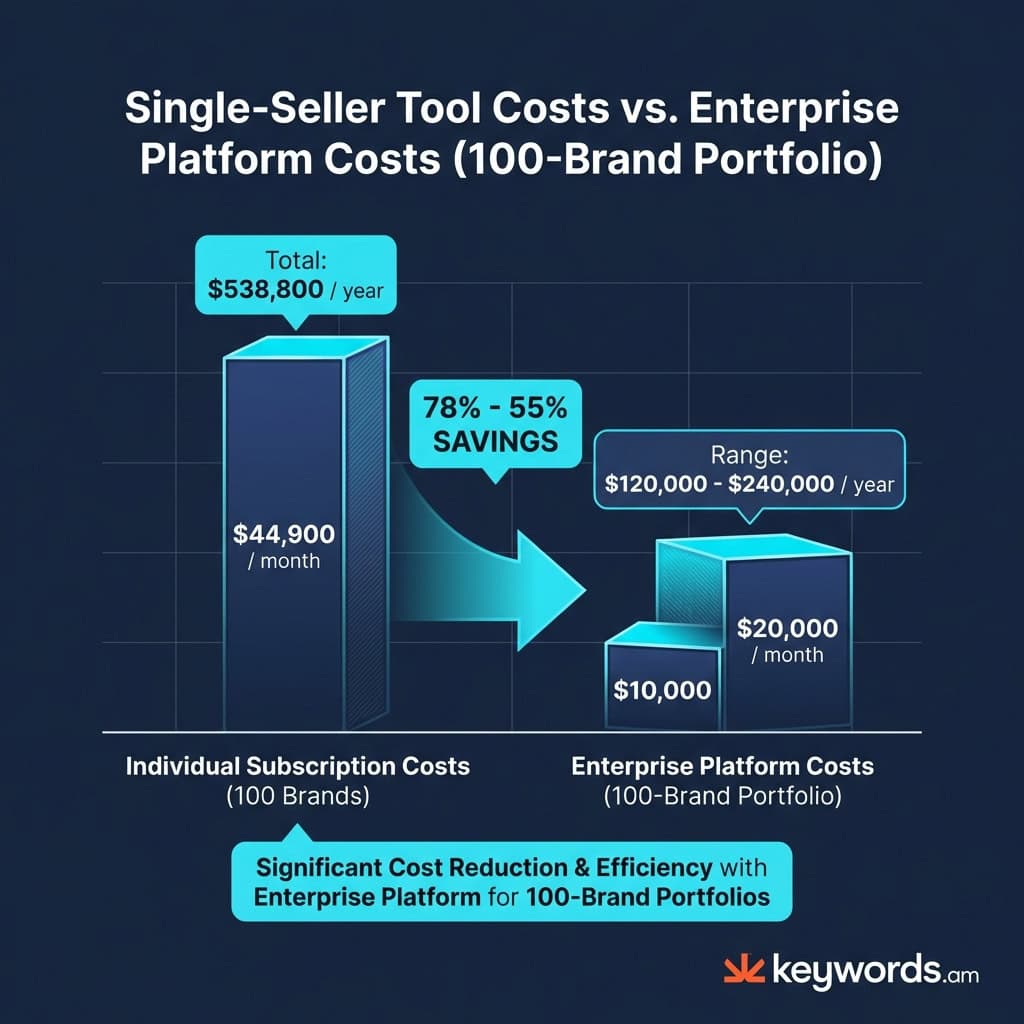

Thrasio raised $3.4 billion and acquired over 200 brands before filing for bankruptcy—and a fragile tooling infrastructure was a significant contributing factor. When aggregators attempt to manage more than 100 Amazon brands with software designed for single sellers, the operational and financial models collapse. This reality has driven demand for specialized amazon seller tools for aggregators that can handle portfolio-scale operations. Per-brand SaaS pricing at $200-500 per month multiplies across a portfolio, resulting in costs of $20,000-50,000 per month for basic tools.

