📑 Table of Contents

- How do Amazon PPC tools actually work (and why do they all claim to be AI-powered)?

- What are the best Amazon PPC tools ranked by pricing and features?

- Which Amazon PPC tool is best for sellers spending under $2,000 per month on ads?

- What about sellers spending $2,000 to $10,000 per month on Amazon ads?

- Which PPC tools handle $10,000+ monthly ad spend and multi-marketplace campaigns?

- How does flat-fee vs. percentage-of-ad-spend pricing really compare?

- Why does PPC tool performance start with keyword research?

- Frequently Asked Questions About Amazon PPC Tools

- Conclusion

TL;DR

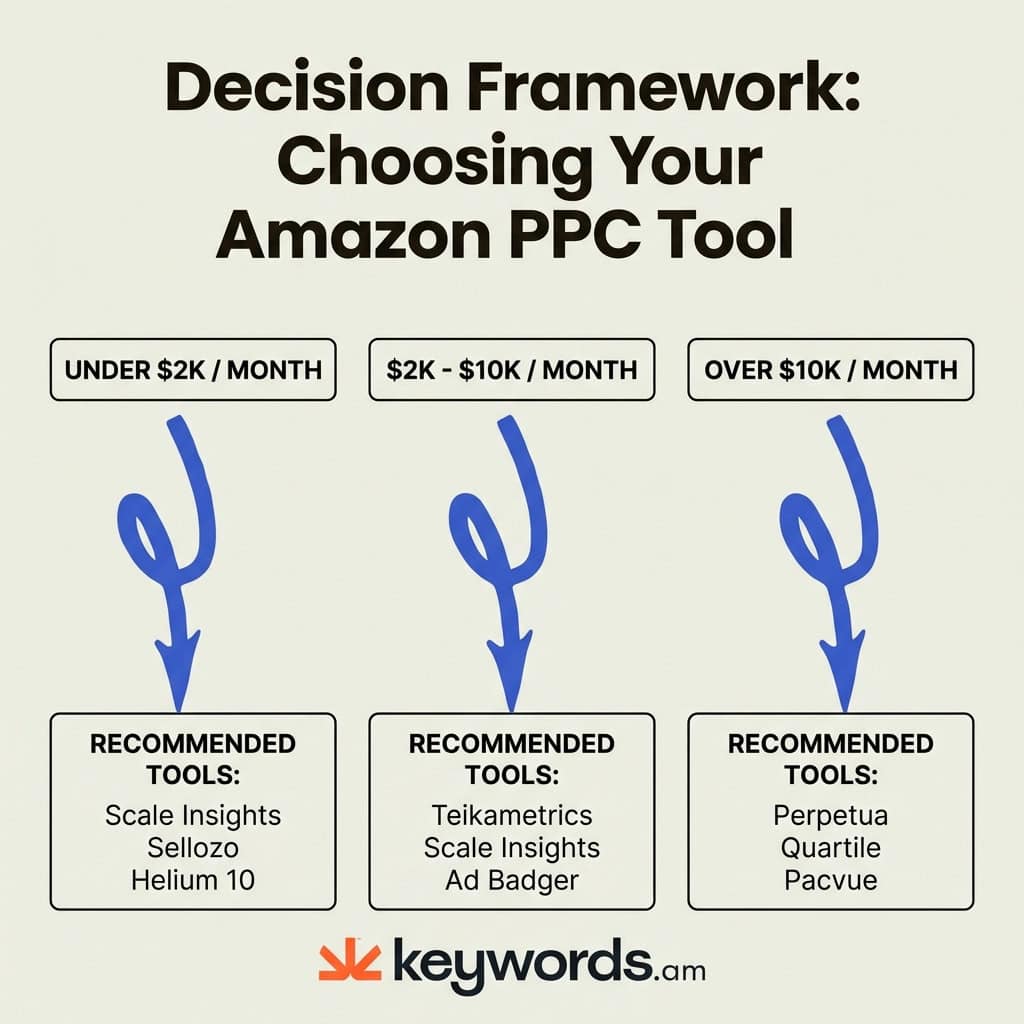

- Under $2,000/mo spend: Use Scale Insights ($78/mo) or Sellozo ($149/mo) to keep costs low while automating bid adjustments.

