At 50 client products, Helium 10 Diamond runs $4,476/year but still caps you at 1,000 tracked ASINs. Managing just five clients each with 100 SKUs already exceeds that limit. This reality drives many agencies to explore Helium 10 alternatives for agencies that offer better economics. This is the harsh economic reality for Amazon agencies relying on tools built for solo sellers. The per-ASIN and per-seat pricing models that make sense for a single brand can quickly crush agency margins, turning a profitable client engagement into a loss leader. This comparison of Helium 10 alternatives for agencies focuses exclusively on the features that matter at scale: multi-account management, team access, and batch operations. Unlike generic listicles that lump all users together, this analysis covers pricing for agency-level portfolios and the critical need for white-label capabilities.

TLDR: Top Helium 10 Alternatives for Agencies

- Pricing at Scale: Per-ASIN pricing models from tools like Helium 10 become economically unviable for agencies managing multiple clients. Flat-rate tools offer predictable costs.

- Keywords.am: Best for data accuracy and batch operations, offering unlimited ASIN audits and white-label reports on all plans.

- DataDive: Strong for deep competitor intelligence and offers massive team capacity on its Enterprise plan.

- SellerApp: A good all-in-one solution for smaller agencies that want a single platform for listings and PPC.

- Agency-Specific Needs: The most critical features for agencies are multi-brand dashboards, scalable team seats with permissions, and batch processing capabilities.

- White-Label Reporting: Delivering professional, agency-branded reports is key to client retention and demonstrating value, a feature standard in Keywords.am but rare elsewhere.

- Specialized Tools: For agencies with a specific focus, tools like Perpetua (PPC) and SmartScout (market intelligence) are powerful additions to a core listing optimization tool.

Why Are Agencies Leaving Helium 10?

Agencies leave Helium 10 because per-ASIN pricing destroys margins at scale, account switching wastes time, and there’s no unified view across client portfolios. The tool’s architecture, while powerful for individual sellers, creates significant friction when applied to a multi-client agency model.

The primary driver is the per-ASIN economics. The Helium 10 Diamond plan, priced at $279 per month when billed annually, includes tracking for 1,000 ASINs. For an agency with 10 clients that each have 100 SKUs, this limit is hit immediately. Any growth—either in the number of clients or the size of their catalogs—pushes the agency into a costly and opaque Enterprise plan. This model forces agencies to either absorb rising software costs or pass them on to clients, making bids less competitive. For a deeper analysis of how these tools stack up, see our complete Keywords.am vs Helium 10 comparison.

Beyond cost, workflow inefficiencies are a major pain point. While the Diamond plan allows for connecting up to 10 Seller Central accounts, it lacks a unified dashboard. Team members must constantly switch between client contexts, a clunky and time-consuming process that increases the risk of errors. Furthermore, the plan’s limit of five user seats means a growing 10-person agency must either resort to sharing logins—a significant security risk—or negotiate an expensive custom plan. Finally, Helium 10’s reporting is generic. The standard exports are not client-ready and lack the professional, white-labeled presentation that reinforces an agency’s brand and value.

What Do Amazon Agencies Actually Need in a Tool?

Amazon agencies need multi-brand dashboards, team seats with permissions, batch operations across clients, flat-rate or unlimited pricing, and white-label reporting capabilities. These features directly address the scaling challenges and workflow inefficiencies encountered with seller-focused tools.

A multi-brand dashboard provides a single pane of glass to monitor all client accounts, offering portfolio-level insights without constant context switching. This is complemented by granular team access controls, allowing for role-based permissions where account managers, analysts, and even clients have different levels of access. Batch operations are another non-negotiable; running keyword research or listing audits one ASIN at a time is simply not feasible at agency scale. The ability to process entire client catalogs at once is a massive efficiency gain. Pricing must be predictable, with flat-rate or unlimited usage models being far superior to per-ASIN or per-keyword plans that penalize growth. Lastly, white-label capabilities are essential for delivering professional, client-ready reports that carry the agency’s branding, building trust and commoditizing the agency’s work.