Beyond the prohibitive expense, these tools lack the portfolio-wide visibility, API access for automation, and integration with the internal business intelligence (BI) systems that professional aggregators depend on. This guide compares the enterprise platforms built for aggregator scale, analyzing their API capabilities, portfolio management features, and pricing models that support, rather than hinder, growth. Unlike typical listicles that recommend standard tools like Helium 10 or Jungle Scout, the focus here is exclusively on solutions offering enterprise pricing, robust API access, and multi-brand portfolio capabilities.

TL;DR: Key Insights on Aggregator Tooling

- Single-Seller Tools Don’t Scale: Per-brand pricing models become unsustainable for portfolios over 100 brands, often exceeding $40,000 monthly.

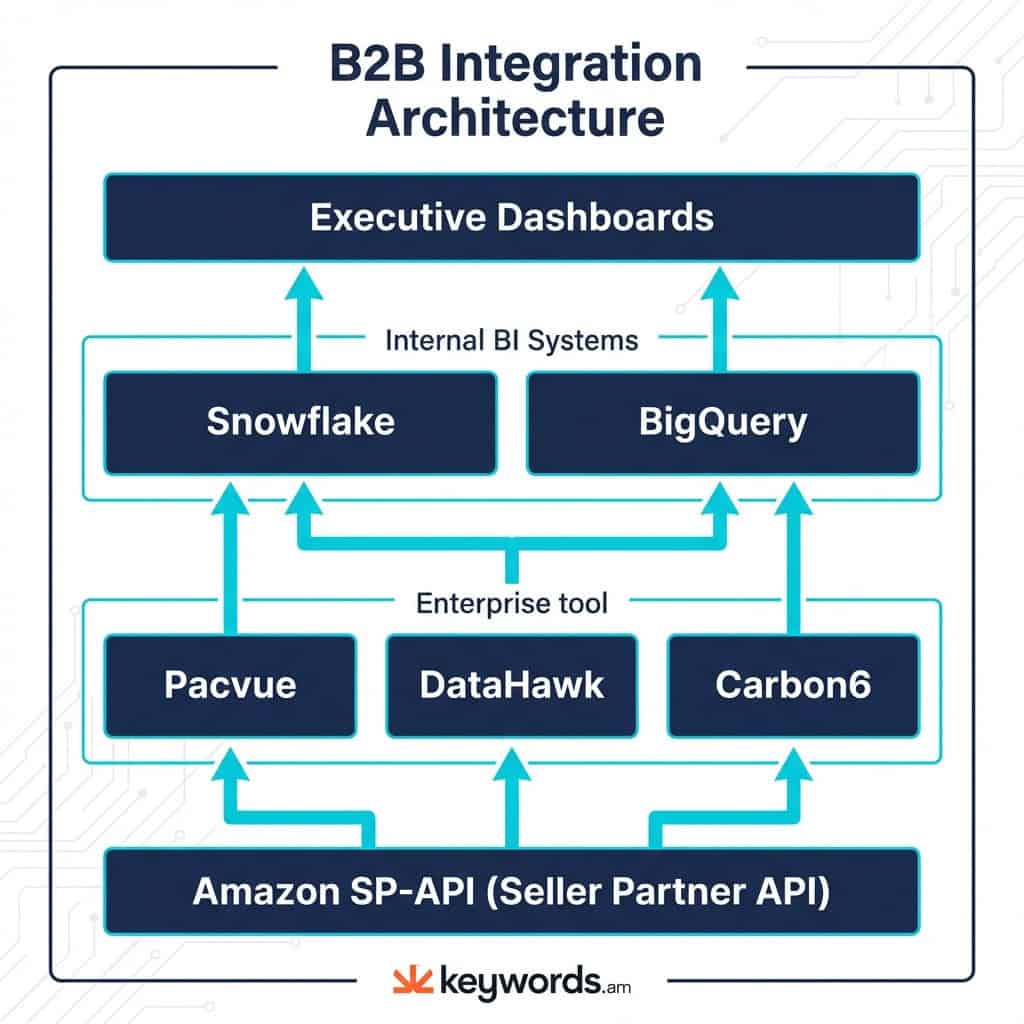

- API Access is Non-Negotiable: Programmatic access is essential for integrating with internal BI systems like Snowflake or BigQuery and automating workflows.

