Table of Contents

- What Are FBA and FBM on Amazon?

- What Are the Key Differences Between FBA and FBM?

- How Do 2026 FBA Fees Compare to FBM Costs?

- How Does Fulfillment Choice Affect Amazon Keyword Rankings?

- When Should Sellers Choose FBA, FBM, or a Hybrid Model?

- Frequently Asked Questions About FBA vs FBM

- The Bottom Line on FBA vs FBM

TL;DR

- Fee Reality: While the average fee increase is $0.08, popular standard-sized items saw a $0.25 jump in 2026.

- Ranking Impact: FBA indirectly boosts SEO by improving conversion rates and click-through rates via the Prime badge.

- The Buy Box: FBA offers a 30-50% higher probability of winning the Buy Box, which drives over 82% of sales.

- Cost Analysis: A $24.99 item typically nets $0.87 more profit per unit on FBA compared to FBM, assuming standard shipping rates.

- Hybrid Strategy: 22% of sellers use both models to protect against stockouts and maximize reach.

- Optimization Constant: Regardless of fulfillment choice, rigorous keyword optimization is required to appear in search results.

Eighty-two percent of Amazon sellers rely on Fulfillment by Amazon (FBA), yet the average $0.08 per unit fee increase announced for 2026 masks a harsher reality: for the most common product tier (small standard items priced between $10 and $50) fulfillment costs actually surged by $0.25 per unit. This discrepancy forces brands to reconsider the math behind their logistics.

Most comparisons of FBA versus Fulfillment by Merchant (FBM) stop at the immediate costs and logistical differences. They fail to explain how fulfillment choice ripples through Amazon’s ecosystem, directly impacting keyword rankings, Buy Box eligibility, and ultimately, conversion rates. The fba vs fbm decision is rarely just about shipping; it is about visibility.

This guide provides a definitive fba vs fbm comparison for 2026. It covers the updated fee structures with a worked Profit and Loss (P&L) example, analyzes the ranking impact of each model, and offers a decision framework tailored to product type and business stage.

The connection between fulfillment method, conversion rate, and organic ranking is often the missing piece in strategic planning. Understanding this relationship allows sellers to optimize their operations not just for margin, but for market share.

What Are FBA and FBM on Amazon?

FBA (Fulfillment by Amazon) means Amazon stores, packs, and ships products, while FBM (Fulfillment by Merchant) means the seller handles all logistics directly.

Fulfillment by Amazon (FBA) allows sellers to send their inventory to Amazon’s network of fulfillment centers. Once received, Amazon takes responsibility for storage, picking, packing, shipping, and handling returns and customer service. Products fulfilled this way automatically receive the Prime badge, signaling fast, free delivery to subscribers. This model is designed to be hands-off for the seller regarding logistics, allowing them to focus on product development and marketing.

Fulfillment by Merchant (FBM), conversely, places the logistical burden entirely on the seller. The merchant stores inventory in their own warehouse or a third-party logistics (3PL) facility and ships orders directly to customers as they come in. While this offers full control over the packaging and unboxing experience, FBM listings do not automatically qualify for the Prime badge unless the seller is enrolled in the rigorous Seller Fulfilled Prime (SFP) program.

Both models compete on the same Amazon listing. The fundamental difference lies in who executes the post-sale logistics and which entity bears the liability for delivery performance. However, listing optimization remains a critical constant; keywords and content must be optimized regardless of who ships the box.

What Are the Key Differences Between FBA and FBM?

FBA and FBM differ across six dimensions: fulfillment speed, Prime eligibility, Buy Box advantage, seller control, fee structure, and scalability requirements.

The choice between these two fulfillment models fundamentally alters a business’s operational structure. While FBA offers scale and visibility, FBM offers control and margin protection for specific product types. The table below outlines the core operational differences in this fba vs fbm comparison.

