Thrasio, remember them? They raised $3.4 billion. They bought over 200 brands. Then they filed for bankruptcy. Honestly, a fragile tooling infrastructure was a big problem. See, when aggregators try to run over 100 Amazon brands with software built for single sellers… Well, the operational and financial models? They just collapse.

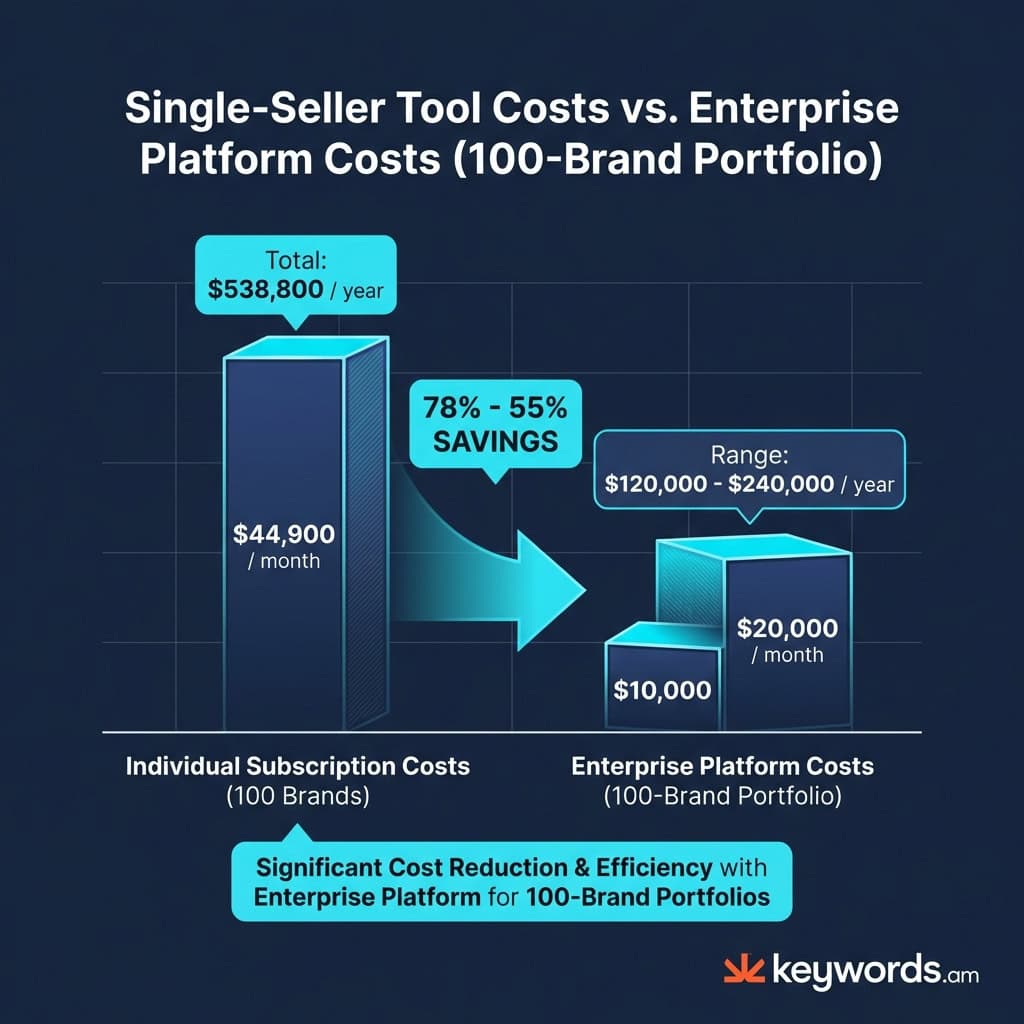

This has created demand for specialized Amazon seller tools. These tools should handle portfolio-scale operations. That said, per-brand SaaS pricing adds up fast. I mean, $200-500 per month, per brand? It multiplies across a portfolio pretty quick. That results in costs of $20,000-50,000 per month. And that’s just for basic tools!

