Table of Contents

- Why does hyper-segmented Amazon PPC campaign structure fail in 2026?

- What is the 30-conversion threshold (and how do you audit your campaigns)?

- How does the three-bucket consolidation framework work for Amazon PPC?

- Why does upstream signal quality matter more than Amazon PPC campaign structure?

- How should you measure and set guardrails for consolidated Amazon PPC campaigns?

- Frequently Asked Questions About Amazon PPC Campaign Structure

- Conclusion

TL;DR

- The old playbook is broken. Hyper-segmented campaigns starve Amazon’s algorithms of the conversion data they need to optimize bids effectively.

- Amazon shifted from keyword-matching to customer-matching. New algorithms like COSMO and Rufus use semantic understanding and persona signals, not just keyword frequency.

- The 30-conversion threshold matters. Any campaign segment with fewer than 30 conversions in the last 30 days cannot feed Amazon’s automated bidding effectively.

- Three-bucket framework. Consolidate campaigns into Brand Defense (exact/high-intent), Mid-Funnel Consideration (broader targeting), and Upper-Funnel Exploration (automated ML).

- Upstream signals matter more than structure. Product feed quality, listing metadata, images, and keyword research drive algorithm performance more than campaign granularity.

- Run it as a pilot first. Consolidate one product line, measure for 4-6 weeks, then scale what works.

Amazon’s ad business hit a $69 billion annual run rate in Q1 2025, CPCs climbed to an average of $1.12, and ACoS hovered around 30.4%. Every dollar of wasted spend hurts more than it did in 2020. Yet most sellers continue to rely on an Amazon PPC campaign structure designed for a keyword-matching engine that no longer exists.

The prevailing advice for years (segment by match type, isolate single keywords, create granular ad groups) made sense when Amazon matched ads to search terms literally. In 2026, Amazon uses sophisticated systems like COSMO and Rufus to match ads to customer intent profiles rather than text strings. The result is a structural problem: data starvation. Hyper-segmented campaigns that generate only 5-10 conversions per month provide the algorithm with almost nothing to learn from.

This article introduces a three-bucket consolidation framework for Amazon PPC campaign structure. By grouping campaigns based on strategic intent (Brand Defense, Mid-Funnel Consideration, and Upper-Funnel Exploration), sellers can ensure each bucket clears the 30-conversion monthly threshold required by Amazon’s bidding system while retaining strategic control.

Why does hyper-segmented Amazon PPC campaign structure fail in 2026?

Hyper-segmented campaigns fragment conversion data across too many segments, preventing Amazon’s automated bidding from reaching the 30-conversion monthly minimum needed to optimize.

The logic that dominated Amazon PPC strategies in 2020 was straightforward: control everything. Sellers were advised to segment by match type, create separate campaigns for every product variation, and isolate keywords to manage bids with precision. This granular approach was genuinely effective when Amazon functioned primarily as a keyword-matching engine.

The Amazon algorithm of 2024-2025 underwent a fundamental shift. COSMO replaced keyword-frequency ranking with semantic authority, allowing the system to understand the intent behind a search. Rufus, Amazon’s AI shopping assistant, now serves 250 million users and drives 60% higher purchase likelihood by understanding context and customer behavior. These systems are customer-matching engines that rely on conversion volume to identify patterns.

This shift created a data starvation crisis. Consider a seller with 50 granular campaigns generating 200 total monthly conversions. That averages only 4 conversions per campaign. Amazon’s rule-based bidding requires a minimum of 30 conversions in a 30-day period to function effectively. Splitting 200 conversions across 50 campaigns ensures that none have enough data to inform the algorithm.

While Single Keyword Ad Groups (SKAGs) can still deliver a 35-50% ROAS improvement on top-performing keywords, they create unmanageable complexity at scale. The hyper-segmentation that once offered control now creates a ceiling on performance.

What is the 30-conversion threshold (and how do you audit your campaigns)?