- $2,000-$10,000/mo spend: Teikametrics Flywheel ($179/mo) and Ad Badger (~$400/mo) offer the best balance of features and flat-fee pricing before percentage costs scale up.

- $10,000+/mo spend: Enterprise tools like Perpetua, Quartile, and Pacvue provide necessary multi-marketplace support and advanced algorithmic control.

- Pricing Trap: Percentage-of-spend models (2-3%) can cost 10x more than flat-fee alternatives as you scale, often for similar functionality.

- The Foundation: No PPC tool can fix a bad keyword strategy. Success starts with high-relevance keyword research, not just bid automation.

Most PPC tool roundups are written by PPC tool vendors. SellerMetrics ranks itself #1 in its own review. Eva.guru calls itself “Your Best Choice.” Keywords.am is a keyword research company. It does not sell PPC software, so it can actually be honest about what works. This distinction matters because the market is flooded with conflicting advice designed to sell subscriptions rather than solve problems.

Amazon CPCs hit $1.12 in 2025, representing a 15.5% year-over-year increase, and are projected to reach $1.25 in 2026. With over 70% of sellers now using Amazon Ads, manual bidding has become increasingly unviable for anyone serious about maintaining margins. The days of setting a few manual bids and checking them once a week are over; the competition is simply too fast and too automated. However, rushing into a software subscription without a clear strategy is equally dangerous.

This guide to the best Amazon PPC tools provides an independent comparison of 10 leading options, ranked by pricing transparency, automation depth, and marketplace support. It includes a decision framework based on ad spend level and an honest breakdown of the hidden costs associated with percentage-of-spend pricing models. Having analyzed thousands of sellers’ keyword strategies, the data shows exactly which tools complement a solid foundation and which ones merely drain the budget.

How do Amazon PPC tools actually work (and why do they all claim to be AI-powered)?

Amazon PPC tools automate bid adjustments, keyword harvesting, and campaign structuring. Most “AI” claims mean rule-based algorithms, not true machine learning.

At their core, these tools perform functions that a human could theoretically do, but at a scale and speed that is impossible to match manually. They manage bids by analyzing conversion data and adjusting the cost-per-click bid up or down to hit a target ACoS (Advertising Cost of Sales). They harvest keywords by identifying search terms that generated sales in auto campaigns and moving them to manual campaigns. They also handle negative keyword management, isolating search terms that spend money without generating sales and blocking them to prevent further waste. More advanced features include dayparting (turning ads off during low-conversion hours) and budget pacing to ensure funds last throughout the day.

The “AI” label is often applied loosely in this industry. True machine learning, used by enterprise platforms like Quartile, involves algorithms that learn from vast datasets to predict future performance without explicit human instruction. However, many tools marketed as AI are actually rule-based automation engines. Tools like Scale Insights, for example, allow users to configure over 200 specific parameters. If A happens, do B. This is not machine learning; it is sophisticated logic. For many sellers, rule-based automation is actually superior because it offers transparency. You know exactly why a bid was raised or lowered. “Black box” AI can sometimes make decisions that seem illogical to the seller, with no way to override or understand the reasoning.

PPC tools cannot fix bad keyword selection. They cannot rewrite weak listing copy. They cannot improve a product rating suffering from quality control issues. A PPC tool acts as an accelerator. If the foundation (the product and the keywords) is strong, the tool accelerates growth. If the foundation is weak, the tool simply accelerates the rate at which budget is wasted. This is why keyword research tools are often the first step in a successful ad strategy, long before a bid management tool is connected.

What are the best Amazon PPC tools ranked by pricing and features?