- Portfolio Visibility is Crucial: Aggregators need unified dashboards to monitor performance across all brands simultaneously, a feature absent in single-seller tools.

- The Thrasio Lesson: The downfall of major aggregators highlights the critical need for scalable operational infrastructure, not just rapid acquisitions.

- A Composable Stack is Optimal: The most effective approach combines enterprise platforms for core functions (e.g., advertising) with specialized data layers for others (e.g., listing intelligence).

- Enterprise Tooling ROI: The return on investment is measured in operational efficiency, time savings that can amount to over $75,000 per month, and revenue lift from advanced optimization features.

- Key Enterprise Players: Pacvue, Teikametrics, and Carbon6 offer comprehensive platforms, while DataHawk and Perpetua provide specialized solutions for analytics and advertising.

What Are the Best Amazon Seller Tools for Aggregators?

The best amazon seller tools for aggregators require API access for automation, portfolio-wide dashboards, enterprise pricing, and integration with internal BI systems like Snowflake or BigQuery.

The operational reality for an aggregator managing over 100 brands, thousands of SKUs, and more than ten global marketplaces is fundamentally different from that of a single seller.

The Thrasio case, involving over 200 brands and 1,600 employees, exemplifies this challenge of scale.

Aggregators depend on programmatic data access to feed their custom internal systems. They need to connect tool data with platforms like Snowflake and BigQuery to build proprietary dashboards and run M&A due diligence.

This requires robust APIs, a feature often missing from standard seller tools.

Portfolio-wide visibility is another critical differentiator; operators need to see performance metrics for all brands in a single view, rather than logging into a hundred separate accounts.

The cost structure of per-brand pricing models also breaks at scale. A leading tool charging $449 per month would cost an aggregator with 100 brands $44,900 monthly, an unsustainable expense. Enterprise tools offer custom pricing models that accommodate this scale. Finally, the ability to integrate with an existing private equity tech stack is essential for seamless operations and accurate reporting. Specialized solutions like Amazon listing optimization tools can serve as components in this larger ecosystem.

Why Did Thrasio-Style Aggregators Struggle with Operations?

Thrasio’s challenges stemmed from acquiring 200+ brands without adequate integration infrastructure, limited Amazon customer data extraction, and tooling that couldn’t scale with explosive growth.

The core issue was a mismatch between acquisition velocity and operational capacity. The valuation bubble led to paying 7x EBITDA multiples for brands that were difficult to integrate post-acquisition. John Hefter, a Thrasio co-founder, noted that some acquisitions were of “Chinese vaporware garbage” at peak market enthusiasm.

The integration of over 200 disparate brands created an operational nightmare. Each brand came with its own supply chain, marketing strategy, and data footprint, which had to be standardized and managed.

Amazon’s platform itself poses a challenge, as it restricts customer data extraction, limiting the cross-selling synergies that aggregators rely on to create value. The tooling gaps further compounded these problems. Without dedicated amazon seller tools for aggregators at the enterprise level, gaining portfolio-wide intelligence was nearly impossible. The lesson from this era is clear: software and tooling aggregators like Threecolts (which raised $200 million) and Carbon6 (acquired for $210 million) have succeeded where many brand aggregators struggled, demonstrating that building the operational infrastructure is a more viable long-term business model.

What Are the Best Enterprise Amazon Tools for Aggregators in 2026?