Factor |

FBA |

FBM |

|---|---|---|

Fulfillment |

Amazon handles everything (storage, pack, ship) |

Seller handles everything (warehouse, labor, carriers) |

Prime Eligibility |

Automatic |

Only via Seller Fulfilled Prime (SFP) |

Buy Box Impact |

Strong advantage (30-50% more likely to win) |

Must compete aggressively on price and metrics |

Seller Control |

Low (Amazon’s packaging, processes) |

Full control (branding, custom packaging, inserts) |

Fee Structure |

Per-unit fulfillment + storage + placement fees |

Shipping costs + warehouse + labor costs |

Scalability |

Scales instantly with Amazon’s infrastructure |

Requires own logistics infrastructure to scale |

Customer Service |

Amazon handles |

Seller handles |

Returns |

Amazon processes |

Seller processes |

Data indicates that 82% of sellers utilize FBA, while 34% use FBM, with a significant overlap of 22% of sellers employing a hybrid approach to leverage the strengths of both systems. This hybrid model often serves as a hedge against FBA capacity limits or unexpected fee hikes.

The Buy Box is the most critical real estate on Amazon, capturing between 82% and 85% of all sales. Because Amazon prioritizes customer experience, the reliability and speed of FBA give those listings a substantial edge in the algorithm that awards the Buy Box. FBM sellers must maintain near-perfect metrics and often lower prices to compete for this position against FBA offers.

How Do 2026 FBA Fees Compare to FBM Costs?