The best Amazon PPC tools range from $78/month (Scale Insights) to custom enterprise pricing (Pacvue, Cobalt). Flat-fee tools save money at scale; percentage-based tools cost more as ad spend grows.

For sellers who need a quick answer, the table below ranks the best Amazon PPC tools by starting price. This comparison highlights the fundamental divide in the industry: flat-fee pricing versus percentage-of-ad-spend pricing.

Tool |

Starting Price |

Pricing Model |

Best For |

Marketplaces |

|---|---|---|---|---|

Scale Insights |

$78/mo |

Per-ASIN tiers |

Mid-market, aggregators |

Amazon |

Helium 10 Adtomic |

$79/mo (Platinum bundle) |

Subscription + 2% over $5K |

SMBs already using H10 |

Amazon, Walmart |

Sellozo |

$149/mo |

Flat fee |

Solo sellers, budget-conscious |

Amazon |

Teikametrics Flywheel |

$179/mo |

Flat + 3% over $10K |

Growing brands |

Amazon, Walmart |

Ad Badger |

~$400/mo |

Ad-spend-based |

Education-focused sellers |

Amazon |

BidX |

EUR 495/mo |

Base + % of spend |

EU-focused sellers |

Amazon, Walmart |

Perpetua |

$695/mo |

Flat + % of spend |

Mid-to-enterprise |

Amazon, Walmart, Instacart |

Quartile |

$895/mo |

Flat fee by spend tier |

Multi-channel brands |

Amazon, Walmart, Google, Meta |

Teikametrics Enterprise |

Custom |

Custom |

Large brands |

Amazon, Walmart |

Jungle Scout Cobalt |

~$2,500/mo |

Custom (per ASIN/seat) |

Enterprise intelligence |

Amazon |

Pacvue |

Custom (~$500-$20K) |

Custom + % of spend |

Enterprise, agencies |

100+ retail networks |

Note: Prices are subject to change by the software providers. Always verify current pricing on their official sites.

The distinction between pricing models is the single biggest factor in long-term profitability. Flat-fee tools like Scale Insights and Sellozo offer predictable overhead. Whether a seller spends $5,000 or $50,000 on ads, the software cost remains relatively stable. This incentivizes the seller to scale aggressive campaigns without worrying about the software bill eating into the added revenue.

Percentage-based tools, such as Perpetua or the advanced tiers of Teikametrics, operate differently. Their costs scale directly with success. A seller spending $50,000 a month on ads using a tool with a 3% fee pays $1,500 a month just for the software, often on top of a base fee. Hybrid models, like Helium 10 Adtomic, charge a base subscription and then add a percentage fee once ad spend crosses a certain threshold (in Helium 10’s case, 2% for spend over $5,000). For a seller spending $50,000, that’s a significant monthly expense: $1,199 base (Diamond plan) plus potentially more depending on exact configuration and overages.

Which Amazon PPC tool is best for sellers spending under $2,000 per month on ads?

Sellers spending under $2,000 per month should consider Scale Insights ($78/month), Sellozo ($149/month), or Helium 10 Adtomic (if already on the Platinum plan at $79/month).

When evaluating the best Amazon PPC tools at this budget level, efficiency is paramount. Every dollar spent on software is a dollar not spent on acquiring customers. The margin for error is slim, and expensive enterprise tools are unnecessary overkill.

Scale Insights stands out as a highly technical, budget-friendly option. Starting at $78 per month for up to 5 ASINs, it provides access to 11 proprietary algorithms with over 200 tunable parameters. It does not try to hide the logic behind a “magic AI button.” Instead, it gives sellers granular control over every bid adjustment rule. For a seller who wants to learn the mechanics of PPC and retain full control, this is an excellent starting point. The flat-fee structure ensures that as the brand grows from $1,000 to $2,000 in spend, the software cost does not increase.