The best enterprise amazon seller tools for aggregators include Pacvue, Teikametrics, Carbon6, DataHawk, Perpetua, and custom data stacks. When evaluating amazon seller tools for aggregators, portfolio scalability should be the primary consideration.

These tools can be categorized into distinct groups: advertising automation, advanced analytics, unified operational platforms, and custom-built solutions.

True enterprise tools are distinguished from premium tiers by three core features: comprehensive API access, custom pricing models designed for portfolio scale, and dedicated support and onboarding. When selecting a tool, aggregators should evaluate them based on the depth of their API capabilities, the sophistication of their portfolio management features, the flexibility of their pricing, and their ability to integrate with an existing tech stack. This framework ensures that the chosen tools can handle the complexity and scale of a multi-brand portfolio.

Enterprise Tool Reviews: Pacvue, Teikametrics, and Carbon6

Pacvue excels at enterprise PPC across 100+ retail networks with $2,000-20,000/month pricing, Teikametrics offers AI-driven automation starting at $149/month with custom enterprise tiers, and Carbon6 provides unified operations through 18 integrated tools acquired via a roll-up strategy.

Among amazon seller tools for aggregators focused on advertising, Pacvue positions itself as a retail-media-first platform designed for brands and aggregators with a monthly advertising spend exceeding $50,000. Its feature set is built for sophisticated advertising management, including granular campaign automation, DSP management, daypart bidding, and deep integration with the Amazon Marketing Cloud.

As an Advanced Amazon API Partner, Pacvue offers robust API access and Data-as-a-Service (DaaS) feeds directly into BI systems like Snowflake and BigQuery. This makes it ideal for aggregators managing advertising across numerous marketplaces, including Amazon, Walmart, and Instacart. However, its high minimum spend and a complex platform requiring a 2-3 month onboarding process and dedicated internal resources make it best suited for large, mature organizations.

Teikametrics focuses on AI-powered optimization, leveraging its proprietary ARI generative AI engine to automate bidding, budgeting, and inventory forecasting. It also provides features for listing optimization, making it an attractive option for mid-market aggregators seeking the benefits of AI automation without the complexity of a full enterprise platform. Pricing starts at a more accessible $149 per month for its AI-powered tier, with custom pricing available for enterprise clients. A significant limitation is its lack of a native API, which restricts its ability to integrate with custom internal systems. Instead, it relies on standard connections to the Amazon and Walmart APIs.

Carbon6 offers a different value proposition: a unified operational ecosystem built by acquiring 18 distinct tools, including SellerLegend and D8aDriven. This private equity-backed company provides a single dashboard for managing reimbursements, inventory, advertising, and analytics. For enterprise clients, Carbon6 offers API access, allowing for integration with other systems. Following its acquisition by SPS Commerce for $210 million in January 2025, the platform is positioned as a single-vendor solution for multiple operational needs. This approach is ideal for aggregators looking to consolidate their tool stack. The primary drawback can be inconsistent integration between the various acquired tools within the platform.

Platform |

Starting Price |

API Access |

Marketplaces |

Best For |

|---|---|---|---|---|

Pacvue |

$2,000/mo |

Yes (DaaS) |

100+ |

Enterprise PPC |

Teikametrics |

$149/mo |

No |

Amazon, Walmart, TikTok |

AI automation |

Carbon6 |

$200/mo |

Enterprise only |

Amazon, Walmart |

Unified operations |

How Do DataHawk and Perpetua Compare for Analytics and Advertising?

DataHawk specializes in enterprise analytics with API access, Snowflake pipelines, and white-label reporting for agencies managing 10+ brands, while Perpetua focuses on goal-based advertising automation starting at $695/month for DSP and Sponsored Ads management.