Need |

Why It Matters for Agencies |

|---|---|

Multi-brand dashboards |

One view across all clients |

Team seats + permissions |

Account managers, analysts, clients |

Batch operations |

Audit 50+ SKUs simultaneously |

Flat-rate pricing |

Predictable costs, not per-ASIN surprises |

White-label reports |

Client-ready deliverables with your branding |

The 7 Best Helium 10 Alternatives for Amazon Agencies

The best Helium 10 alternatives for agencies include Keywords.am for data accuracy and batch operations, DataDive for competitor intelligence, SellerApp for all-in-one functionality, and specialized tools for specific agency needs. Each of these platforms offers a distinct advantage for agencies looking to move beyond the limitations of seller-centric software.

Tool 1: Keywords.am – Best for Data Accuracy + Batch Operations

Keywords.am is designed specifically for high-volume listing optimization, making it an ideal fit for agencies. Its core strength lies in using real data from Amazon Brand Analytics, providing a level of accuracy that estimated metrics cannot match.

Pricing: The platform offers three tiers: Starter ($30/mo), Growth ($60/mo), and Scale ($120/mo). Critically, none of these plans have per-ASIN limits, and all include multi-user support, eliminating the two biggest cost-scaling issues for agencies.

Key Agency Features: The standout feature is the Bulk ASIN Audit, which allows an agency to analyze an entire client catalog in a single operation. Reports can be white-labeled with the agency’s logo and a custom call-to-action. The platform also offers multi-brand workspaces to keep client data cleanly separated. The entire optimization process is guided by the TFSD Framework, ensuring a consistent and effective methodology is applied across every client account. Furthermore, the platform’s affiliate program offers a 30% lifetime commission, creating a potential new revenue stream for the agency.

Limitations: As a newer platform, Keywords.am has a smaller community than incumbents like Helium 10. It is also highly focused on listing optimization and does not include built-in PPC management tools.

Best if your agency: Focuses on data-driven Amazon SEO and listing optimization. It’s a perfect choice for agencies tired of justifying discrepancies between estimated search volumes and the real data inside Seller Central.

Tool 2: DataDive – Best for Competitor Intelligence

DataDive excels at deep competitor analysis, providing agencies with the intelligence needed to build winning client strategies and pitch decks. It is built around a research-heavy workflow.

Pricing: Plans range from Starter ($39/mo) to Standard ($149/mo) and Enterprise ($490/mo). The Enterprise plan is notable for supporting up to 10 Seller Central accounts and a staggering 100,000 team members.

Key Agency Features: Its core strengths are competitor keyword analysis and rank tracking. The platform uses “Spaces & Labels” to help organize client work. For technical teams, API access is available on the Standard plan and above, while the Enterprise plan includes audit logs for security and compliance.

Limitations: The platform imposes limits on “Dive ASINs” (4,000 on the Enterprise plan), which can be a constraint for agencies with large client catalogs. It also lacks built-in white-label reporting, requiring manual work to create client-ready deliverables.

Best if your agency: Specializes in competitive analysis and market research. It provides the deep insights needed to inform client strategy and differentiate your agency’s services.

Tool 3: SellerApp – Best All-in-One for Smaller Agencies

SellerApp offers a comprehensive suite of tools that covers everything from PPC management and product research to listing optimization, making it a viable all-in-one platform.

Pricing: The standard plans are Pro ($99/mo) and Smart ($149/mo), but SellerApp also offers a dedicated ecommerce agency platform with custom pricing.

Key Agency Features: The primary appeal is its feature breadth, covering 18 Amazon marketplaces. For agencies looking to offload work, SellerApp also offers managed services. The dedicated agency platform suggests a commitment to this user segment, though details are sparse.