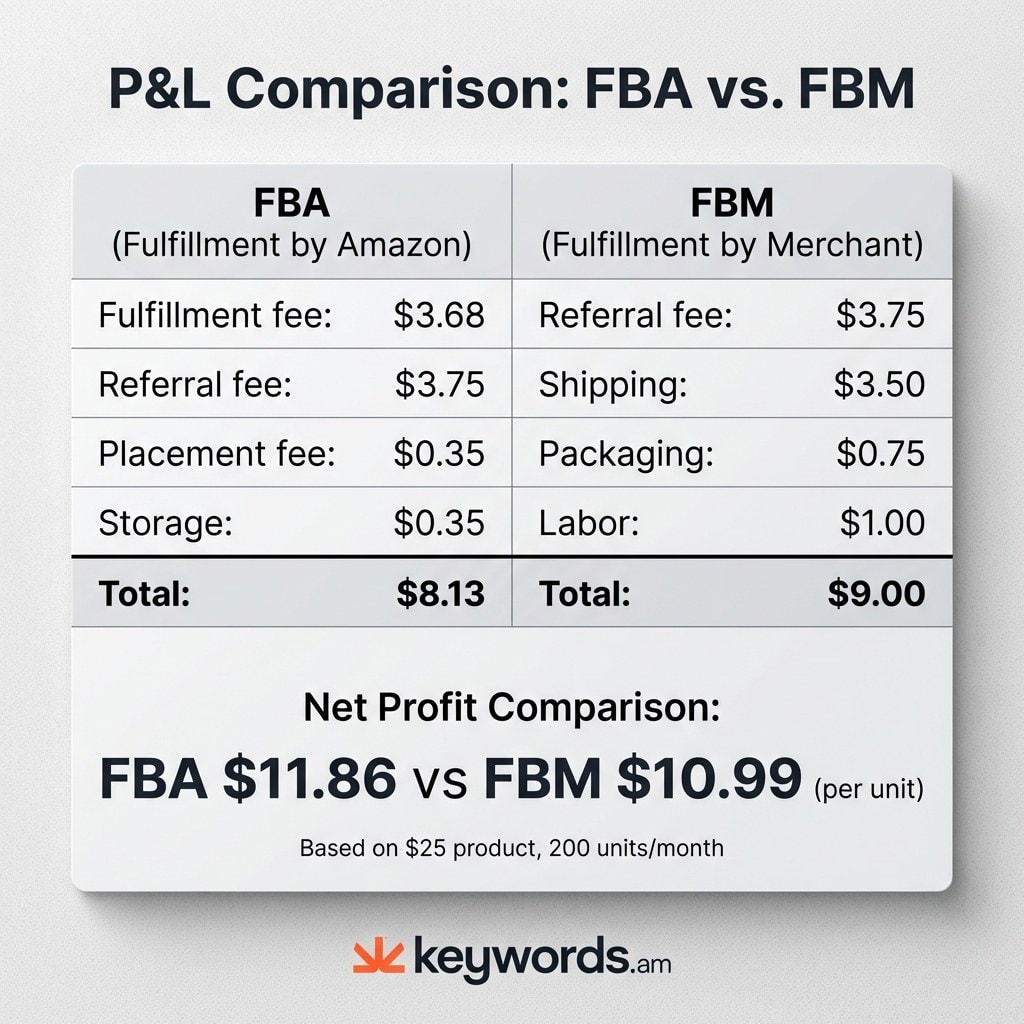

A $24.99 product at 200 units per month costs roughly $8.13 per unit under FBA versus $9.00 under FBM, a difference of $0.87 per unit in FBA’s favor.

Understanding the precise financial impact of the 2026 fee schedule is essential for margin preservation. Below is a detailed Profit and Loss (P&L) breakdown for a standard-size product (10 oz) selling for $24.99 with a sales velocity of 200 units per month. This fba vs fbm cost comparison uses the confirmed 2026 fee data.

FBA Cost Breakdown:

Fee Type |

Per Unit |

Monthly (200 units) |

|---|---|---|

FBA Fulfillment Fee |

$3.68 |

$736 |

Referral Fee (15%) |

$3.75 |

$750 |

Inbound Placement Fee |

~$0.35 |

$70 |

Monthly Storage |

~$0.35 |

$70 |

Total Amazon Fees |

~$8.13 |

$1,626 |

Product Cost (est.) |

$5.00 |

$1,000 |

Net Profit |

$11.86 |

$2,372 |

The FBA fulfillment fee of $3.68 applies to small standard items (8-10 oz) in the $10-$50 price tier. The referral fee remains standard at 15% for most categories. The inbound placement fee (a cost for distributing inventory across Amazon’s network) adds approximately $0.35 per unit, a factor often overlooked in preliminary calculations.

FBM Cost Breakdown (Estimated):

Fee Type |

Per Unit |

Monthly (200 units) |

|---|---|---|

Referral Fee (15%) |

$3.75 |

$750 |

Shipping (self-fulfilled) |

~$3.50 |

$700 |

Packaging |

~$0.75 |

$150 |

Warehouse/Labor |

~$1.00 |

$200 |

Total Costs |

~$9.00 |

$1,800 |

Product Cost (est.) |

$5.00 |

$1,000 |

Net Profit |

$10.99 |

$2,198 |

In this specific scenario, FBA yields a higher net profit of $11.86 compared to FBM’s $10.99 (a difference of $0.87 per unit). However, FBM costs are highly variable. A seller with negotiated rates from UPS or USPS might reduce shipping costs to $2.50, swinging the advantage back to FBM. Conversely, relying on retail shipping rates could push FBM costs significantly higher.

FBM becomes the clear financial winner for products with a high shipping weight-to-value ratio, oversized items, or goods requiring special handling (like hazardous materials) that attract steep FBA surcharges. Low-margin items under $15 also frequently benefit from FBM if lightweight shipping options like USPS Ground Advantage are utilized.

How Does Fulfillment Choice Affect Amazon Keyword Rankings?

FBA indirectly boosts keyword rankings through higher conversion rates from the Prime badge, faster shipping, and stronger Buy Box win rates that feed Amazon’s A10 algorithm.

Many sellers mistakenly believe that organic ranking is purely a function of keyword relevance. In reality, Amazon’s A10 algorithm heavily weighs sales velocity and conversion rate. The fulfillment method chosen acts as a powerful lever on these metrics.

The Prime Badge Effect on CTR

Listings displaying the Prime badge achieve significantly higher click-through rates (CTR) in search results. Shoppers filter for Prime to ensure fast delivery. A higher CTR signals to Amazon that the product is relevant to the search query. This signal, in turn, improves the product’s organic ranking for those target keywords.

Buy Box Ownership and Search Visibility

Visibility is inextricably linked to the Buy Box. If a seller loses the Buy Box, their offer is effectively invisible for the 82-85% of purchases that happen through the “Add to Cart” button. Without sales, the product’s ranking history stagnates or declines. FBA sellers, being 30-50% more likely to win the Buy Box, maintain the consistent sales velocity required to hold top keyword positions.

