Helium 10 Diamond costs $4,476 per year. But here’s the thing though, that plan only lets you track 1,000 ASINs. Honestly, that isn’t a lot. Managing five clients with 100 SKUs each? You’ve already gone over that limit. And the reality is, this pushes many agencies to look at Helium 10 alternatives. They just need something that’s better economically for them.

This is the harsh truth. Tools built for individual sellers? They don’t always work for Amazon agencies. Per-ASIN and per-seat pricing can really hurt agency profits. What starts as a good client deal? It might become a money pit.

So, this comparison focuses on the things that matter to agencies. Multi-account management is key. Team access is a must. And batch operations? Agencies need ’em. Unlike those generic lists that treat everyone the same, this looks at agency-level pricing. It also looks at the super important need for white-label options.

Table of Contents

- Why Are Agencies Leaving Helium 10?

- What Do Amazon Agencies Actually Need in a Tool?

- The 7 Best Helium 10 Alternatives for Amazon Agencies

- How Does Pricing Compare at Agency Scale?

- How Many Team Seats Does Each Tool Offer?

- Which Tools Offer White-Label Reports?

- Which Tool Should You Choose Based on Agency Size?

- Frequently Asked Questions About Helium 10 Alternatives for Agencies

- Conclusion

⚡ TL;DR

- Per-ASIN pricing kills margins: Helium 10’s 1,000 ASIN limit on Diamond ($279/mo) is exceeded by just 10 clients with 100 SKUs each.

- Keywords.am wins on economics: Flat $120/mo for unlimited ASINs with white-label reports on all plans.

- DataDive for competitor intel: Best for deep analysis with up to 100K team members on Enterprise.

- Critical agency features: Multi-brand dashboards, batch operations, and scalable team seats are non-negotiable.

- White-label reporting is rare: Only Keywords.am and SellerApp offer built-in agency branding; most require Enterprise or manual formatting.