But it’s not just about the expense. The reality is, these tools often lack key features. Portfolio-wide visibility is one. API access for automation is another. And then there’s integration with internal business intelligence (BI) systems. Professional aggregators depend on these things. This guide compares enterprise platforms. They’re designed for aggregator scale. The analysis will cover API capabilities and portfolio management features. Pricing models are important too, it’s worth noting.

Look, this guide is different. We don’t recommend standard tools like Helium 10 or Jungle Scout. The focus here is *only* on solutions that offer enterprise pricing. Plus they need robust API access and multi-brand portfolio capabilities.

📑 Table of Contents

- What Are the Best Amazon Seller Tools for Aggregators?

- Why Did Thrasio-Style Aggregators Struggle with Operations?

- What Are the Best Enterprise Amazon Tools for Aggregators in 2026?

- Enterprise Tool Reviews: Pacvue, Teikametrics, and Carbon6

- How Do DataHawk and Perpetua Compare for Analytics and Advertising?

- When Should Aggregators Build Custom Data Stacks?

- How Should Aggregators Evaluate Enterprise Tool ROI?

- Frequently Asked Questions About Amazon Aggregator Tools

- Conclusion

⚡ TL;DR

- Single-seller tools don’t scale: Per-brand pricing exceeds $40,000/month for 100+ brand portfolios