Conversion Rate Impact

FBA products typically convert at higher rates due to the trust consumers place in Amazon’s shipping speed and return policy. A high conversion rate is perhaps the single strongest signal for ranking. If 100 people click a listing and 15 buy (15% conversion), Amazon will rank that product higher than a competitor where 100 click and only 5 buy. FBA facilitates the service levels that drive these numbers.

The FBM Counter-Argument

FBM sellers can rank well, but the bar is higher. To compete, FBM merchants must demonstrate flawless metrics: rapid handling times, valid tracking rates, and low order defect rates. The algorithm rewards performance. FBA simply provides that high-performance infrastructure by default, whereas FBM requires the seller to build it.

Ultimately, keyword optimization matters regardless of fulfillment method. Fulfillment affects how high a product ranks based on performance, but Amazon keyword indexing determines which terms the product is eligible to show for. A product that is not indexed for relevant keywords will not rank, no matter how fast it ships.

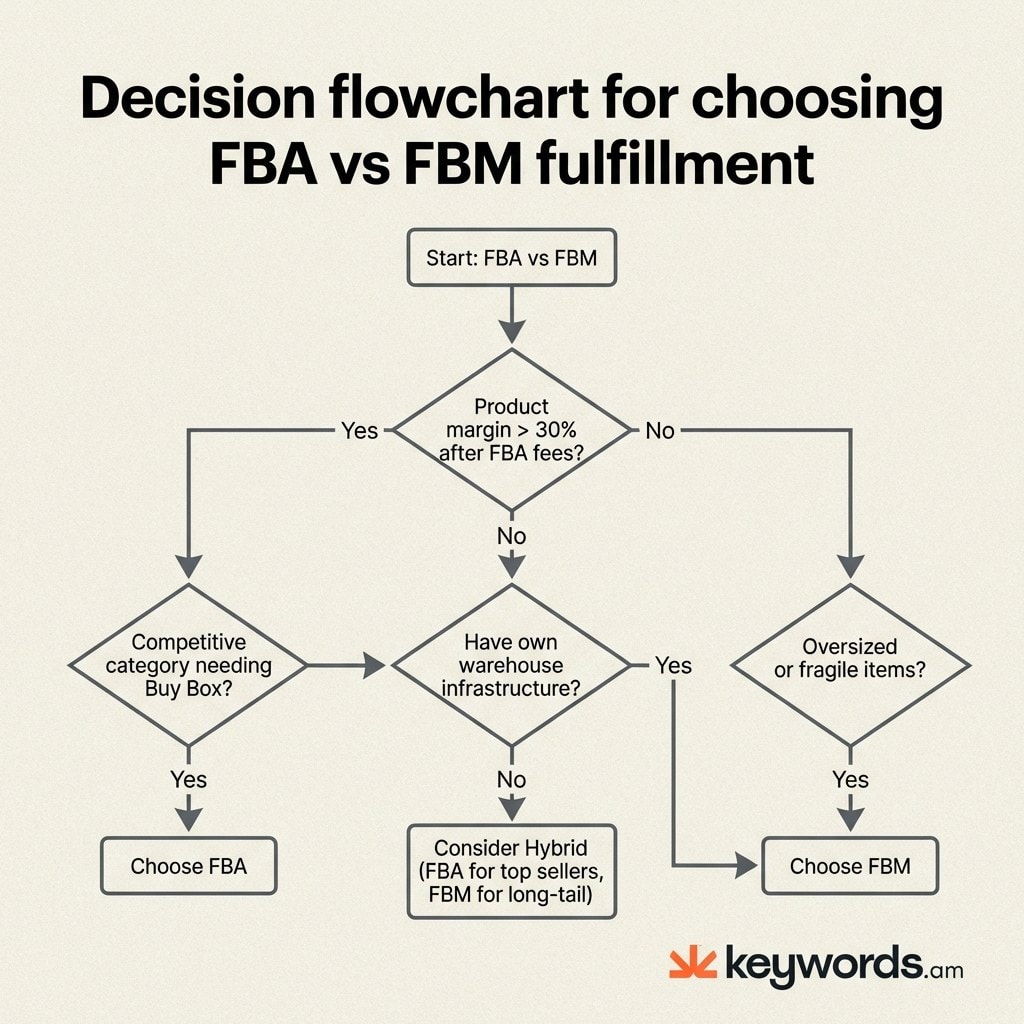

When Should Sellers Choose FBA, FBM, or a Hybrid Model?