DataHawk is an enterprise-grade marketplace analytics platform supporting Amazon, Walmart, and Shopify. It is designed for multi-account aggregation, offering executive dashboards, anomaly detection, and AI-driven guidance. Its key strength is its composable API infrastructure, which includes managed data pipelines and native connectors for Snowflake, BigQuery, Looker Studio, and Power BI. This makes it a powerful data layer for aggregators that need to feed marketplace analytics into their central BI systems.

The company reports significant client results, including a 130% average revenue lift within six months and a 31% RoAS increase in 12 months. After being acquired by Worldeye Technologies in March 2025, DataHawk is a top choice among amazon seller tools for aggregators focused on portfolio analytics and BI integration.

Perpetua provides AI-powered advertising optimization and intelligence. Its platform automates bidding and campaign creation for sponsored ads and offers sophisticated tools for managing the demand-side platform (DSP). Perpetua also integrates with the Amazon Marketing Cloud (AMC) and provides tools for creative optimization. Pricing begins at $695 per month for up to $10,000 in ad spend, transitioning to a percentage-of-spend model for larger accounts, with custom pricing for those spending over $500,000.

Like Teikametrics, it relies on marketplace API connections rather than providing its own native API, which may limit its use in highly customized tech stacks. It is best suited for aggregators focused on sophisticated, full-funnel advertising strategies. Mentioning Amazon AI tools for sellers can provide additional context on how AI is shaping the landscape.

Platform |

Specialty |

API |

Data Export |

Starting Price |

|---|---|---|---|---|

DataHawk |

Analytics |

Yes |

Snowflake, BigQuery |

$200+/mo |

Perpetua |

Advertising |

Via marketplace |

AMC integration |

$695/mo |

When Should Aggregators Build Custom Data Stacks?

Aggregators should consider custom data stacks when managing 50+ brands with unique BI requirements or when competitive advantage depends on proprietary analytics.

The decision to build versus buy is triggered when an aggregator’s portfolio reaches a certain scale and complexity, or when existing tools lack the required integrations.

A modern custom stack typically consists of the Amazon Selling Partner API (SP-API) as the foundational data source, a cloud data warehouse like Snowflake or BigQuery, a data transformation tool like dbt, and a visualization tool like Looker or Tableau.

This approach offers maximum flexibility but also requires significant engineering resources to build and maintain.

The economics of a custom build are also changing, as Amazon announced it will begin charging subscription fees for SP-API developers starting in January 2026. This move will affect the total cost of ownership for custom solutions. Even with a custom stack, specialized tools often serve as critical data layers. For example, an aggregator might use the Keywords.am API to feed Amazon backend keywords intelligence and listing analytics into their proprietary systems. When building custom amazon seller tools for aggregators, the stack can cost between $5,000 and $15,000 per month in infrastructure and engineering, which can be competitive with enterprise platform costs that range from $10,000 to $30,000 per month.

How Should Aggregators Evaluate Enterprise Tool ROI?

When selecting amazon seller tools for aggregators, evaluate enterprise tool ROI by calculating time saved across portfolio operations multiplied by analyst hourly cost, plus revenue lift from optimization features, minus total platform cost including implementation and training time. A concrete framework is essential for making a sound investment decision.

The most significant return comes from time savings. A simple formula can quantify this value: (Hours saved per brand per month) x (Number of brands) x (Analyst hourly rate). For example, if a platform saves 10 hours per brand for a 100-brand portfolio, with an analyst rate of $75 per hour, the value of time saved is $75,000 per month.

The second component is revenue lift. Vendors often provide metrics for this; for instance, DataHawk reports a 130% average revenue lift for its clients. These figures should be treated with caution but can be used for modeling.

It is also crucial to account for hidden costs. Enterprise platforms like Pacvue require a 2-3 month implementation period, extensive training, and dedicated internal resources to manage. A break-even analysis should be conducted to determine how long it will take for the investment to pay for itself compared to the current approach. Effective use of analytics tools can also be informed by a solid understanding of resources like the Brand Analytics guide.