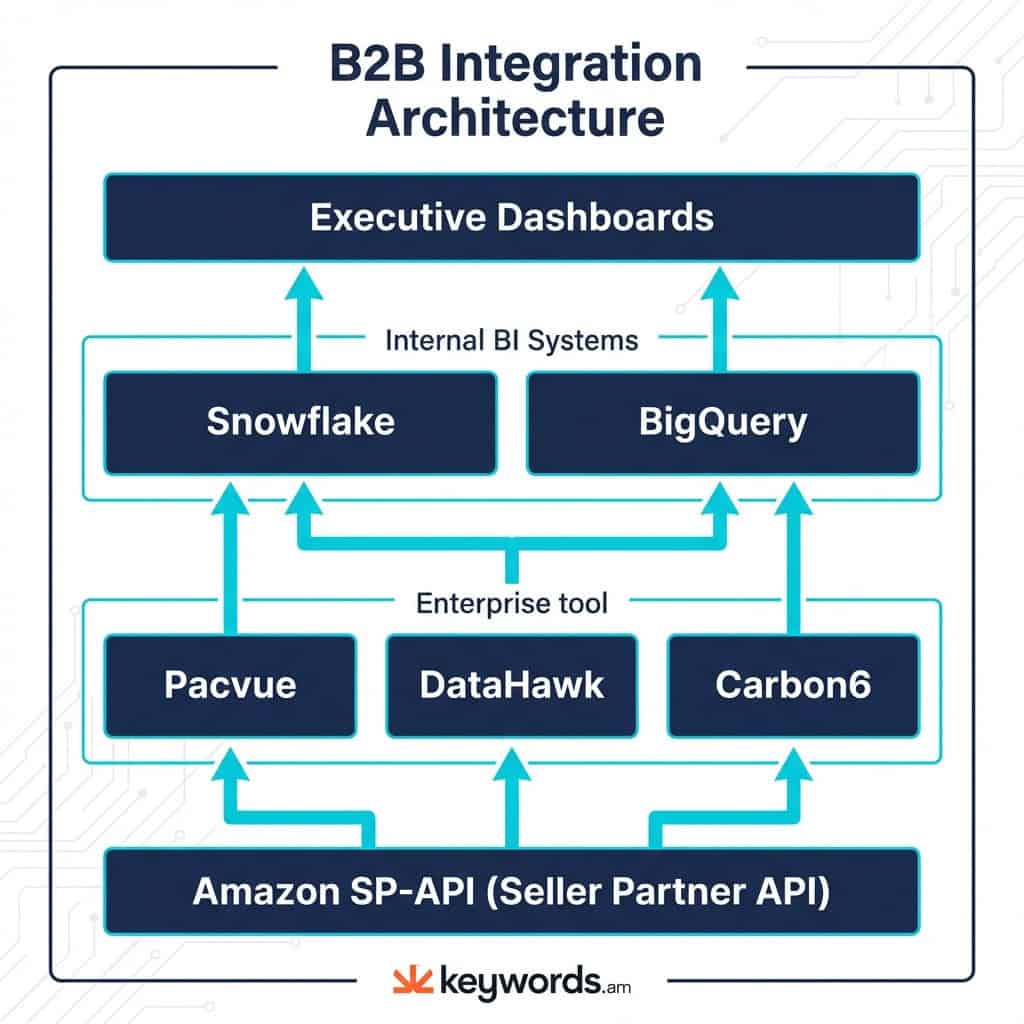

- API access is non-negotiable for integrating with internal BI systems like Snowflake and BigQuery

- Portfolio-wide visibility requires unified dashboards absent in standard seller tools

- Thrasio’s bankruptcy highlights the critical need for scalable operational infrastructure

- Top enterprise platforms include Pacvue ($2K-20K/mo), Teikametrics ($149+/mo), Carbon6 ($200+/mo)

- Enterprise tooling ROI: Time savings of 10-20 hrs/brand/month can exceed $75,000/month value

- Custom data stacks cost $5K-15K/month but offer maximum flexibility for 50+ brand portfolios

What Are the Best Amazon Seller Tools for Aggregators?

The reality is, the best Amazon seller tools for aggregators? They absolutely must have API access. This allows for automation. Plus, portfolio-wide dashboards are key. And, enterprise pricing? That’s super important. Finally, you need integration with internal BI systems like Snowflake or BigQuery.

Managing over 100 brands, thousands of SKUs, and 10+ global marketplaces is just… different. A single seller faces very different problems, honestly.

Look, the Thrasio case makes this point really clear. Over 200 brands, 1,600 employees – that’s a scale challenge right there.

Aggregators? They need programmatic data access. It’s how they feed their custom internal systems. They need to connect tool data with platforms like Snowflake and BigQuery to build their dashboards and run M&A due diligence.

This requires good APIs. Here’s the thing though: standard seller tools often don’t have them.

Portfolio-wide visibility is another big differentiator. Operators need to see performance metrics for all brands in one place. They don’t want to log into 100 separate accounts. That’s a lot of wasted time.

The cost structure of per-brand pricing models? It just doesn’t work at scale. One tool charges $449 a month. So, for an aggregator with 100 brands, that’s $44,900 monthly. That’s an expense no one can sustain. Enterprise tools? They offer custom pricing models to deal with this scale. And the ability to integrate with your existing private equity tech stack is essential. It allows for operations and accurate reporting that is pretty much seamless. Worth noting: specialized solutions like Amazon listing optimization tools can be components in this larger setup.

Why Did Thrasio-Style Aggregators Struggle with Operations?

Thrasio’s problems? They bought 200+ brands and didn’t really have the setup to handle it. Plus, getting customer data off Amazon is tricky. Their tools couldn’t keep up.

The real problem was they grew way too fast. Honestly, the valuation bubble meant they were paying, like, 7x EBITDA for brands. These brands? They were hard to deal with after buying them. And John Hefter, a Thrasio co-founder, even said some were “Chinese vaporware garbage” when things were at their craziest.

Integrating 200+ different brands became a total operational mess. Each one had its own supply chain and a completely different marketing strategy. And a different data footprint, of course. These all needed standardizing. Amazon isn’t super helpful either. Here’s the thing though, it restricts how much customer data you can pull. So cross-selling, which aggregators depend on? Harder than it should be.

That said, the tooling gaps made things worse. Without dedicated amazon seller tools for aggregators at the enterprise level, getting a full view across all brands was nearly impossible. So, the lesson? Pretty simple: software and tooling aggregators like Threecolts (which raised $200 million) and Carbon6 (acquired for $210 million) have done well where brand aggregators struggled. Building the right infrastructure is a better business model, in my experience.

What Are the Best Enterprise Amazon Tools for Aggregators in 2026?

Aggregators need the right tools. So, what *are* the best enterprise Amazon seller tools in 2026? Think Pacvue, Teikametrics, Carbon6, DataHawk, Perpetua, even custom data stacks. But here’s the thing though – portfolio scalability? That should be your #1 focus when you look at these tools.