Choose FBA for high-volume competitive products, FBM for oversized or low-margin items, and hybrid when managing both standard and specialty inventory.

The decision of which fulfillment model to use should be based on data, not preference. Using the best Amazon product research tools can help identify high-margin niches suitable for FBA before a single unit is shipped. Sellers should evaluate their portfolio against the following criteria to determine the optimal fba or fbm strategy.

Choose FBA When:

* The product is standard-size and lightweight: These items benefit most from Amazon’s standardized fees.

* Margins are healthy: Products with margins above 30% (after fees) can absorb FBA costs while capitalizing on the volume boost.

* The category is competitive: In crowded niches, the Buy Box advantage of FBA is non-negotiable.

* Volume justifies storage: High turnover rates keep the Inventory Performance Index (IPI) score above 400, avoiding storage penalties.

* Launching a new product: The initial conversion boost from Prime is critical for establishing early rank. A strong product launch keyword strategy combined with FBA can accelerate visibility.

Choose FBM When:

* The product is oversized or heavy: FBA fees for large items escalate quickly, often making merchant fulfillment cheaper.

* Margins are thin: For items with net margins below 20%, saving on fulfillment and storage fees is vital.

* Infrastructure exists: Sellers with their own warehouses and staff can utilize existing labor rather than paying Amazon.

* Turnover is slow: Long-tail items that sit in storage for months incur punitive long-term storage fees in FBA.

* Control is paramount: Brands requiring specific packaging experiences or temperature control often prefer FBM.

Choose Hybrid When:

* Managing diverse catalogs: Use FBA for best-sellers to maximize volume and FBM for slower-moving, long-tail SKUs.

* Mitigating stockouts: Keeping FBM active as a backup ensures the listing stays live if FBA inventory runs dry.

* Testing new markets: Sellers can use the Amazon sales estimator to gauge demand before committing stock to FBA.

Seller Fulfilled Prime (SFP) Note

SFP allows FBM sellers to display the Prime badge, theoretically offering the best of both worlds. However, the requirements are stringent: over 99% on-time delivery and cancellation rates under 0.5%. The program is frequently closed to new applicants and requires the seller to absorb the cost of 1-2 day shipping, which can be prohibitive.

Frequently Asked Questions About FBA vs FBM

These are the most common questions Amazon sellers ask when comparing FBA and FBM fulfillment models.

The Bottom Line on FBA vs FBM

The best fulfillment model balances fee math with ranking impact. FBA wins for most standard products; FBM wins for oversized or low-margin items.

While the mechanics of shipping are distinct, the strategic implication is clear: fulfillment is a marketing lever. The 2026 fee landscape requires sellers to be more precise in their fba vs fbm calculations, as the gap between advertised averages and specific tier increases can erode profitability.

Key Takeaways:

* The 2026 fee increase averages $0.08/unit, but standard items in the $10-$50 range actually increased $0.25/unit.

* FBA’s ranking advantage is a result of the Prime badge driving higher CTR and conversion, which feeds the organic ranking algorithm.

* 22% of successful sellers use both models simultaneously to ensure coverage and flexibility.

* Listing optimization is the one constant: whether FBA or FBM, keyword strategy determines which terms a product ranks for.

Sellers should immediately calculate their net margin under both FBA and FBM using the worked example above as a template. Once the financial baseline is established, audit the listing keywords to ensure optimization regardless of fulfillment choice. For deeper analysis, explore the best Amazon seller tools to automate fee calculations and refine Amazon PPC keyword strategy to complement the fulfillment model.