Sellozo offers a slightly different value proposition at $149 per month. It is a flat-fee PPC automation tool that includes a built-in repricer. This combination is powerful because price and ad position are intrinsically linked; a lower price often improves conversion rate, which improves ad performance. Sellozo is designed for automation-first sellers. The “Campaign Studio” allows users to visually map out how keywords should flow from auto campaigns to manual campaigns. It also offers a “Full Management” tier for $399/month, which includes weekly 1-on-1 consultations, essentially bridging the gap between software and an agency.

Helium 10 Adtomic is a logical choice for sellers already deeply embedded in the Helium 10 ecosystem. If a seller is already paying for the Platinum plan ($79/month) for product research and keyword tracking, Adtomic is included. Previously, high-end AI features were gated behind the Diamond plan, but recent updates have made automation accessible at the Platinum level. However, users must be wary of the 2% fee that kicks in once ad spend exceeds $5,000/month. For a seller strictly under $2,000, this fee is irrelevant, making Adtomic a very cost-effective “free” add-on to their existing tool stack.

The danger at this level is relying on automation to fix a broken strategy. With a limited budget, bidding on the wrong keywords is fatal. A machine learning algorithm needs data to learn, and a $2,000 budget provides very little data points compared to a $50,000 budget. This makes the initial TFSD Framework setup (Title, Features, Search Terms, Description) critical. The keywords chosen manually at the start will dictate the success of the automation later.

What about sellers spending $2,000 to $10,000 per month on Amazon ads?

At $2K-$10K monthly ad spend, Teikametrics Flywheel ($179/month), Scale Insights ($98-$288/month), and Ad Badger (~$400/month) offer the best value before percentage fees become meaningful.

As ad spend grows, the complexity of campaigns increases. Sellers usually expand from a few manual campaigns to a comprehensive structure involving exact match, broad match, auto, and product targeting campaigns. The administrative burden of managing this manually becomes unsustainable.

Teikametrics Flywheel shines in this mid-market tier. The “Essentials” plan at $179/month covers sellers up to $10,000 in monthly ad spend. Its “Flywheel 2.0” philosophy integrates advertising data with inventory and catalog data. This is crucial because advertising an out-of-stock product is the fastest way to burn cash. Teikametrics automatically adjusts bids based on inventory levels, preventing stockouts and maximizing profitability during high-stock periods. It supports both Amazon and Walmart, making it a strong choice for brands expanding to a second marketplace. Crucially, the 3% ad spend fee only kicks in on the Advanced plan for spend over $10K, making the Essentials plan a very strong value.

Scale Insights continues to be a top contender here. The pricing scales to $98 or $288 per month depending on the number of ASINs (10 to 35). For a brand with a focused catalog, the cost-to-performance ratio is hard to beat. The “1% Plan” allows for unlimited ASINs and charges 1% of ad spend, which starts to make sense for aggregators or brands with massive catalogs but moderate spend per SKU. However, for most single-brand sellers in this bracket, the fixed-tier plans remain the most economical choice.

Ad Badger takes a unique approach with a heavy focus on education. The tool itself, costing around $400/month, uses proprietary daily micro-bid adjustments to target specific ACoS goals. But the real value often comes from the ecosystem. Their “PPC Den Podcast” is widely regarded as one of the best educational resources in the industry. For sellers who want to understand the why behind the what, Ad Badger is a strong partner. Their “Performance Grader” is a free tool that audits campaigns for wasted spend, often a good first step for sellers unsure if they are ready to upgrade.

It is at this spend level that the “tax” of percentage-based pricing starts to loom. A tool charging 3% of ad spend costs $300/month when spend hits $10,000. While $300 is manageable, it sets a precedent. As the brand scales to $20,000 or $50,000, that bill will climb effortlessly, regardless of whether the software’s utility has actually doubled or tripled. This is a real business decision that must be weighed carefully.

Which PPC tools handle $10,000+ monthly ad spend and multi-marketplace campaigns?

Sellers spending $10K+ per month need enterprise-grade tools like Perpetua ($695/month), Quartile ($895-$9,995/month), or Pacvue (custom pricing) for multi-marketplace campaigns and advanced analytics.