You can kind of break them down into groups. Advertising automation is one. Also consider advanced analytics. And don’t forget unified operational platforms. Some companies even build custom solutions.

What separates a *true* enterprise tool from just a “premium” version? Three things, in my experience. First, it’s got to have full API access. Next up? Custom pricing built for a large portfolio. Lastly, you’ll want dedicated support and onboarding. Honestly, it’s worth paying for that support. When you pick a tool, really look at the API – how deep does it go? What about portfolio management features? Are they sophisticated enough? Is the pricing flexible? Can it play nice with your current tech? That said, this framework makes sure the tools you pick won’t buckle under the pressure of managing tons of brands. That’s the reality is.

Enterprise Tool Reviews: Pacvue, Teikametrics, and Carbon6

Pacvue, Teikametrics, and Carbon6 all bring something unique. Pacvue pricing? Expect $2,000-20,000/month. Teikametrics has AI starting at just $149/month. Carbon6 gives you 18 tools, all rolled into one.

Among Amazon seller tools for aggregators focused on advertising, Pacvue says it’s retail-media-first. They target brands and aggregators who drop over $50,000 monthly on ads. Its features are all about advertising management. Granular campaign automation is possible. So is DSP management. They also do daypart bidding. Deep integration with the Amazon Marketing Cloud is included.

Pacvue, being an Advanced Amazon API Partner, provides API access. They offer Data-as-a-Service (DaaS) feeds straight to BI systems. Think Snowflake and BigQuery. This is great if you’re handling advertising across many marketplaces. Amazon, Walmart, and Instacart are covered. But, honestly, here’s the thing though: that high minimum spend is a barrier. The platform’s complex too. You’ll need 2-3 months to onboard. You need dedicated internal resources. It’s pretty much for huge, mature orgs.

Teikametrics is all about AI-powered optimization. They use their ARI generative AI engine. It automates bidding, budgeting, and inventory forecasting. Listing optimization’s also included. That said, it’s an attractive option. Especially for mid-market aggregators wanting AI benefits, but not a full enterprise platform’s complexity. Pricing starts at $149 per month for the AI-powered tier. Custom pricing is there for enterprise clients. The reality is, there’s a big downside. It’s the lack of a native API. This limits integration with custom internal systems. They use standard connections to the Amazon and Walmart APIs.

Carbon6 is different. It’s a unified operational ecosystem. They bought 18 different tools. SellerLegend and D8aDriven are a few. This private equity-backed company gives a single dashboard. You can manage reimbursements, inventory, advertising, and analytics. For enterprise clients, Carbon6 offers API access. This lets you integrate with other systems. Worth noting: SPS Commerce acquired them for $210 million back in January 2025. The platform is positioned as a single-vendor solution for many operational needs. This approach is ideal if you want to consolidate. The primary drawback? Inconsistent integration is possible between the acquired tools.

Platform |

Starting Price |

API Access |

Marketplaces |

Best For |

|---|---|---|---|---|

Pacvue |

$2,000/mo |

Yes (DaaS) |

100+ |

Enterprise PPC |

Teikametrics |

$149/mo |

No |

Amazon, Walmart, TikTok |

AI automation |

Carbon6 |

$200/mo |

Enterprise only |

Amazon, Walmart |

Unified operations |

How Do DataHawk and Perpetua Compare for Analytics and Advertising?

DataHawk really focuses on enterprise analytics. They offer API access, Snowflake pipelines, and even white-label reporting. This is generally for agencies that handle 10+ brands. Perpetua, on the other hand, puts its energy into goal-based advertising automation. It starts at $695/month and includes DSP and Sponsored Ads management.

DataHawk supports Amazon, Walmart, and Shopify. It’s an enterprise-grade marketplace analytics platform. It’s designed for folks dealing with multiple accounts. Executive dashboards, anomaly detection, and AI-driven guidance are included. Honestly, its biggest strength is its composable API infrastructure. Managed data pipelines and native connectors are there for Snowflake, BigQuery, Looker Studio, and Power BI. So, it becomes a data layer for aggregators needing to feed marketplace analytics into their central BI systems.