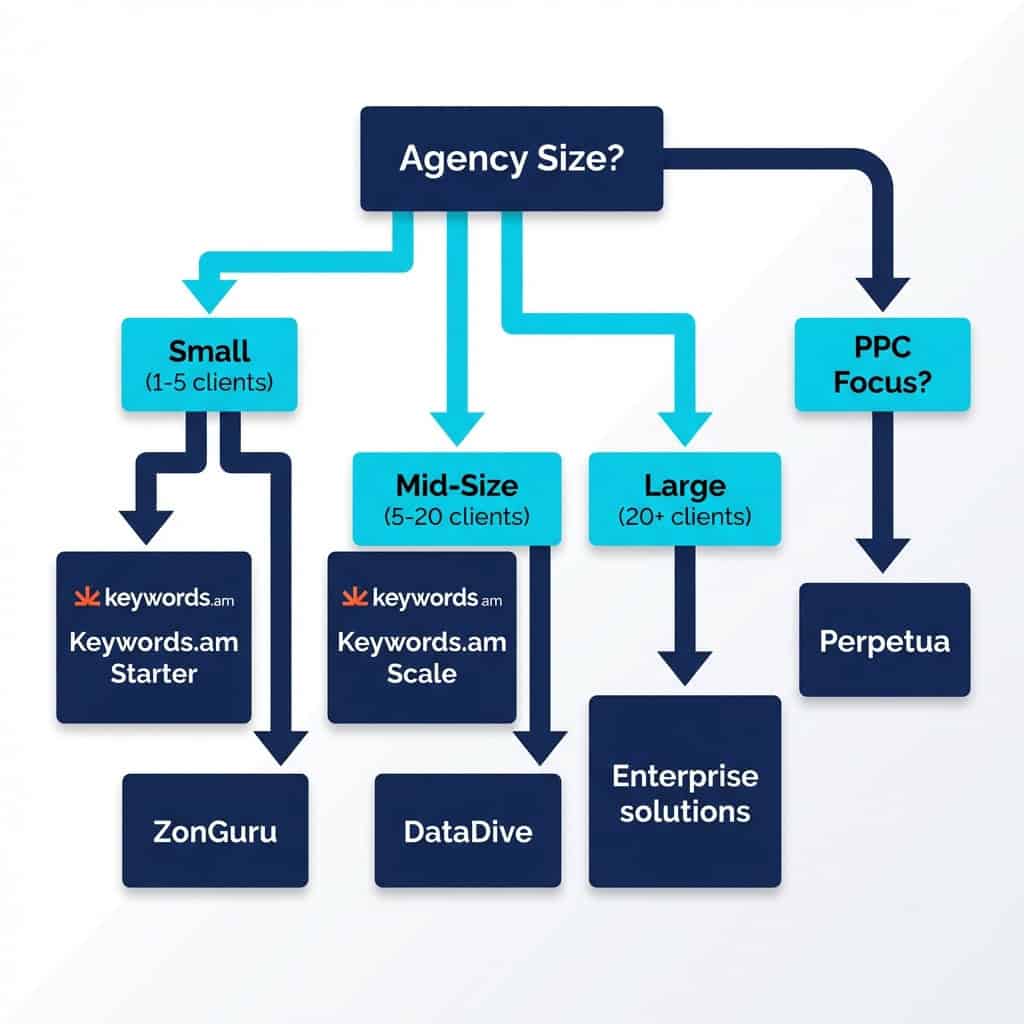

- Match tool to scale: Small agencies start with ZonGuru/Keywords.am Starter; mid-size need Keywords.am Scale; large agencies negotiate Enterprise.

- PPC specialists need Perpetua: Starting at $695/mo, it’s the premium choice for agencies managing $50K+ monthly ad spend.

Why Are Agencies Leaving Helium 10?

Agencies ditch Helium 10. Why? Well, per-ASIN pricing kills margins when you’re working at scale. Account switching eats up time. And there isn’t a single spot to see everything across all client portfolios. Honestly, the tool setup—though powerful if you’re a single seller—causes problems when you apply it to an agency dealing with multiple clients.

The big reason? Per-ASIN costs. Helium 10 Diamond plan costs $279 a month (if you pay yearly), and it covers tracking for 1,000 ASINs. That’s it. Here’s the thing though: an agency with, say, 10 clients and each has 100 SKUs? Boom, hit that limit. And any growth—more clients or bigger catalogs—pushes them into an Enterprise plan, which is pricey and hard to understand. In my experience, this forces agencies into a corner. Either they eat the extra software costs or they pass them on to clients. Either way, it makes their bids less competitive. For a deeper analysis, see our Keywords.am vs Helium 10 comparison.

Beyond cost, workflows are a total pain. The Diamond plan allows linking to 10 Seller Central accounts. But there’s no single dashboard. Team members switch between client accounts constantly, which is slow and increases mistakes. Worth noting: the plan has a limit of five users. So, if an agency has 10 people, they share logins (risky!) or negotiate a special (expensive) plan. The reality is, Helium 10’s reporting is generic. The standard exports aren’t ready to go for clients. They also don’t have that professional, white-labeled feel that shows an agency’s value.

What Do Amazon Agencies Actually Need in a Tool?

Amazon agencies have pretty specific tool needs. Multi-brand dashboards are a must. Also, team seats with permissions, batch operations across clients, flat-rate or unlimited pricing, and white-label reporting capabilities are all really important. These things directly tackle scaling headaches and workflow problems that just come up when you’re dealing with lots of sellers.

A multi-brand dashboard? It’s your single spot to keep tabs on all client accounts. You get portfolio-level views without flipping between accounts constantly. Huge time saver! And it’s helped a lot of agencies, honestly.

Then you need team access controls that are really detailed. Account managers, analysts, even clients need different access levels. Role-based permissions are key.

Batch operations? Non-negotiable. Doing keyword research or listing audits one ASIN at a time? Forget it at agency scale. The ability to handle entire client catalogs at once is a major boost. Like, a *major* boost.

Pricing. Here’s the thing though: it needs to be predictable. Flat-rate or unlimited usage is better than per-ASIN or per-keyword plans that ding you for growing. Nobody wants surprises there.

Lastly, white-label stuff. Essential for pro-looking, client-ready reports with *your* branding. That builds trust and avoids cheapening your work. And let’s face it, you want that.

Need |

Why It Matters for Agencies |

|---|---|

Multi-brand dashboards |

One view across all clients |

Team seats + permissions |

Account managers, analysts, clients |

Batch operations |

Audit 50+ SKUs simultaneously |

Flat-rate pricing |

Predictable costs, not per-ASIN surprises |

White-label reports |

Client-ready deliverables with your branding |

The 7 Best Helium 10 Alternatives for Amazon Agencies

So, Helium 10 is great. But agencies? They often need more. The reality is, seller tools aren’t always a perfect fit. You need power! Here’s the thing though: plenty of options exist.