At the enterprise level, the best Amazon PPC tools shift from “saving money on bids” to “dominating market share across channels.” Manual intervention is minimal; strategic oversight is everything.

Perpetua is a powerhouse for brands scaling beyond Amazon. With a base fee of roughly $695/month plus a percentage of spend, it is not cheap, but it offers capabilities that smaller tools lack. Most notably, it offers intraday bid optimization. Instead of adjusting bids once every 24 hours, Perpetua can adjust them multiple times a day to capitalize on peak conversion hours. It also supports Amazon DSP (Demand Side Platform), Walmart, Instacart, and Target. For brands selling consumer packaged goods (CPG) where grocery delivery platforms are key, Perpetua’s integration is invaluable.

Quartile represents one of the most sophisticated AI applications in the space. Managing over $1 billion in retail media spend, its algorithms are trained on a massive dataset. It is fully autonomous, connecting Amazon, Walmart, Google, and Meta ads into a single optimization engine. The pricing is a flat fee based on spend tiers, ranging from $895 to nearly $10,000 per month. While high, this flat fee structure (within tiers) is often preferred by CFOs over uncapped percentage models. Quartile is designed for brands that want to hand over the keys to the algorithm and focus entirely on product development and supply chain.

Pacvue is the definitive choice for massive conglomerates and agencies. If a brand needs to advertise on 100+ retail media networks (not just Amazon and Walmart, but Kroger, Best Buy, and international marketplaces), Pacvue is the solution. It offers deep competitive intelligence and share-of-voice reporting that goes far beyond standard ACoS metrics. Pricing is custom and generally starts in the thousands, scaling up to $20,000+ per month for large agencies. It is a complex, heavy-duty platform meant for teams of professional media buyers.

Jungle Scout Cobalt serves a specific niche at this level. Priced around $2,500/month, it is less of a pure bid manager and more of a market intelligence platform that includes ad optimization. It is ideal for brands that need to track market share trends and competitor movement with extreme precision. However, it is primarily Amazon-focused, which can be a limitation for brands diversifying into Walmart or DTC.

BidX, a major player from Europe, offers a strong alternative for sellers with a heavy EU presence. Pricing starts around EUR 495/month plus a percentage of spend. It offers self-service to fully managed tiers and includes AMC (Amazon Marketing Cloud) and DSP add-ons. For sellers managing VAT compliance and pan-European campaigns, BidX’s localization and support can be a decisive factor.

Even the best Amazon PPC tools need surrounding infrastructure. Sellers at this level should look at broader Amazon seller tools that integrate holistically. An ad tool that doesn’t talk to inventory or profit analytics is a liability when moving this much volume.

