📑 Table of Contents

- Why Does Good Keyword Research Still Lead to Bad PPC Campaigns?

- What Are the Four Keyword Categories for Amazon PPC (and How Should You Prioritize Them)?

- What Match Type Should You Use for Each Amazon PPC Keyword?

- How Does Amazon Keyword Harvesting Work (Step by Step)?

- How Can You Build Negative Keyword Lists Before Wasting Ad Spend?

- How Do Organic Rankings and PPC Work Together for Amazon Keywords?

- Conclusion

TL;DR

- Keyword research without a deployment strategy leads to wasted ad spend and high ACoS.

- Categorize keywords into Branded, Competitor, Generic, and Long-tail segments for budget control.

- Assign match types strategically: Exact for proven winners, Phrase for reach, Broad for discovery only.

- Implement a weekly harvesting pipeline to move converting search terms from Auto to Manual campaigns.

- Use research data to build negative keyword lists proactively before launching campaigns.

Amazon sellers collectively waste an estimated $10 billion annually on PPC, and a significant portion of that waste traces back to a single gap: the absence of a translation layer between keyword research and campaign structure. While tools generate millions of data points, the failure to systematically categorize and deploy that data results in inefficient spend that drains profitability before campaigns even gain traction.

The cost of inaction is quantifiable and severe. The average Amazon Advertising Cost of Sales (ACoS) reached 30.4% in 2025, with projections indicating a rise to 32-35% in 2026. Simultaneously, Cost Per Click (CPC) climbed 15.5% year-over-year to an average of $1.12. Sellers who treat keyword research and PPC as disconnected activities (exporting lists and dumping them into campaigns without a strategy) pay the highest price in this inflationary environment.

This guide details the complete pipeline required to turn raw keyword data into profitable campaigns. It covers the five essential stages: categorization, match type assignment, campaign structuring, harvesting, and negative keyword management. Unlike standard PPC advice that focuses solely on bid optimization, this framework addresses the foundational data quality that dictates campaign performance. Keywords.am provides the research intelligence; this methodology ensures it translates into revenue.

Why Does Good Keyword Research Still Lead to Bad PPC Campaigns?

Good keyword research fails in PPC when sellers skip the categorization and match type assignment steps, dumping all keywords into one campaign without strategic structure.

The “dump and pray” approach remains the most common failure mode in Amazon advertising. Sellers frequently conduct extensive keyword research, identify high-volume terms, and then paste entire lists directly into a single campaign with uniform bids and match types. This practice ignores user intent and keyword performance variability, forcing the Amazon algorithm to make costly decisions about where to allocate budget. The result is often a rapid depletion of daily budgets on broad, low-intent terms while high-converting specific phrases receive zero impressions.

Match type mismanagement compounds this inefficiency. Data indicates that 70% of sellers default to broad match for the majority of their keywords. While broad match offers reach, it inflates CPCs by 20-40% on queries that would be far cheaper and more effective if targeted via exact match. In 2025, Amazon’s algorithm updates increased the impression share for broad match terms, meaning relying on this match type now exposes campaigns to an even wider, less relevant audience than in previous years. Without a strategy to rein in this reach, ad spend evaporates on irrelevant clicks.

The industry suffers from a “missing middle” between research and execution. Keyword tools excel at finding data, and PPC management tools excel at adjusting bids, but a critical translation layer is often absent. This layer involves the strategic grouping of keywords based on intent and the assignment of match types based on confidence levels. Without this step, even the most accurate Amazon keyword research methodology cannot save a campaign from structural inefficiency.

What Are the Four Keyword Categories for Amazon PPC (and How Should You Prioritize Them)?

Amazon PPC keywords fall into four categories (branded, competitor, generic, and long-tail), each requiring different bids, match types, and budget allocations for profitable campaigns.

Effective campaign structure begins with categorization. Every keyword exported from a research tool must be sorted into one of four distinct buckets before it enters a campaign. This segmentation allows for precise budget control, ensuring that defensive spending does not cannibalize growth budgets and that experimental targeting does not drain profit margins.