Limitations: The pricing for their agency platform is not transparent, requiring a sales call. The sheer number of features can also be overwhelming, and the per-account structure of their standard plans may still require multiple subscriptions for different clients.

Best if your agency: Is a smaller, generalist firm that wants a single tool to manage a wide range of Amazon services for a handful of clients.

Tool 4: Jungle Scout – Best for Product Research Focus

Jungle Scout is a market leader and is particularly strong in the area of product research and opportunity identification. It is an excellent choice for agencies that help clients launch new products.

Pricing: The most relevant plan for agencies is Brand Owner at $149/mo, which includes 10 user seats. For larger needs, Jungle Scout Cobalt offers an enterprise-level solution with custom pricing.

Key Agency Features: Its product research tools, including the Opportunity Score and Supplier Database, are best-in-class. The platform also provides strong educational resources through its Academy.

Limitations: The tool’s primary focus is product research, with listing optimization being a secondary feature. It lacks native white-label reporting, and true agency-level scale and features are gated behind the custom-priced Cobalt tier.

Best if your agency: Focuses on helping clients with product sourcing, validation, and launches. It is less suited for agencies whose primary service is ongoing listing optimization.

Tool 5: Perpetua – Best for PPC-Focused Agencies

Perpetua is a specialized, high-end platform designed exclusively for advertising optimization. It is not a listing tool but is a powerful choice for agencies managing significant client ad spend.

Pricing: The entry point is high, starting at $695/mo for up to $10,000 in monthly ad spend. From there, pricing is a percentage of ad spend, a model that can become very expensive.

Key Agency Features: Perpetua uses AI to optimize bids across all Amazon ad types (Sponsored Products, Sponsored Brands, Sponsored Display). It supports multiple marketplaces, including Walmart and Instacart, and integrates with the Amazon Marketing Cloud for advanced analytics.

Limitations: The high starting price and percentage-of-spend model make it inaccessible for agencies with smaller clients. It is exclusively an advertising tool and contains no features for listing optimization or keyword research for SEO.

Best if your agency: Manages large advertising budgets (over $50,000 per month across the client portfolio) and needs a dedicated, AI-powered optimization engine.

Tool 6: SmartScout – Best for Market Intelligence

SmartScout is a powerful tool for market-level analysis, helping agencies identify trends, uncover opportunities, and understand the competitive landscape at a macro level.

Pricing: The Business plan at $187/mo includes 3 users. Larger teams will need to negotiate an Enterprise plan.

Key Agency Features: The platform’s strengths are in brand and category research. Its Traffic Graph feature provides unique insights into how Amazon’s internal traffic flows. The Business tier allows for custom reporting via Excel exports, and the AdSpy add-on is useful for competitor ad research.

Limitations: SmartScout is purely a research tool and does not offer a listing builder or optimizer. The user limits on standard plans are low, and key features like AdSpy are paid add-ons that increase the total cost.

Best if your agency: Sells strategic consulting services based on market analysis and opportunity identification. It is a tool for strategists, not for listing copywriters.

Tool 7: ZonGuru – Best Budget Option

ZonGuru offers a solid set of features at an affordable price point, making it a good entry-level tool for new or budget-conscious agencies.

Pricing: Pricing is based on the number of SKUs tracked, ranging from $49/mo for 20 SKUs to $159/mo for 1,000 SKUs. A custom Enterprise plan is available for agencies.

Key Agency Features: The tool includes a “Keywords on Fire” tool for keyword research, a listing optimizer with AI, and tools for automating email and review requests. It also supports connected regions for international clients.

Limitations: The SKU-based pricing model, while affordable at the low end, becomes expensive and runs into the same scaling issues as other per-unit pricing tools. Key agency features are likely gated behind the custom Enterprise plan.

Best if your agency: Is just starting out, is highly budget-conscious, and manages clients with small product catalogs.

How Does Pricing Compare at Agency Scale?