They claim pretty significant client results. DataHawk reports a 130% average revenue lift within six months. Also, they mention a 31% RoAS increase in 12 months. Acquired by Worldeye Technologies in March 2025, DataHawk is now a top choice for aggregators when it comes to portfolio analytics and BI integration.

Perpetua gives you AI-powered advertising optimization and intelligence. Their platform automates bidding and campaign creation for sponsored ads. Sophisticated tools are there to manage the demand-side platform (DSP). And Perpetua integrates with the Amazon Marketing Cloud (AMC) and has creative optimization tools. Pricing kicks off at $695 per month, that’s for up to $10,000 in ad spend. After that, it changes to a percentage-of-spend model for larger accounts. Custom pricing exists for those spending over $500,000.

Like Teikametrics, Perpetua relies on marketplace API connections. It doesn’t have its own native API. Worth noting, this might limit its use in highly customized tech stacks. It is best if you are focused on full-funnel advertising strategies. Mentioning Amazon AI tools for sellers can give you context on how AI is changing things.

Platform |

Specialty |

API |

Data Export |

Starting Price |

|---|---|---|---|---|

DataHawk |

Analytics |

Yes |

Snowflake, BigQuery |

$200+/mo |

Perpetua |

Advertising |

Via marketplace |

AMC integration |

$695/mo |

When Should Aggregators Build Custom Data Stacks?

Aggregators should think about custom data setups when handling 50+ brands. These brands probably have unique BI needs. Or, honestly, if staying ahead hinges on your own special analytics, custom could be the way.

The reality is, the “build versus buy” question pops up when an aggregator’s stuff gets pretty big and complex. Or, maybe the tools they’re using just don’t play well together.

A modern, custom setup? It pretty much always has the Amazon Selling Partner API (SP-API) at its core. That’s your data source. Then, you’ll have a cloud data warehouse. Think Snowflake or BigQuery. Next up: a data transformation tool, like dbt. And, of course, something for visuals, like Looker or Tableau.

This route gives you the most wiggle room. That said, you’ll need some serious engineering firepower to build and keep it all running.

Here’s the thing though: the money side of building something custom is changing. Amazon said it will start charging subscription fees for SP-API developers in January 2026. Worth noting: this will impact how much custom solutions cost overall. Even with your own stack, specific tools often act as key data layers. For example, an aggregator might use the Keywords.am API to pump Amazon backend keywords smarts and listing analytics into their systems. When building custom amazon seller tools for aggregators, the stack can cost between $5,000 and $15,000 per month. That’s for infrastructure and engineering. And, you’ll find this can be competitive with enterprise platform costs that range from $10,000 to $30,000 per month.

How Should Aggregators Evaluate Enterprise Tool ROI?

When choosing Amazon seller tools for aggregators, you must evaluate ROI. Do this by calculating time saved across all operations multiplied by analyst cost per hour, plus any revenue increase from optimization stuff, then subtract the total platform cost. This includes implementation, training – everything. A solid framework? Honestly, it’s essential to making a smart investment.

The biggest return comes from saving time. And you can actually put a value on it. The formula: (Hours saved per brand each month) x (Number of brands) x (Analyst hourly rate). For example, say a platform saves 10 hours per brand. A portfolio of 100 brands exists, and analysts make $75 an hour. So, the time saved is worth $75,000 per month. Not bad.

Second, revenue lift. Vendors often give you metrics. For example, DataHawk says their clients see a 130% average revenue lift. Treat these numbers carefully. But you can use them for modeling.

It’s also important to remember hidden costs. Enterprise platforms, like Pacvue, can take 2-3 months to implement. Plus, there’s training and dedicated resources needed. Here’s the thing though, do a break-even analysis. You need to know how long the investment takes to pay for itself. Compared to what you’re doing now. Worth noting: a solid understanding of resources like the Brand Analytics guide will help a lot too.