The best Helium 10 alternatives for agencies? Well, that depends on what you need. Keywords.am gets you great data and can do batch stuff. Super helpful. Then there’s DataDive. It’s great for digging into what your competitors are doing. SellerApp is another one. It tries to be an all-in-one solution. It does a lot of stuff pretty well.

Worth noting: there are also specialized tools. Maybe you want something super specific. Each of these platforms gives agencies a distinct advantage. They move beyond the limits of software built for individual sellers, and honestly, that’s important.

Tool 1: Keywords.am – Best for Data Accuracy + Batch Operations

Keywords.am? It’s pretty much built for agencies doing a lot of listing optimization. Honestly, its biggest plus is the super accurate data. It actually pulls info straight from Amazon Brand Analytics. Estimated metrics just can’t compete with that real data.

Pricing: They have three pricing levels: Starter at $30/mo, Growth at $60/mo, and Scale at $120/mo. Here’s the thing though: none of them have ASIN limits. And, they all include multi-user support! That wipes out the two biggest cost headaches for agencies.

Key Agency Features: The Bulk ASIN Audit is a huge deal. It lets you check a whole client catalog all at once. Reports can be white-labeled, too – slap on your agency logo and a custom call-to-action. Plus, multi-brand workspaces keep everything organized. I like that a lot. The whole process uses the TFSD Framework. It makes sure the same awesome method gets used for every client. Worth noting: they have an affiliate program offering 30% lifetime commission. Hello, extra revenue!

Limitations: As a newer platform, the community is smaller than, say, Helium 10. And, it’s really focused on listing stuff. It doesn’t have built-in PPC management.

Best if your agency: Focuses on Amazon SEO and listing optimization using real data. In my experience, it’s a great pick if you’re tired of explaining why search volume guesses don’t match Seller Central data.

Tool 2: DataDive – Best for Competitor Intelligence

DataDive is really good at competitor analysis. Agencies can use it to figure out smart strategies and impressive pitch decks for clients. It’s pretty much made for digging deep into research.

Pricing: Plans range from Starter ($39/mo) to Standard ($149/mo) and Enterprise ($490/mo). Honestly, the Enterprise plan is wild – it supports up to 10 Seller Central accounts and, get this, 100,000 team members.

Key Agency Features: Its best stuff? Competitor keyword research and watching how rankings change. The platform has “Spaces & Labels” – that helps keep client work organized. For techy folks, API access is there on the Standard plan and Enterprise, and the big Enterprise plan also has audit logs for security, y’know, compliance stuff.

Limitations: Here’s the thing though, the platform limits “Dive ASINs” (4,000 on the Enterprise plan). That can be a pain if you’ve got a lot of clients with big product ranges. And it doesn’t have built-in white-label reporting. So you’ll have to put reports together by hand for clients.

Best if your agency: Focuses on looking at the competition and market research. It gives you the insights to build client strategies and make your agency stand out. In my experience, that’s key. Worth noting – the reality is that differentiation is everything.

Tool 3: SellerApp – Best All-in-One for Smaller Agencies

SellerApp? It offers a ton of tools. PPC management, product research… even listing optimization. Honestly, it’s pretty much an all-in-one platform.

Pricing: The standard plans are Pro ($99/mo) and Smart ($149/mo). But SellerApp also has a dedicated ecommerce agency platform with custom pricing.

Key Agency Features: The feature breadth is a big draw. They cover 18 Amazon marketplaces. That’s a lot. For agencies that want to offload some work, SellerApp offers managed services, too. The reality is, the dedicated agency platform suggests they care about this user group. Details are sparse, though.

Limitations: Pricing for their agency platform isn’t clear. You have to call them. And the sheer number of features? It can be overwhelming. The per-account thing? It may require multiple subscriptions for clients; something to consider.

Best if your agency: Is smaller. And generalist. You want a single tool. To manage a wide range of Amazon services. For a handful of clients.

Tool 4: Jungle Scout – Best for Product Research Focus

Jungle Scout? It’s a market leader. A big one. And honestly, they shine when it comes to product research and spotting opportunities.