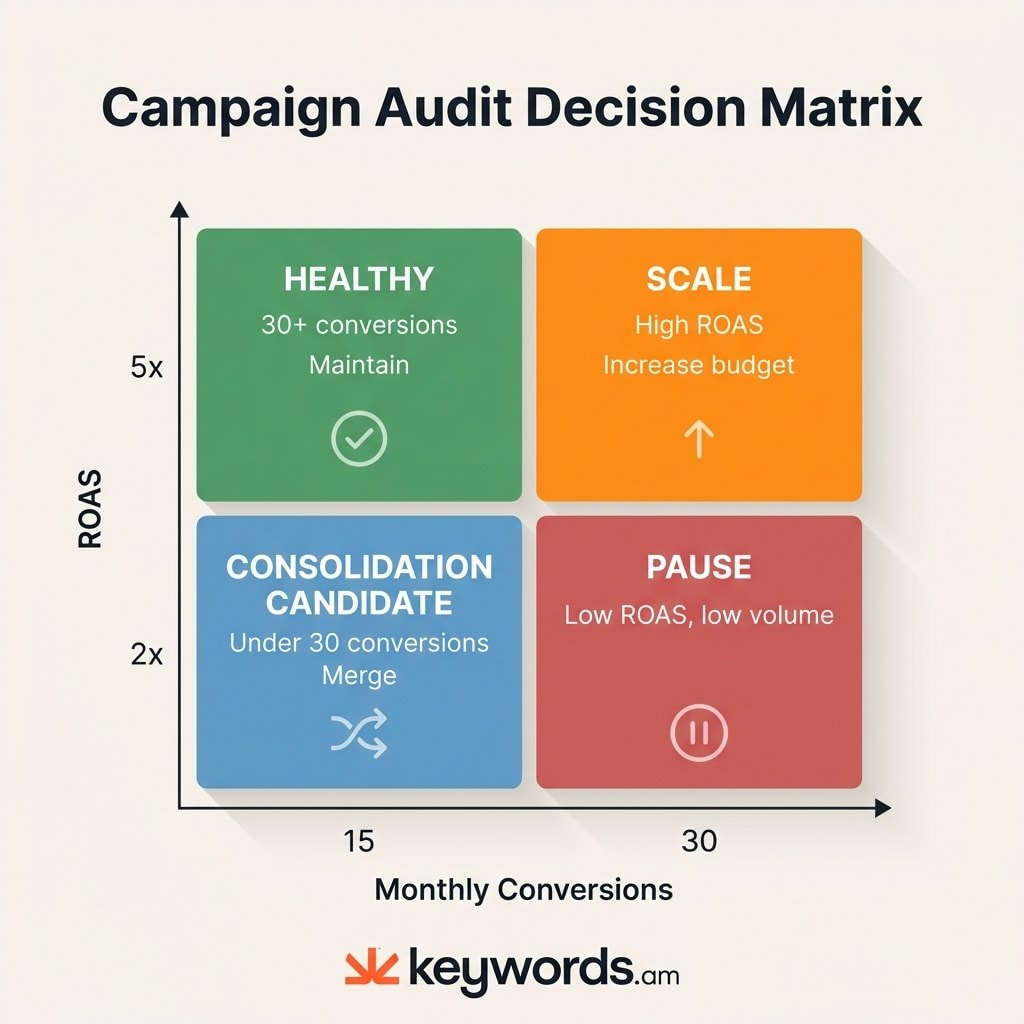

Amazon’s automated bidding needs at least 30 conversions per campaign in the last 30 days. Campaigns below this threshold get poor bid optimization from the algorithm.

Understanding the data requirements of Amazon’s bidding system is crucial for restructuring an Amazon advertising campaign structure effectively. According to Amazon’s advertising API documentation, rule-based bidding requires a campaign running for at least 30 days, a minimum daily budget of $10, and at least 30 conversions in the last 30 days. This is not an arbitrary suggestion; it is the statistical floor the algorithm needs for reliable predictions.

When a campaign fails to meet this threshold, Amazon’s system evaluates performance over a 21-day window. If the target is not met or data remains too sparse, the rule is disabled and the campaign reverts to base settings. The sophisticated Amazon PPC optimization the seller expected simply does not happen.

Sellers can diagnose their account by performing a straightforward audit:

1. Pull campaign reports: Download the last 30 days of performance data for all active campaigns.

2. Filter by conversion volume: Sort by the “Orders” or “Conversions” column.

3. Identify starved segments: Highlight every campaign with fewer than 30 conversions. These are consolidation candidates.

4. Check spend efficiency: Cross-reference low-volume campaigns with their ACoS and spend levels.

With an average Sponsored Products conversion rate of 10-12% and an average CPC of $1.04, achieving 30 conversions requires approximately 250-300 clicks and roughly $260-$310 in monthly spend per campaign. Campaigns spending less than this cannot generate enough data for optimization.

