariff hikes. Vietnam and India also offer competitive advantages with low MFN rates following the recent court ruling.

Strategy 2: HTS code optimization

Many products can legitimately be classified under multiple HTS codes, each with different duty rates. A “kitchen tool” might be classified by its material (e.g., steel) or its function (e.g., hand-operated mechanical appliance). Working with a licensed customs broker to review classifications can often identify a compliant code with a lower tariff rate. This is a standard legal practice, not evasion.

Strategy 3: Gradual pricing adjustments

Raising prices is often necessary, but sudden jumps can kill conversion rates and Buy Box eligibility. The effective approach is to raise prices by 5-7% increments over several days. Amazon has relaxed enforcement on price increases for top sellers, acknowledging the market-wide cost pressures.

Strategy 4: Supply chain restructuring

Optimizing the flow of goods can save significantly on logistics. Splitting inventory between FBA and 3PL providers allows for cheaper long-term storage. Additionally, some sellers source components from low-tariff countries and perform final assembly in a different region to legally alter the country of origin, though this requires strict adherence to substantial transformation rules.

Strategy 5: Sharper listing optimization

When margins compress, there is no room for wasted ad spend. Sellers cannot afford to chase high-volume keywords that drive traffic but do not convert. The focus must shift to high-intent, high-converting keywords that deliver profitable sales. Tools like Keywords.am help identify these specific terms, allowing sellers to cut wasteful spend and focus budget where it generates actual return. Before committing to a new strategy, validating product viability with the best Amazon product research tools ensures resources are invested in winning products.

These strategies work best when sellers have answers to the most common tariff questions.

Frequently Asked Questions About Amazon Tariffs in 2026

These are the most common questions about Amazon tariffs 2026, including duties and import costs.

### How long will tariffs on Chinese imports last?

### Can sellers pass tariff costs to customers without losing sales?

### What if a seller sources from multiple countries?

### How do tariffs affect PPC profitability?

### Will sellers get refunds for IEEPA tariffs already paid?

Conclusion

Amazon tariffs 2026 demand accurate cost calculations, diversified sourcing, and sharper listing optimization from every seller competing on the platform.

The Amazon tariffs 2026 landscape is multi-layered, and success depends on knowing exactly which duties apply to specific HTS codes. While the Supreme Court ruling removed IEEPA tariffs, Section 301 and Section 232 duties remain a significant burden. Mexico under USMCA currently offers the strongest advantage for sourcing diversification, but true landed cost for Chinese imports remains 40-60% higher than product cost.

When margins compress, every keyword and conversion decision becomes higher-stakes. The immediate next step for any seller is to look up their top product’s HTS code at hts.usitc.gov/search and calculate the actual landed cost using the formula provided in this guide. Sellers navigating tighter margins need every keyword decision to count. Explore Amazon seller tools that help focus research on high-converting opportunities.