Pricing: For agencies, look at the Brand Owner plan at $149/mo. This gets you 10 user seats. Need more? They have Jungle Scout Cobalt, which is their enterprise thing with custom pricing. It’s pricey though.

Key Agency Features: Their product research tools are top-notch, no question. Opportunity Score? Supplier Database? The best. Plus, there’s a strong Academy. You get a lot of learning stuff.

Limitations: Here’s the thing though, it’s mostly about product research. Listing optimization is kind of secondary. And no native white-label reporting. True agency scale is locked behind that Cobalt tier too. That said, the reality is it gets expensive fast.

Best if your agency: You focus on helping clients source products, validate ideas, and launch new stuff. Simple. It’s not the best if you’re mostly doing ongoing listing optimization. Worth noting.

Tool 5: Perpetua – Best for PPC-Focused Agencies

Perpetua? It’s a pretty specialized platform. It’s high-end, and honestly, it’s really designed just for advertising optimization. It’s not a listing tool at all. But it *is* a powerful choice if you’re an agency that manages a lot of client ad spend.

Pricing: The entry point is high; starting at $695/mo for up to $10,000 in monthly ad spend. From there, pricing becomes a percentage of ad spend. The reality is, that model can get very expensive, very fast.

Key Agency Features: Perpetua uses AI. It optimizes bids across *all* Amazon ad types. That means Sponsored Products, Sponsored Brands, and Sponsored Display. Plus, it supports multiple marketplaces, including Walmart and Instacart. And it integrates with the Amazon Marketing Cloud for advanced analytics. So, a lot of useful stuff.

Limitations: The high starting price is one thing. Worth noting that the percentage-of-spend model makes it inaccessible for agencies with smaller clients. It’s *exclusively* an advertising tool. It contains no features for listing optimization. And no keyword research for SEO.

Best if your agency: Manages large advertising budgets (over $50,000 per month across the client portfolio). And needs a dedicated, AI-powered optimization engine. Makes sense, right?

Tool 6: SmartScout – Best for Market Intelligence

SmartScout is really strong for market analysis. It helps agencies spot trends, see new possibilities, and get a grip on the competition. It’s a big-picture kind of tool.

Pricing: The Business plan is $187/mo. It comes with 3 user accounts. Larger teams need Enterprise, but you’ll have to talk to them about pricing.

Key Agency Features: The platform is strongest for brand and category research, in my experience. And the Traffic Graph? Honestly, it gives you insights into Amazon’s internal traffic that you can’t find anywhere else. The Business tier lets you make custom reports. You do that via Excel exports. AdSpy is also pretty useful. It’s an add-on for checking out competitor ads.

Limitations: Here’s the thing though: SmartScout is just for research. It doesn’t build listings or help you optimize them. User limits on the basic plans? Low. Key features, like AdSpy, cost extra. So the total price goes up.

Best if your agency: Sells strategic consulting services that rely on market analysis. And opportunity identification, of course. That said, it’s a tool for strategists. Not for listing copywriters.

Tool 7: ZonGuru – Best Budget Option

ZonGuru’s pretty good. It offers a decent set of features. And it won’t break the bank. Honestly, it’s a solid entry-level tool. Great for new agencies. Or agencies watching their pennies.

Pricing: Pricing? It’s based on SKUs tracked. $49/mo gets you 20 SKUs. Jumping to $159/mo covers 1,000 SKUs. But there’s a custom Enterprise plan too. This is for agencies.

Key Agency Features: The tool has “Keywords on Fire” for keyword research. There’s also a listing optimizer with AI. You’ll also find tools to automate email and review requests. And it supports connected regions for international clients. So that’s useful.

Limitations: The SKU-based pricing? It’s affordable early on, sure. Here’s the thing though: it gets expensive. It runs into the same scaling problems as other per-unit tools. That said, key agency features are probably behind that custom Enterprise plan.

Best if your agency: Is just starting. Is highly budget-conscious. Manages clients with small product catalogs. Simple as that.

How Does Pricing Compare at Agency Scale?

Agency pricing. It’s complicated.

At agency scale, flat-rate tools—like Keywords.am at $120/mo unlimited—cost *way* less. I’m talking 10-40x less than per-ASIN tools. Think Helium 10, which can easily run $500+/month for 50+ client products. The difference really becomes noticeable as an agency grows.