Metric |

Healthy |

At Risk |

Consolidation Candidate |

|---|---|---|---|

Monthly conversions |

30+ |

15-29 |

<15 |

Monthly spend |

$300+ |

$150-299 |

<$150 |

Data points for ML |

Sufficient |

Marginal |

Insufficient |

Recommended action |

Maintain |

Monitor |

Merge into bucket |

How does the three-bucket consolidation framework work for Amazon PPC?

The three-bucket framework groups campaigns by strategic intent into Brand Defense, Mid-Funnel Consideration, and Upper-Funnel Exploration, ensuring each bucket exceeds the 30-conversion threshold.

The solution to data starvation is not to merge everything into a single auto-campaign, which would surrender all strategic control. The smart Amazon PPC strategy for 2026 consolidates around intent. The three-bucket framework preserves the “why” behind ad spend while aggregating enough conversion data to satisfy the algorithm.

Bucket A: Brand Defense (High-Intent)

This bucket houses exact match keywords for brand names, product names, and defensive ASIN targeting. The goal is to protect brand traffic and maximize ROAS from customers already searching for the brand.

* Targeting: Exact match branded terms, defensive ASINs.

* Bidding: Manual or rule-based with tight ROAS guardrails.

* Budget Allocation: 20-30% of total PPC spend.

Bucket B: Mid-Funnel Consideration

This is where the majority of consolidation occurs. Instead of fracturing category keywords into dozens of micro-campaigns, sellers group phrase and broad match terms, competitor ASIN targeting, and category targeting into this single consolidated bucket. The campaign accumulates data faster, allowing Amazon to identify which competitor pages or category terms yield the best customers.

* Targeting: Phrase/Broad match non-branded terms, competitor ASINs, category targeting.

* Bidding: Rule-based bidding optimized for conversion or value.

* Budget Allocation: 40-50% of total PPC spend.

Bucket C: Upper-Funnel Exploration

The exploration bucket acts as the research engine. It uses automated targeting to find new search terms, audiences, and placements. Because this bucket relies entirely on Amazon’s ML, it is the most sensitive to data volume. Consolidating discovery efforts into one large automated campaign ensures maximum data for refinement.

* Targeting: Automatic targeting groups (Close match, Loose match, Substitutes, Complements).

* Bidding: Fully automated.

* Budget Allocation: 20-30% of total PPC spend, strictly capped.

Assigning existing campaigns to buckets:

1. Is the campaign targeting your own brand? Move to Bucket A.

2. Is it targeting competitors or category keywords? Move to Bucket B.

3. Is it an auto-campaign or broad discovery effort? Move to Bucket C.

Merge all campaigns within each bucket that individually fall below the 30-conversion threshold.

Why does upstream signal quality matter more than Amazon PPC campaign structure?

Campaign structure determines how efficiently Amazon spends ad dollars, but listing metadata, keyword research, and product feed quality determine what the algorithm has to work with.

Fixing the Amazon sponsored products campaign structure stops the bleeding, but it does not guarantee health. The structure is the container; the fuel is the data quality provided by the product listing itself. Amazon’s COSMO algorithm ranks products based on “Information Quality and Semantic Authority,” meaning the richness and accuracy of product data directly influences how well Amazon matches ads to relevant customer intent profiles.

The product feed (titles, bullet points, descriptions, and backend attributes) must be optimized not just for keywords, but for meaning. The Amazon keyword research methodology used to build the listing should go beyond high-volume search terms to include specific attributes and problem-solution phrases. Using a framework like TFSD (Title, Features, Search Terms, Description) ensures complete keyword coverage and helps the algorithm interpret the product correctly.

High-quality images and A+ content that demonstrate the product solving a problem improve conversion rate directly. A higher CVR means a campaign reaches the 30-conversion threshold with fewer clicks and less spend. If a listing converts at 5% instead of 10%, it takes twice as much traffic to generate the data needed.

Sellers should also leverage Amazon Brand Analytics Search Query Performance data, which reveals which customer queries lead to purchases versus just clicks. By aligning the Amazon PPC keyword strategy with these high-value queries, the consolidated campaigns get fed with the most potent targeting data available.