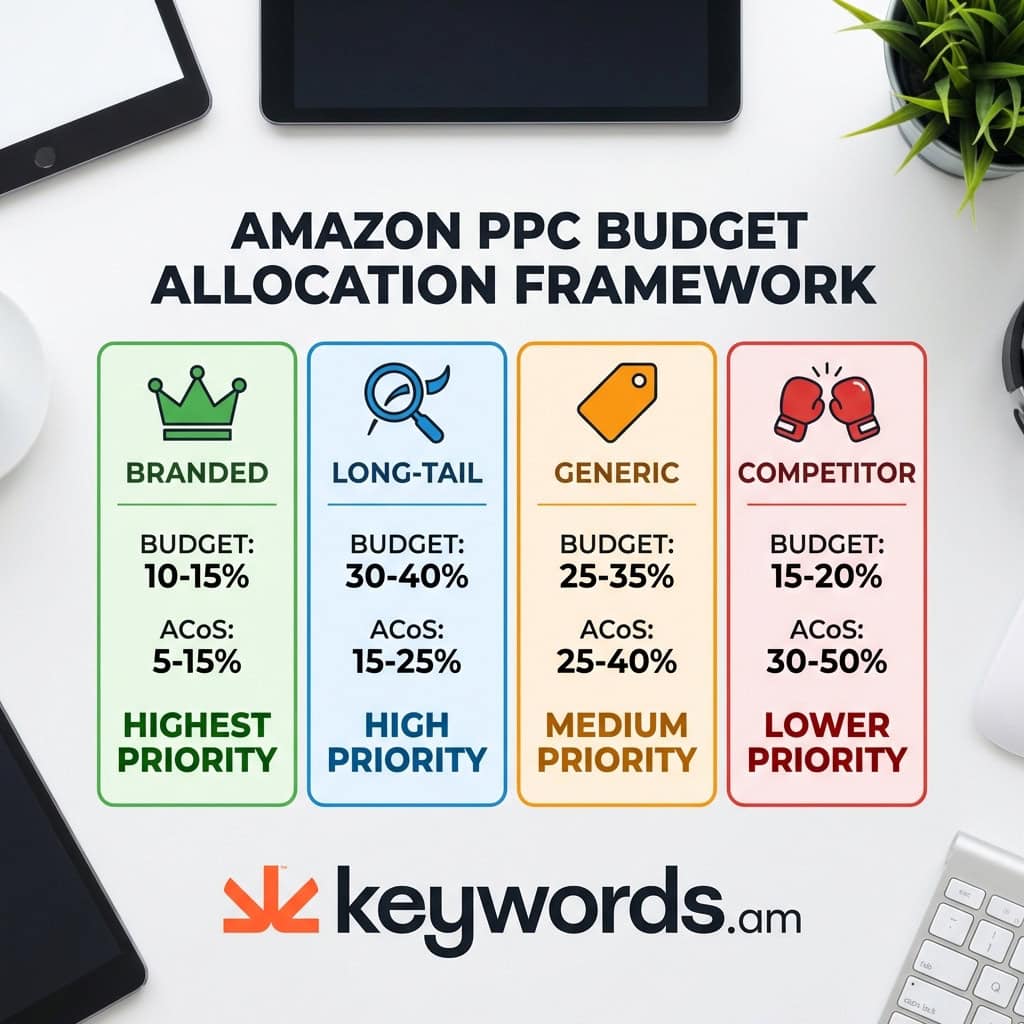

Branded Keywords encompass the product name, brand name, and specific ASIN variations. These terms typically yield the highest conversion rates (25-40%) and the lowest CPCs. They represent a defensive play, necessary to protect market share from competitors who might otherwise bid on these terms to steal traffic. Allocating 10-15% of the total budget here ensures that high-intent customers find the correct product immediately.

Competitor Keywords target rival brand names and ASINs. These are identified through reverse ASIN lookup and represent an offensive strategy. While conversion rates are lower (3-8%) and CPCs higher, these campaigns are essential for stealing consideration from market leaders. A budget allocation of 15-20% allows for aggressive targeting without jeopardizing overall account profitability.

Generic Keywords cover broad category terms such as “wireless earbuds” or “protein powder.” These terms offer the highest search volume but come with the highest CPCs and variable conversion rates. They are a discovery play intended to capture new-to-brand shoppers. However, the volume trap is real; high traffic does not equal high profit. Limiting spend here to 25-35% prevents budget exhaustion on low-converting clicks.

Long-tail Keywords consist of specific phrases of three or more words, such as “waterproof bluetooth earbuds for running.” These terms have lower individual search volume but significantly higher purchase intent and lower CPCs. This is where keyword research tools deliver the most value, uncovering profitable niches that competitors overlook. A disciplined strategy allocates 30-40% of the budget here to build a “profit engine” of efficient sales.