Cost Factor |

Individual Tools (100 brands) |

Enterprise Platform |

|---|---|---|

Monthly subscription |

$20,000-50,000 |

$5,000-20,000 |

Implementation time |

Minimal |

2-3 months |

Analyst hours saved |

Baseline |

10-20 hrs/brand/month |

Data integration |

Manual export |

API/automated |

Portfolio visibility |

None |

Full |

Frequently Asked Questions About Amazon Aggregator Tools

What is the best Amazon tool for managing 100+ brands?

So, you’re trying to pick the best Amazon seller tool for managing a huge portfolio. Honestly, it really depends on what you’re trying to do. For aggregators with 100+ brands, Pacvue offers, in my experience, the most enterprise-level stuff, especially with coverage across so many marketplaces. But Carbon6 is a great value if you care more about unified operations than crazy deep advertising features. Advertising-heavy firms will probably dig Pacvue. Operationally-focused ones might prefer Carbon6’s breadth across reimbursements, inventory stuff, and analytics.

Do Amazon aggregators need API access to seller tools?

Yes. Aggregators absolutely need API access. Here’s the thing though: API access is super important for feeding data into internal BI systems, think Snowflake. Plus, you can automate reporting across all those brands – we’re talking 100+. Worth noting: it’s key for integrating with M&A due diligence. Without API access, they’re stuck doing manual data exports. That’s inefficient, error-prone, and you won’t get the real-time visibility needed to make smart decisions.

How much should aggregators budget for Amazon seller tools?

Aggregators need to budget for this kind of thing. Enterprise aggregators usually budget like $10,000-30,000 a month for their core tools. But that can go up to $20,000-50,000 or even more if they’re using individual seller subscriptions across, say, a 100+ brand portfolio. And when you budget, don’t forget implementation costs! You’ll need to factor those in. That can take 2-3 months of integration. Also, ongoing support and training will cost you.

Can Keywords.am work for Amazon aggregators?

Keywords.am can work. It’s a specialized listing intelligence layer, kind of. It fits right into aggregator tech stacks. It helps with keyword research, listing optimization, and the TFSD Framework at scale using API integration. It doesn’t replace platforms like Pacvue. Instead, Keywords.am complements them with deep listing optimization that those bigger, more general platforms often don’t have.

What happened to Thrasio and what does it mean for aggregator tooling?

Thrasio filed for Chapter 11 bankruptcy. They had acquired over 200 brands! One contributing factor was operational scaling challenges, including tooling gaps. That said, it’s a cautionary tale about investing in your infrastructure. That being said, the success of software aggregators like Threecolts (who raised $200M) and Carbon6 (acquired for $210M) suggests that building the tooling infrastructure is a solid business. Even if the whole brand roll-up strategy is facing problems.

Which enterprise Amazon tool has the best API?

DataHawk has the most composable API infrastructure. They’ve got managed Snowflake and BigQuery pipelines. Pacvue’s Data-as-a-Service (DaaS) offering is also pretty good for enterprise analytics. In contrast, Teikametrics and Perpetua mostly rely on marketplace API connections, and don’t expose their own native APIs, which limits what you can do with custom integrations.

Conclusion

The days of using single-seller tools to manage huge Amazon portfolios? Over. Modern Amazon seller tools for aggregators? They’ve changed a lot to deal with enterprise needs. The financial and operational models just don’t work when you get really big. Enterprise pricing can save an aggregator $20,000-30,000 each month on a 100-brand portfolio, and API access is a must. You need it to integrate with the fancy BI systems that run modern business.

Look, Thrasio’s story shows us that investing in operations is as important as buying up brands. The aggregators doing best are building tech stacks. These stacks combine a core enterprise platform with specialized tools and custom BI to get an edge.

To get going, aggregators should audit how much they’re spending on tools right now. Figure out the real per-brand cost across their whole portfolio. Next? Ask Pacvue, Teikametrics, and Carbon6 for enterprise pricing. Compare them directly. And honestly, you need to thoroughly evaluate your internal API needs against each platform’s features. That’ll show you the best way forward. Worth noting: these platforms all have different capabilities, so dig in. For those wanting better listing intelligence at aggregator scale, explore Keywords.am’s multi-brand workspace to see how the TFSD framework can be applied across an entire portfolio. It’s pretty cool.