At agency scale, flat-rate tools like Keywords.am ($120/mo unlimited) cost 10-40x less than per-ASIN tools like Helium 10 which can run $500+/month for 50+ client products. The difference becomes more pronounced as an agency grows.

The table below illustrates how quickly costs can escalate with per-unit pricing models compared to a flat-rate structure. Models that seem affordable for a solo seller become unsustainable when managing dozens of client products. For example, Helium 10’s Diamond plan ($279/mo) covers 1,000 ASINs. An agency with 10 clients averaging 100 SKUs each is already at this limit, forcing them into a much more expensive Enterprise plan to add even one more small client. In contrast, a flat-rate tool like Keywords.am maintains a predictable cost, allowing the agency to scale its client base without scaling its software overhead.

Tool |

10 Client Products |

25 Client Products |

50 Client Products |

|---|---|---|---|

Keywords.am |

$120/mo (Scale) |

$120/mo |

$120/mo |

DataDive |

$149/mo (Standard) |

$149/mo |

$490/mo (Enterprise) |

SellerApp |

$99-149/mo |

Custom |

Custom |

Jungle Scout |

$149/mo |

$149/mo |

Cobalt (custom) |

Perpetua |

$695/mo minimum |

$695+ |

$695+ (+ % spend) |

SmartScout |

$97/mo |

$187/mo |

Enterprise |

ZonGuru |

$49-99/mo |

$99-159/mo |

Enterprise |

Helium 10 |

$279/mo |

$279/mo (near limit) |

Enterprise needed |

How Many Team Seats Does Each Tool Offer?

Team seat offerings range from 1 user on basic plans to unlimited on enterprise tiers, with DataDive Enterprise offering up to 100,000 users and most tools providing 5-10 users on mid-tier plans. Access for your team is a critical factor that is often overlooked when evaluating Helium 10 alternatives for agencies.

Most tools gate multi-user access behind their more expensive tiers. Helium 10, for instance, only provides 5 seats on its $279/mo Diamond plan. Jungle Scout includes 10 seats on its Brand Owner plan. Keywords.am stands out by including multi-user support on all plans, even its $30/mo Starter tier, which is a significant advantage for small but collaborative agency teams. For very large organizations, DataDive’s Enterprise plan offers a massive capacity, though this is likely overkill for most Amazon agencies.

Tool |

Basic Plan |

Mid-Tier |

Enterprise |

|---|---|---|---|

Keywords.am |

Multi-user all plans |

Multi-user |

Custom |

DataDive |

1 user |

10 users |

100,000 users |

SellerApp |

1 user |

Contact |

Custom |

Jungle Scout |

1 user |

1 user |

10 users (Brand Owner) |

Perpetua |

Team |

Team |

Full team |

SmartScout |

2 users |

3 users |

Custom |

ZonGuru |

1 user |

1 user |

Enterprise |

Helium 10 |

1 user |

5 users (Diamond) |

Custom |

Which Tools Offer White-Label Reports?

Keywords.am and SellerApp offer built-in white-label reporting with agency branding, while most tools like Helium 10 and Jungle Scout require manual export formatting or Enterprise negotiations. This is a crucial feature for demonstrating professionalism and reinforcing brand value.

Keywords.am allows agencies to add their own logo and a custom call-to-action to their ASIN audit reports. This transforms a standard data export into a professional client deliverable. Coupled with their affiliate program, these reports can even become a passive revenue source. SellerApp’s dedicated agency platform also includes white-label reporting, but access and pricing require a custom negotiation. For a deeper look at the importance of this feature, explore our guide to Amazon listing software for agencies. Most other tools, including market leaders Helium 10 and Jungle Scout, do not offer this capability on their standard plans. Agencies using these tools are forced to spend time manually reformatting data into their own templates, a time-consuming process that introduces the risk of errors.

Which Tool Should You Choose Based on Agency Size?