Budget Allocation Framework

Category |

Budget Share |

Typical ACoS |

Campaign Priority |

|---|---|---|---|

Branded |

10-15% |

5-15% |

Highest (defensive) |

Long-tail |

30-40% |

15-25% |

High (profit engine) |

Generic |

25-35% |

25-40% |

Medium (growth) |

Competitor |

15-20% |

30-50%+ |

Lower (strategic) |

What Match Type Should You Use for Each Amazon PPC Keyword?

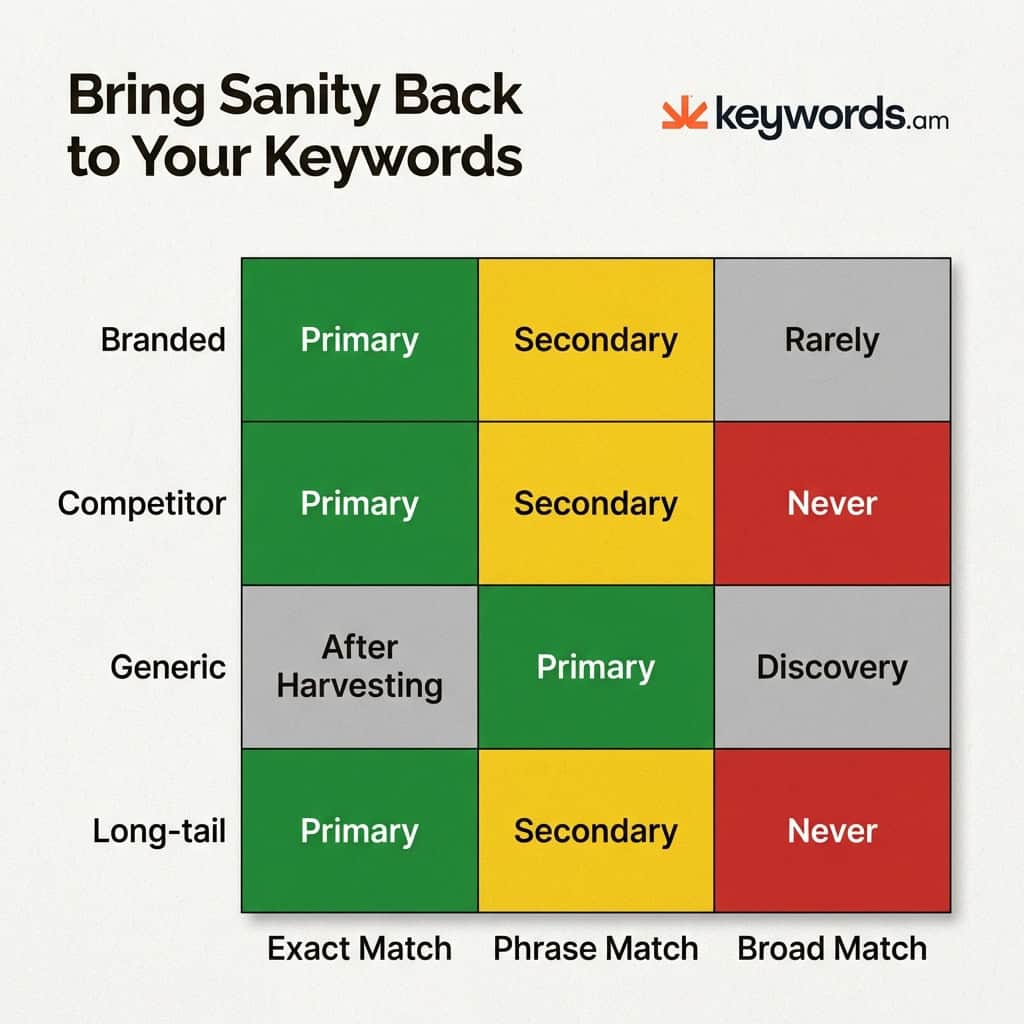

Match type selection depends on keyword category and campaign goal: exact match for proven converters, phrase match for validated terms needing reach, and broad match only for discovery.

Strategic match type assignment is the second step in the translation pipeline. It acts as a filter, determining how strictly Amazon must match a customer’s search query to the bid keyword. The correct choice balances the need for impression volume against the requirement for profitability.

Exact match remains the gold standard for efficiency. With conversion rates frequently exceeding 20% and the lowest ACoS, exact match should be the destination for all branded keywords and proven long-tail winners. In 2025, data confirmed that exact match continues to outperform other types in conversion efficiency, making it the primary vehicle for profit generation. However, its reach is limited to the specific terms entered, requiring a constant feed of new keywords to maintain volume.