How should you measure and set guardrails for consolidated Amazon PPC campaigns?

Set ROAS targets per bucket, implement spend caps on automated campaigns, and allow a minimum four-week learning window before evaluating consolidated campaign performance.

Consolidation requires a shift in how performance is measured. Instead of managing individual keyword bids daily, the focus moves to managing bucket efficiency with clear guardrails.

Per-Bucket Targets

* Brand Defense: Target 5-8x ROAS. These customers are already searching for you; the goal is capture efficiency.

* Mid-Funnel Consideration: Target 3-5x ROAS. This is the growth engine, balancing volume and efficiency.

* Exploration: Target 1.5-3x ROAS. The primary value here is data and new customer acquisition, so lower immediate returns are acceptable.

Creative Alignment

Discovery ads (Bucket C) should address questions or broad problems. Consideration ads (Bucket B) should highlight competitive advantages. Brand defense ads (Bucket A) can focus on price, offers, and direct calls to action.

Guardrails for Automation

Since Bucket C and parts of Bucket B rely on automation, strict financial guardrails are essential. Use the best Amazon PPC tools to set daily or weekly spend caps. Establish a minimum ROAS floor. Monitor search term reports weekly and negate irrelevant matches. Use Amazon keyword rank tracker tools to monitor organic lift alongside PPC performance.

The Learning Window

Allow a minimum of four weeks before making sweeping changes. Amazon excludes anomalous events like Prime Day and BFCM from evaluation periods. Panic-adjusting after three days breaks the optimization cycle before it starts.

Pilot Approach

Select one product line, audit its campaigns, consolidate according to the three-bucket framework, and measure lift for 4-6 weeks against unconsolidated products. This data-driven validation provides confidence to scale.

Frequently Asked Questions About Amazon PPC Campaign Structure

These are the most common questions sellers ask about structuring and consolidating Amazon PPC campaigns in 2026.

> There is no universal number. The right count depends on whether each campaign clears the 30-conversion monthly threshold.

Most products perform well with 3-5 campaigns mapped to the three-bucket framework. A product with 100 monthly conversions can support 3 healthy campaigns, while a product with 20 conversions should run in 1-2 consolidated campaigns.

> Single-keyword campaigns make sense for the top 3-5 highest-volume branded terms or proven converters that individually exceed 30 monthly conversions.

SKAGs deliver 35-50% ROAS improvement on high-volume terms. The key is selectivity: reserve them for keywords that have enough volume to stand alone without starving other campaigns.

> The three-bucket framework applies primarily to Sponsored Products. Sponsored Brands and Display follow similar consolidation logic but optimize for different objectives.

Sponsored Brands work well in Bucket A (brand defense) and Bucket B (category capture). Sponsored Display fits Bucket C (exploration/retargeting).

> Brand Defense should target 15-20% ACoS, Mid-Funnel Consideration 25-35%, and Upper-Funnel Exploration 35-50% during the learning period.

These ranges assume average Amazon margins. Adjust based on product margin and lifecycle stage. Launch products tolerate higher ACoS; mature products demand tighter efficiency.

> Consolidation reduces campaign-level granularity but increases overall performance by giving the algorithm enough data to optimize.

Spend caps and negative keywords maintain control within consolidated buckets. The goal is not to hand Amazon full control, but to provide guardrails that maintain strategic direction while feeding the ML what it needs.

Conclusion

The most effective Amazon PPC campaign structure in 2026 consolidates around strategic intent, feeds algorithms enough conversion data, and invests in upstream signal quality.

The era of hyper-segmentation as the gold standard for Amazon PPC is over. The platform has evolved into a semantic, customer-centric ecosystem that thrives on data volume. Continuing to split budgets into dozens of starved campaigns actively fights against how the marketplace now works.

Sellers who succeed in 2026 will recognize that structure must serve the algorithm, not just the organizer’s desire for tidiness. By auditing campaigns for the 30-conversion threshold and consolidating into three strategic buckets (Brand Defense, Mid-Funnel Consideration, Upper-Funnel Exploration), brands can maximize the effectiveness of Amazon’s automated bidding.

Pull the last 30 days of campaign-level conversion data right now. Count how many campaigns fall below 30 conversions. Those segments are the immediate opportunities for improvement. The campaign structure gets ads in front of the right customers, but the keyword research feeding those campaigns determines whether the right customers find the right products.