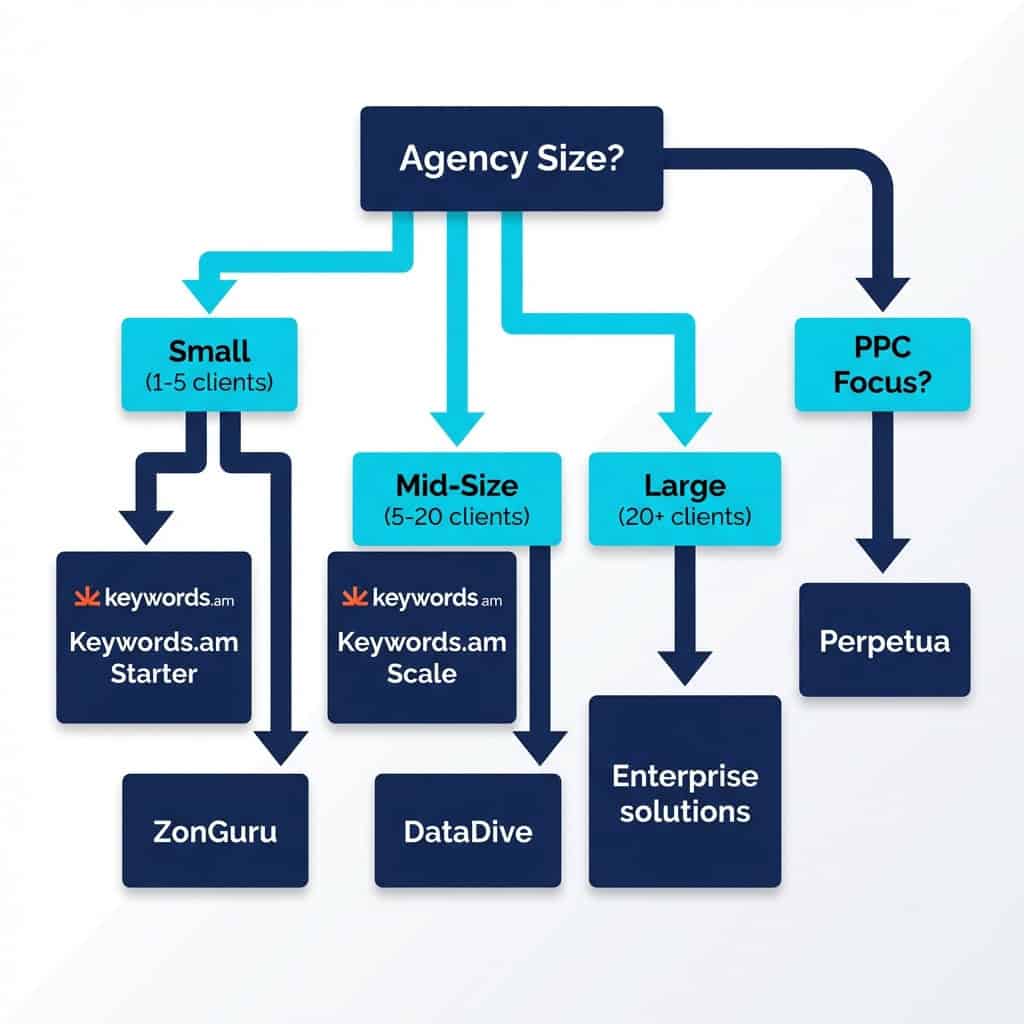

Small agencies (under 5 clients) can start with ZonGuru or Keywords.am Starter, mid-size agencies (5-20 clients) benefit from Keywords.am Scale or DataDive Standard, while large agencies (20+ clients) need Enterprise solutions. The right tool depends heavily on your agency’s scale and specific service offering.

- Small Agency (1-5 clients, <50 total SKUs): The priorities are low cost and core functionality. Keywords.am Starter ($30/mo) or ZonGuru Researcher ($29/mo) provide the essential listing optimization tools without a large financial commitment.