Phrase match serves as the bridge between discovery and precision. It captures word-order variations and close qualifiers, offering high-teens conversion rates with moderate ACoS. This match type is ideal for validated generic keywords and mid-funnel terms where the core intent is known, but the exact phrasing may vary. It allows sellers to cast a wider net than exact match while avoiding the irrelevance often associated with broad match.

Broad match has undergone significant changes. Following an algorithm update in 2025, Amazon increased the impression share for broad match terms, causing them to overtake exact match in some portfolios. While this increases visibility, it also increases the risk of wasted spend on loosely related queries. As a result, broad match should be reserved strictly for the initial discovery phase or for specific mining campaigns. It is no longer a “set and forget” option but a tool for data gathering.

Match Type Decision Matrix

Keyword Category |

Exact Match |

Phrase Match |

Broad Match |

|---|---|---|---|

Branded |

Primary bid (defend) |

Secondary (catch variants) |

Rarely (discovery only) |

Competitor |

Primary bid (target ASINs) |

Secondary (catch brand variants) |

Never (too broad) |

Generic |

After harvesting confirms conversion |

Primary starting point |

Initial discovery phase |

Long-tail |

Primary bid (high intent) |

Secondary (catch close variants) |

Never (defeats purpose) |

The most effective strategy employs a harvesting pipeline. New keywords start in broad or phrase match campaigns to gather data. Once a search term proves its ability to convert, it is “harvested” and moved to an exact match campaign. Sellers utilizing this pipeline have reported a 23% reduction in ACoS while maintaining sales volume, proving that match type discipline directly impacts the bottom line. Specialized best Amazon PPC tools can automate parts of this process, but the strategic decision logic must come from the seller.

How Does Amazon Keyword Harvesting Work (Step by Step)?

Keyword harvesting moves proven search terms from automatic campaigns to manual campaigns with tighter match types and optimized bids, compounding PPC efficiency over time.

Keyword harvesting is the active process of refining campaigns based on performance data. It transforms the static output of keyword research into a dynamic, improving system. Without harvesting, campaigns stagnate; with it, they become more efficient every week.

Step 1: Launch automatic campaigns to serve as keyword discovery engines. These campaigns should have conservative bids, typically $0.50-$0.75 below the suggested bid, to ensure that data is gathered at a reasonable cost. The goal is not immediate profit but the accumulation of data. Allow these campaigns to run for 2-4 weeks to generate a statistically significant volume of search terms.

Step 2: Pull search term reports on a weekly basis. Navigate to the advertising reports section in Amazon Seller Central and generate a search term report. Filter this data to identify terms that have generated at least three orders with an ACoS below the target threshold. These specific terms are the candidates for harvesting.

Step 3: Move winners to manual campaigns. Take the identified high-performing search terms and add them as keywords in manual campaigns. Use exact or phrase match to lock in their performance. Bids for these harvested keywords should be set 10-20% higher than the CPC observed in the automatic campaign. This aggressive bidding ensures that the manual campaign wins the impression share for these proven converters.

Step 4: Negate harvested terms in auto campaigns. This step is critical and often overlooked. Once a keyword is moved to a manual campaign, it must be added as a negative exact match in the originating automatic campaign. This prevents the two campaigns from bidding against each other and ensures that traffic flows to the manual campaign where the seller has greater control over bids and placement.

Step 5: Repeat weekly. This process creates a flywheel effect. Automatic campaigns continuously discover new terms, manual campaigns maximize the value of those terms, and negative keywords eliminate waste. Using a best Amazon keyword research tool accelerates this process by providing initial seed lists that make the discovery phase shorter and more productive.

How Can You Build Negative Keyword Lists Before Wasting Ad Spend?

Proactive negative keyword lists use keyword research data to block irrelevant terms before campaigns launch, preventing wasted spend rather than reacting to it after the damage.

Most sellers treat negative keywords as a reactive measure, adding them only after seeing wasted spend in search term reports. A superior strategy involves building negative lists proactively using the same research data used to find target keywords. This “pre-negation” approach saves significant budget during the critical launch phase.

From keyword research: Thorough analysis often reveals high-volume terms that are semantically related but intent-mismatched. For example, research for “wireless earbuds” will inevitably surface terms like “wireless earbuds repair,” “wireless earbuds cheap,” or “wireless earbuds case.” If the product is a premium set of new earbuds, these terms will generate clicks but no sales. Adding “repair,” “cheap,” and “case” to a negative list before launch prevents this inevitable waste.