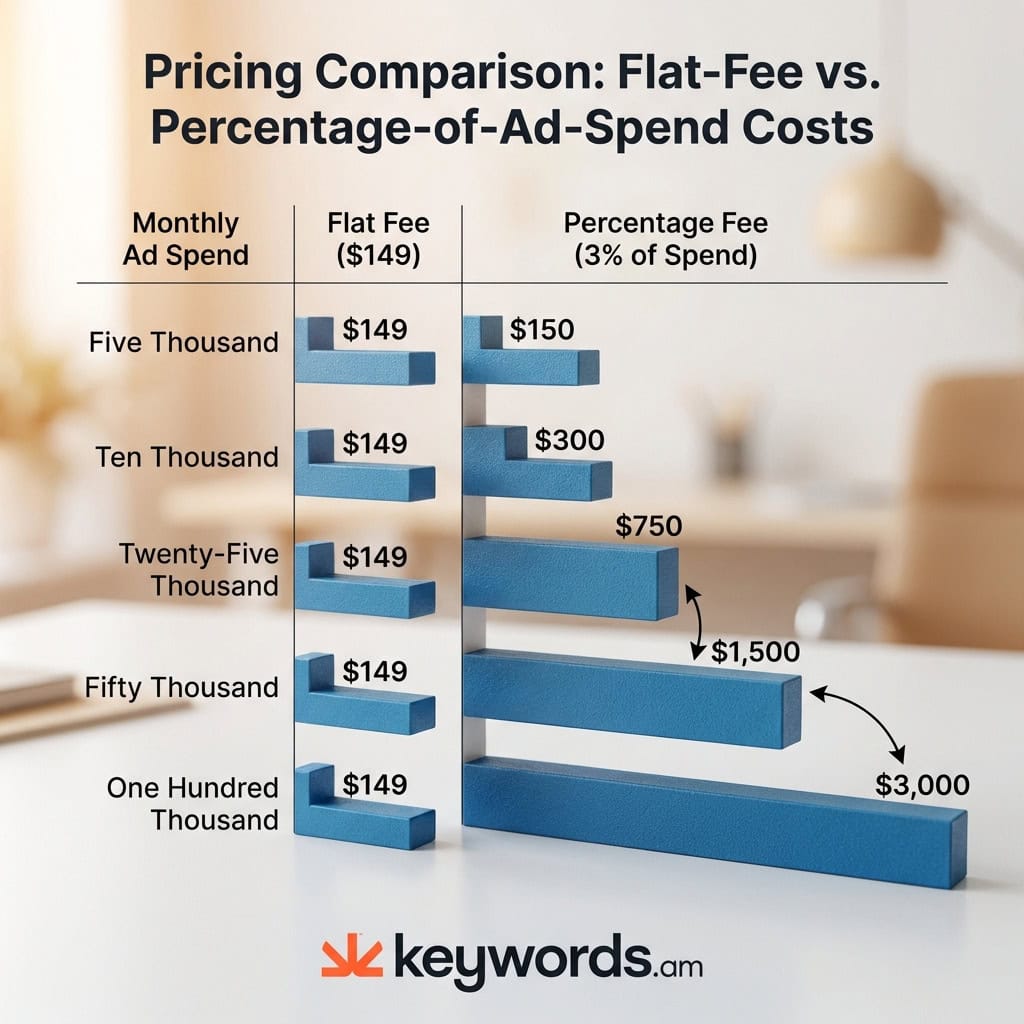

How does flat-fee vs. percentage-of-ad-spend pricing really compare?

Percentage-of-ad-spend pricing (2-3%) costs $200-$600/month at $10K ad spend but $2,000-$6,000/month at $100K, a 10x cost increase for essentially the same software features.

This is the “hidden tax” that even the best Amazon PPC tools impose. Many sellers sign up for a tool when they are small, attracted by a low base fee and a seemingly negligible 2% or 3% commission. As they succeed and grow, the software bill balloons disproportionately to the value provided. The server cost to manage bids for a $100,000 account is not ten times higher than for a $10,000 account, yet the price charged is often exactly that.

The table below illustrates the divergence in cost as a brand scales.

Monthly Ad Spend |

2% Fee |

3% Fee |

Flat $149/mo (Sellozo) |

Flat $695/mo (Perpetua) |

|---|---|---|---|---|

$5,000 |

$100 |

$150 |

$149 |

$695 |

$10,000 |

$200 |

$300 |

$149 |

$695 |

$25,000 |

$500 |

$750 |

$149 |

$695 |

$50,000 |

$1,000 |

$1,500 |

$149 |

$695 |

$100,000 |

$2,000 |

$3,000 |

$149 |

$695 |

Note: “2% Fee” and “3% Fee” columns represent the variable cost portion only. Most tools also charge a base subscription fee on top of this.

At $5,000 in spend, the percentage model is actually cheaper than the premium flat-fee option (Perpetua) and comparable to the budget option (Sellozo). This is why percentage models are attractive to early-stage sellers; they lower the barrier to entry.