- Mid-Size Agency (5-20 clients, 100-500 SKUs): At this stage, batch operations and predictable pricing are paramount. Keywords.am Scale ($120/mo) is ideal due to its flat-rate pricing and unlimited ASIN audits. DataDive Standard ($149/mo) is a strong alternative for agencies focused on competitive intelligence.

- Large Agency (20+ clients, 500+ SKUs): These agencies require enterprise-level support and features. While Keywords.am Scale still works effectively due to its unlimited model, this is the point where negotiating a custom Enterprise plan with a provider like DataDive or SellerApp makes sense.

- PPC-Focused Agency (any size, $50K+ ad spend): Advertising-heavy agencies need a specialized tool. The best stack is Perpetua for ad optimization combined with a dedicated listing tool like Keywords.am to ensure retail readiness.

For a broader overview of the tool landscape, see our guide to the 25 Best Amazon Seller Tools 2026.

Frequently Asked Questions About Helium 10 Alternatives for Agencies

Q1: Can I use my own branding on client reports?

Keywords.am offers white-label reports with custom logos and CTAs. SellerApp has agency-branded options. Most other tools require Enterprise tier or manual formatting. For agencies, professional deliverables are often as important as the data itself. White-label capabilities turn generic exports into agency-branded assets.

Q2: Is there a Helium 10 alternative with unlimited ASINs?

Keywords.am has no per-ASIN limits on any plan. DataDive Enterprise offers 4,000 ASINs. Most alternatives use some form of usage caps. Per-ASIN pricing is the primary reason agencies seek alternatives. Keywords.am’s flat-rate model is specifically designed for high-volume use cases.

Q3: Which tool is best for international Amazon clients?

Keywords.am supports 21 marketplaces with localization. SellerApp covers 18 marketplaces. Perpetua works across Amazon, Walmart, and Instacart globally. International expansion is increasingly common for Amazon brands.

Q4: Do any Helium 10 alternatives offer affiliate programs?

Keywords.am offers 30% lifetime recurring commissions with 60-day attribution. Some other tools have partner programs but with lower payouts or one-time payments. For agencies, affiliate programs create additional revenue streams from tool recommendations. White-label reports with embedded affiliate links can generate passive income.

Q5: What’s the best Helium 10 alternative for a solo agency owner?

For solo operators, Keywords.am Starter ($30/mo) or ZonGuru Researcher ($29/mo) offer the best value with essential features for listing optimization at low cost. Solo agency owners need tools that maximize output per dollar. Avoid Enterprise-tier tools until client volume justifies the investment.

Q6: Can I connect multiple Seller Central accounts?

DataDive Enterprise supports up to 10 Seller Central accounts. Helium 10 Diamond allows 10 connected accounts. Keywords.am works across multiple brands without account connection limits. Multi-account support is essential for agencies but often gated behind higher tiers. Verify limits before committing.

Conclusion

The landscape of Amazon software is evolving, and tools built for the solo seller era are no longer the default best choice for growing agencies. The economics of per-ASIN pricing simply break at agency scale. For agencies managing multiple clients, the most important features are flat-rate pricing, multi-brand dashboards, scalable team access, and white-label reporting. These are the capabilities that enable profitable growth and operational efficiency.

While several strong Helium 10 alternatives for agencies exist, each must be matched to the agency’s specific needs and workflow requirements. Keywords.am is the strongest contender for listing optimization-focused agencies due to its unlimited ASINs and built-in agency features. DataDive excels for competitive intelligence, while Perpetua is the go-to for serious PPC management. Ultimately, the right choice depends on your client roster, service offering, and team size. The key takeaway is to evaluate tools based on their pricing and features at a scale of 50 clients, not just their entry-level plan.

To see the difference for yourself, run a free ASIN audit with Keywords.am and experience the quality of a white-labeled, data-driven report you can confidently send to your clients.