Cost Factor |

Individual Tools (100 brands) |

Enterprise Platform |

|---|---|---|

Monthly subscription |

$20,000-50,000 |

$5,000-20,000 |

Implementation time |

Minimal |

2-3 months |

Analyst hours saved |

Baseline |

10-20 hrs/brand/month |

Data integration |

Manual export |

API/automated |

Portfolio visibility |

None |

Full |

Frequently Asked Questions About Amazon Aggregator Tools

What is the best Amazon tool for managing 100+ brands?

When looking at amazon seller tools for aggregators managing 100+ brand portfolios, Pacvue offers the most comprehensive enterprise capabilities with 100+ marketplace coverage, but Carbon6 provides better value if unified operations matter more than advertising depth. The “best” tool depends on the aggregator’s primary use case. Advertising-focused firms will benefit from Pacvue’s depth, while operationally-focused portfolios may prefer Carbon6’s breadth across reimbursements, inventory, and analytics.

Do Amazon aggregators need API access to seller tools?

Yes, API access is essential for aggregators to feed data into internal BI systems like Snowflake, automate reporting across 100+ brands, and integrate with M&A due diligence workflows. Without API access, aggregators are forced to rely on manual data exports that are inefficient, error-prone, and cannot provide the real-time portfolio visibility needed to make informed decisions.

How much should aggregators budget for Amazon seller tools?

When budgeting for amazon seller tools for aggregators, enterprise aggregators typically budget $10,000-30,000 per month for core tooling, compared to $20,000-50,000 or more if using individual seller subscriptions across a 100+ brand portfolio. When budgeting, it is important to factor in implementation costs, which can involve 2-3 months of integration work, as well as ongoing support and training requirements.

Can Keywords.am work for Amazon aggregators?

Keywords.am serves as a specialized listing intelligence layer within aggregator tech stacks, providing keyword research, listing optimization, and the TFSD Framework at scale via API integration. Rather than replacing enterprise platforms like Pacvue, Keywords.am complements them by providing deep listing optimization capabilities that generalist platforms often lack.

What happened to Thrasio and what does it mean for aggregator tooling?

Thrasio filed for Chapter 11 bankruptcy after acquiring 200+ brands, with operational scaling challenges including tooling gaps contributing to their struggles—a cautionary tale about infrastructure investment. The success of software aggregators like Threecolts ($200M raise) and Carbon6 ($210M acquisition) suggests that building the tooling infrastructure is a viable business model, even as the brand roll-up strategy faces challenges.

Which enterprise Amazon tool has the best API?

DataHawk offers the most composable API infrastructure with managed Snowflake and BigQuery pipelines, followed by Pacvue’s Data-as-a-Service (DaaS) offering for enterprise analytics. In contrast, Teikametrics and Perpetua rely on marketplace API connections rather than exposing their own native APIs, which limits possibilities for custom integration.

Conclusion

The era of managing large Amazon portfolios with single-seller tools is over. Modern amazon seller tools for aggregators have evolved to meet enterprise demands. The financial and operational models simply do not work at scale. Enterprise pricing can save an aggregator $20,000-30,000 per month on a 100-brand portfolio, and API access is non-negotiable for integration with the sophisticated BI systems that drive modern business. The cautionary tale of Thrasio demonstrates that investment in operational infrastructure is just as critical as acquisition velocity. The most successful aggregators are building composable tech stacks, combining a core enterprise platform with specialized tools and custom BI to create a competitive advantage.

To move forward, aggregators should first audit their current tool spend to calculate the true per-brand cost across their portfolio. The next step is to request enterprise pricing proposals from platforms like Pacvue, Teikametrics, and Carbon6 for a direct comparison. Finally, a thorough evaluation of internal API requirements against each platform’s capabilities will clarify the best path forward. For those looking to enhance their listing intelligence at an aggregator scale, explore Keywords.am’s multi-brand workspace to see how the TFSD framework can be applied across an entire portfolio.