However, look at the $50,000 spend row. The 3% fee has jumped to $1,500/month. The flat fee for Sellozo remains $149. Even the premium Perpetua flat fee of $695 is now less than half the cost of the 3% model. Over the course of a year, the difference between paying $149/month and $1,500/month is $16,212. That is pure profit removed from the bottom line.

There are valid reasons to choose a percentage-based tool (they often offer superior features, better UI, or specific integrations that flat-fee tools lack). But this choice should be made with eyes wide open. Sellers expecting to scale must calculate their “future cost” of software, not just the current price. If the goal is to reach $100,000 in monthly ad spend, signing a contract with a 3% uncapped fee is a commitment to pay $36,000 a year for software.

Why does PPC tool performance start with keyword research?

PPC tools optimize bids, budgets, and targeting but cannot determine which keywords are worth bidding on. Campaign performance depends on keyword research quality.

If a PPC tool is the engine of a car, keyword research is the steering wheel. A Ferrari engine will simply drive you into a wall faster if the steering is pointed in the wrong direction. Similarly, the most advanced AI bidding algorithm will efficiently waste budget if it is optimizing bids for irrelevant keywords.

PPC tools are excellent at answering the question “How much?” (how much to bid, how much budget to allocate). They are less effective at answering “What?” (what specific search terms truly align with the product’s value proposition. Automated harvesting campaigns attempt to bridge this gap, but they are reactive. They only find new keywords after Amazon has already tested them (using your money) in an auto campaign.

Proactive keyword research allows a seller to dictate the strategy. With the rise of Amazon Rufus, a generative AI shopping assistant, search behavior is shifting from short-tail keywords (“running shoes”) to natural language queries (“what are the best running shoes for marathon training with high arch support?”). Rufus generated $12 billion in sales in 2025 and converts at 60% higher rates than non-Rufus shopping. Traditional exact-match strategies are struggling to capture this traffic.

This is where the TFSD Framework becomes essential. By optimizing the Title, Features, Search Terms, and Description for semantic relevance, sellers provide the “fuel” that the PPC engine needs. A PPC tool cannot invent relevance; it can only bid on it. If the listing text and backend keywords do not signal to Amazon’s algorithm that the product is relevant for a specific query, the PPC tool will fight an uphill battle, paying higher CPCs for lower visibility.

Before investing hundreds or thousands of dollars a month in a PPC tool, audit the inputs. Are the core keywords accurate? Have negative keywords been identified to prevent waste? Is the listing optimized to convert the traffic the tool sends? A keyword research tool is not a replacement for a PPC tool, but it is the necessary precursor.

Frequently Asked Questions About Amazon PPC Tools

Common questions about Amazon PPC tool pricing, ACoS benchmarks, multi-tool conflicts, and marketplace compatibility.

Conclusion

The best Amazon PPC tool depends on ad spend level, marketplace needs, and pricing model preference, not which vendor wrote the review.

For sellers just starting out with less than $2,000 in monthly ad spend, the priority is cost control and education. Tools like Scale Insights and Sellozo provide powerful automation without breaking the bank. As spend grows to the $2,000-$10,000 range, the decision becomes strategic: stick with a scalable flat-fee tool or invest in a percentage-based ecosystem like Teikametrics that brings in inventory data. At the enterprise level of $10,000+ monthly spend, the focus shifts entirely to multi-channel dominance, where Quartile, Perpetua, and Pacvue justify their higher costs with sophisticated cross-platform AI.

Regardless of the tool chosen, the math on pricing is inescapable. Flat-fee pricing saves thousands of dollars annually at scale, while percentage pricing offers a lower barrier to entry. Sellers must project their growth and choose a model that won’t punish their success.

Finally, remember that automation is not magic. It is a multiplier. It multiplies the effectiveness of the underlying strategy. If the keyword strategy is flawed, the tool will only multiply the waste. Before signing a contract for any of these best Amazon PPC tools, ensure the campaign structure is built on solid data. Audit the current keyword strategy and start with better keywords to give any PPC software the best possible chance of success.