From competitor analysis: Conducting reverse ASIN lookup on competitors provides a wealth of data for negative targeting. It reveals the keywords competitors rank for, some of which may be irrelevant to the seller’s specific product. Competitor brand names that a seller does not wish to target, or product variations (such as “wired” or “over-ear” for a wireless in-ear product) should be negated immediately.

Category-level negatives: Experienced sellers maintain shared negative keyword lists at the portfolio level. These lists contain universal qualifiers that rarely convert for product sales, such as “free,” “used,” “refurbished,” “how to,” “what is,” “review,” and “tutorial.” Blocking these terms globally ensures that no campaign in the account wastes budget on information-seeking traffic.

The ROI math: The financial impact of proactive negation is substantial. With the average Amazon CPC at $1.12, blocking just 50 irrelevant clicks per day saves $56 daily, or approximately $1,680 per month. This saving often exceeds the monthly cost of the Amazon keyword rank tracker tools and research software used to identify them, making the research process self-funding.

How Do Organic Rankings and PPC Work Together for Amazon Keywords?

PPC and organic rankings create a compounding flywheel: PPC drives sales velocity that improves organic rank, while organic visibility reduces dependence on ad spend over time.

PPC and organic performance are deeply intertwined on Amazon. They are not separate channels but two levers moving the same sales velocity flywheel. Understanding this relationship allows sellers to invest in PPC not just for immediate sales, but for long-term asset building in the form of organic rank.

PPC leads to organic lift. Sales velocity is a primary factor in Amazon’s A10 ranking algorithm. When a product generates sales through PPC, it signals relevance to Amazon. Keywords that convert well through paid ads often begin to rank organically within 4-8 weeks. This mechanism means that PPC spend is an investment in future organic visibility, justifying a higher initial ACoS for new product launches.

Organic visibility drives PPC efficiency. Data shows that when a product ranks in the top 10 organically for a keyword, the PPC ACoS for that same keyword typically drops by 15-25%. The combined visibility of an organic listing and a sponsored ad builds consumer trust and reinforces the product’s authority, leading to higher click-through and conversion rates.

The data feedback loop. The synergy extends to data analysis. PPC search term reports frequently reveal converting keywords that initial research may have missed. These terms should be fed back into the listing optimization process using the TFSD Framework (Title, Features, Search Terms, Description). Updating the product listing with these proven terms improves relevance, which in turn can lower PPC costs. Best Amazon SEO tools help track these ranking movements.

Budget reallocation by lifecycle. The relationship changes as a product matures. New products require aggressive PPC spend (70%+) focused on generic and long-tail keywords to establish velocity. As organic rankings take hold, the budget strategy shifts. Mature products often allocate 50% or more of their budget to branded defense, allowing their strong organic positions to capture the bulk of generic traffic without paying for every click.

Frequently Asked Questions About Amazon PPC Keyword Strategy

Conclusion

A profitable Amazon PPC keyword strategy requires systematic keyword categorization, strategic match type assignment, disciplined harvesting, and proactive negative keyword management.

Transforming keyword research into a profitable PPC strategy is not about finding a secret list of words; it is about building a disciplined pipeline for data deployment. The process begins with rigorous research and categorization, ensuring that every keyword has a specific purpose (whether defensive, offensive, or exploratory). It continues with precise match type assignments that balance reach with efficiency, avoiding the common pitfall of broad match over-reliance.

The most successful sellers distinguish themselves through ongoing optimization. They implement a harvesting flywheel that systematically promotes winning search terms and negates wasteful ones, constantly refining the quality of their traffic. They also understand the symbiotic relationship between paid and organic performance, using PPC to drive the velocity that fuels long-term organic rankings.

Key Takeaways:

* Implement the 5-stage pipeline: Research → Categorize → Match Type → Campaign Structure → Harvest/Negate.

* PPC campaigns are only as effective as the structured keyword data feeding them.

* Use the budget allocation framework and match type decision matrix to guide every campaign launch.

* Leverage the compounding effect of PPC on organic rankings for long-term profitability.

Immediate Action:

Export your current keyword list and categorize every keyword into one of the four categories (branded, competitor, generic, long-tail) before your next campaign adjustment.

The quality of keyword research determines the ceiling of PPC performance. Tools like Keywords.am surface the keywords worth bidding on, with priority scores that map directly to campaign strategy, ensuring that your ad spend is an investment rather than an expense.