Here’s the thing though: models that seem fine for a single seller can become totally unsustainable when you’re juggling dozens of client products.

The table below shows you how quickly costs go up with per-unit pricing versus a flat-rate deal. For example, Helium 10’s Diamond plan ($279/mo) covers 1,000 ASINs. And an agency with, say, 10 clients averaging 100 SKUs *each* is already bumping against that limit. Honestly, they’d be forced into a much more expensive Enterprise plan just to add one more small client! In contrast, a flat-rate tool like Keywords.am has a cost that stays pretty much the same. This means the agency can add clients without their software costs going crazy.

Tool |

10 Client Products |

25 Client Products |

50 Client Products |

|---|---|---|---|

Keywords.am |

$120/mo (Scale) |

$120/mo |

$120/mo |

DataDive |

$149/mo (Standard) |

$149/mo |

$490/mo (Enterprise) |

SellerApp |

$99-149/mo |

Custom |

Custom |

Jungle Scout |

$149/mo |

$149/mo |

Cobalt (custom) |

Perpetua |

$695/mo minimum |

$695+ |

$695+ (+ % spend) |

SmartScout |

$97/mo |

$187/mo |

Enterprise |

ZonGuru |

$49-99/mo |

$99-159/mo |

Enterprise |

Helium 10 |

$279/mo |

$279/mo (near limit) |

Enterprise needed |

How Many Team Seats Does Each Tool Offer?

Team seat availability? It varies a lot. You might get 1 user on a basic plan. Or, you could get unlimited access on the enterprise tiers. DataDive Enterprise? It provides access for up to 100,000 users. Many tools give you 5-10 users on those mid-tier plans. Honestly, team access matters. It’s often forgotten when you check out Helium 10 alternatives for agencies.

The reality is, most tools make you pay more for multi-user access.

For instance, Helium 10 only gives 5 seats on its $279/mo Diamond plan. Jungle Scout gives 10 seats on its Brand Owner plan. Keywords.am is different though. It includes multi-user support on all plans. Even the $30/mo Starter tier. This is a big plus if you’ve got a smaller team.

But what about super big orgs? DataDive’s Enterprise plan gives massive capacity. Worth noting: it’s probably overkill for most Amazon agencies.

Tool |

Basic Plan |

Mid-Tier |

Enterprise |

|---|---|---|---|

Keywords.am |

Multi-user all plans |

Multi-user |

Custom |

DataDive |

1 user |

10 users |

100,000 users |

SellerApp |

1 user |

Contact |

Custom |

Jungle Scout |

1 user |

1 user |

10 users (Brand Owner) |

Perpetua |

Team |

Team |

Full team |

SmartScout |

2 users |

3 users |

Custom |

ZonGuru |

1 user |

1 user |

Enterprise |

Helium 10 |

1 user |

5 users (Diamond) |

Custom |

Which Tools Offer White-Label Reports?

Keywords.am and SellerApp have white-label reporting built right in. You get agency branding with those. But Helium 10 and Jungle Scout? Not so much. You’ll probably have to do manual exporting or talk to them about some Enterprise deal. Honestly, this white-label stuff is important to show clients you’re professional and boost your brand.

Keywords.am lets you stick your logo on those ASIN audit reports. You can even add a call-to-action. It turns a plain data export into something a client would actually want to see. And with their affiliate program, the reports can even make you money while you sleep. SellerApp also has white-label reporting in their agency platform. Here’s the thing though, pricing is something you need to talk to them about. For more on why this is a good idea, check out this guide: Amazon listing software for agencies.

Most other tools? They don’t have this feature on their normal plans. That said, even the big ones like Helium 10 and Jungle Scout make you jump through hoops. So agencies using those tools end up spending time redoing the data to match their templates. It takes a lot of time. Worth noting: It can also cause mistakes.

Which Tool Should You Choose Based on Agency Size?

Small agencies with under 5 clients? They can get going with ZonGuru or Keywords.am Starter. Mid-size agencies, say 5-20 clients, will get a lot out of Keywords.am Scale or DataDive Standard. Large agencies, and I mean 20+ clients, they really need Enterprise solutions. It’s all about your agency’s size and exactly what you’re offering.

- Small Agency (1-5 clients, <50 total SKUs): Low cost matters here. You also need core functionality. Keywords.am Starter ($30/mo) or ZonGuru Researcher ($29/mo). They give you the basic listing optimization stuff without costing an arm and a leg.

- Mid-Size Agency (5-20 clients, 100-500 SKUs): Batch operations are super important. So is predictable pricing. Keywords.am Scale ($120/mo) is great ’cause of its flat-rate and unlimited ASIN audits. DataDive Standard ($149/mo)? That’s a good alternative if you’re mostly watching the competition.

- Large Agency (20+ clients, 500+ SKUs): These guys need enterprise-level support. Big time. And features, obviously. Keywords.am Scale still works. Honestly, it does because of the unlimited thing. But, this is when you should think about a custom Enterprise plan. Think DataDive or SellerApp.

- PPC-Focused Agency (any size, $50K+ ad spend): Need a tool for heavy advertising? You do. Perpetua is where it’s at for ad optimization. But you also need a listing tool. Something like Keywords.am, to keep things retail-ready.

That said, want a bigger picture? See our guide to the 25 Best Amazon Seller Tools 2026.

Frequently Asked Questions About Helium 10 Alternatives for Agencies

Q1: Can I use my own branding on client reports?

Keywords.am lets you do white-label reports. Custom logos are included, and CTAs too. SellerApp also has agency-branded options, which is cool. But honestly, most other tools? You’ll need the Enterprise tier or you’re stuck with manual formatting. For agencies, professional deliverables are often as important as the data itself, so that sucks. White-label capabilities turn generic exports into agency-branded assets. It’s pretty much essential.

Q2: Is there a Helium 10 alternative with unlimited ASINs?

Keywords.am has no per-ASIN limits on any plan. That’s right, *any* plan. DataDive Enterprise offers 4,000 ASINs. The reality is most alternatives use some kind of usage caps. Per-ASIN pricing is the primary reason agencies seek alternatives. Keywords.am’s flat-rate model is specifically designed for high-volume use cases. A lot of agencies need that!

Q3: Which tool is best for international Amazon clients?

Keywords.am supports 21 marketplaces with localization. SellerApp covers 18 marketplaces. Perpetua works across Amazon, Walmart, and Instacart globally. International expansion is increasingly common for Amazon brands. Worth noting.

Q4: Do any Helium 10 alternatives offer affiliate programs?

Keywords.am offers 30% lifetime recurring commissions with 60-day attribution. That’s a decent amount of money. Some other tools have partner programs but with lower payouts or one-time payments. For agencies, affiliate programs create additional revenue streams from tool recommendations. White-label reports with embedded affiliate links can generate passive income. Seriously, it’s like free money!

Q5: What’s the best Helium 10 alternative for a solo agency owner?

For solo operators, Keywords.am Starter ($30/mo) or ZonGuru Researcher ($29/mo) offer the best value with essential features for listing optimization at low cost. Solo agency owners need tools that maximize output per dollar. Don’t get the Enterprise-tier tools. Avoid those until client volume justifies the investment.

Q6: Can I connect multiple Seller Central accounts?

DataDive Enterprise supports up to 10 Seller Central accounts. Helium 10 Diamond allows 10 connected accounts. Keywords.am works across multiple brands without account connection limits. Multi-account support is essential for agencies but often gated behind higher tiers. Verify limits before committing, so you don’t get burned.

Conclusion

Amazon software is changing, honestly. Tools that worked for solo sellers just aren’t cutting it for growing agencies. Per-ASIN pricing? It breaks down at agency scale.

For agencies with a lot of clients, some things really matter. Flat-rate pricing is huge. Also, multi-brand dashboards? A must. Scalable team access too, plus white-label reporting. These features drive profitable growth and better operations.

There are several Helium 10 alternatives out there. That said, you need to find the right fit for *your* agency. Keywords.am seems like a great choice if you’re focused on listing optimization. Keywords.am gives you unlimited ASINs and agency-focused features. DataDive crushes it for spying on the competition. And Perpetua? It’s the thing for serious PPC management.

But the reality is, the “right” choice depends. What clients do you have? What services do you offer? How big’s your team? The key? Look at pricing and features when you’re handling 50 clients. Don’t just look at the cheapest plan.

To see the difference, run a free ASIN audit with Keywords.am. Experience a white-labeled, data-driven report. It’s something you can actually send to clients. It’s good.